Start the 2024 Crypto Season with New Weekend Show: Altcoins Review, Bitcoin Halving, and Investment Strategies

Hope you're strapped in because the ride into 2024's crypto landscape just got even more thrilling. With the buzz around altcoin season, Bitcoin halving, and market predictions, it's crucial to stay informed and ahead of the curve.

To help you here, we've launched a new video show where InnMind founder Nelli Orlova together with seasoned crypto investor & co-founder at Weld Money bank Iryna Lorens, will meet every weekend shedding light on the 2024 market predictions, altcoin season indicators, crypto market news, trends, narratives and strategies for navigating the volatile cryptocurrency investments.

In this blog post, we summarize the juicy insights from the recently released first episode.

Btw, oops, we didn't choose the name of the show yet. If you'd like to contribute and suggest a winning name - share your thoughts in our telegram channel!

Let's start?

📩 And don’t forget to subscribe to our weekly newsletter: no spam, just updates about early-stage Alpha, crypto VC fundraising events, hot deals and massive insights for and about web3 startups.

The Dawn of Altcoin Season: Indicators to Watch

The term "altcoin season" is music to the ears of crypto investors, signaling a time when altcoins outshine Bitcoin with substantial price gains. But how can we anticipate its arrival? Lawrence points to several indicators:

Altcoin Season Index: Currently teetering below the threshold, suggesting an imminent altcoin season.

Crypto Fear and Greed Index: A green zone status indicates a bullish market sentiment, encouraging buying activity.

Bitcoin Dominance: A decline here often precedes an altcoin rally, as capital flows from Bitcoin to altcoins.

Understanding these indicators can offer Web3 founders and investors a strategic edge in timing their market moves.

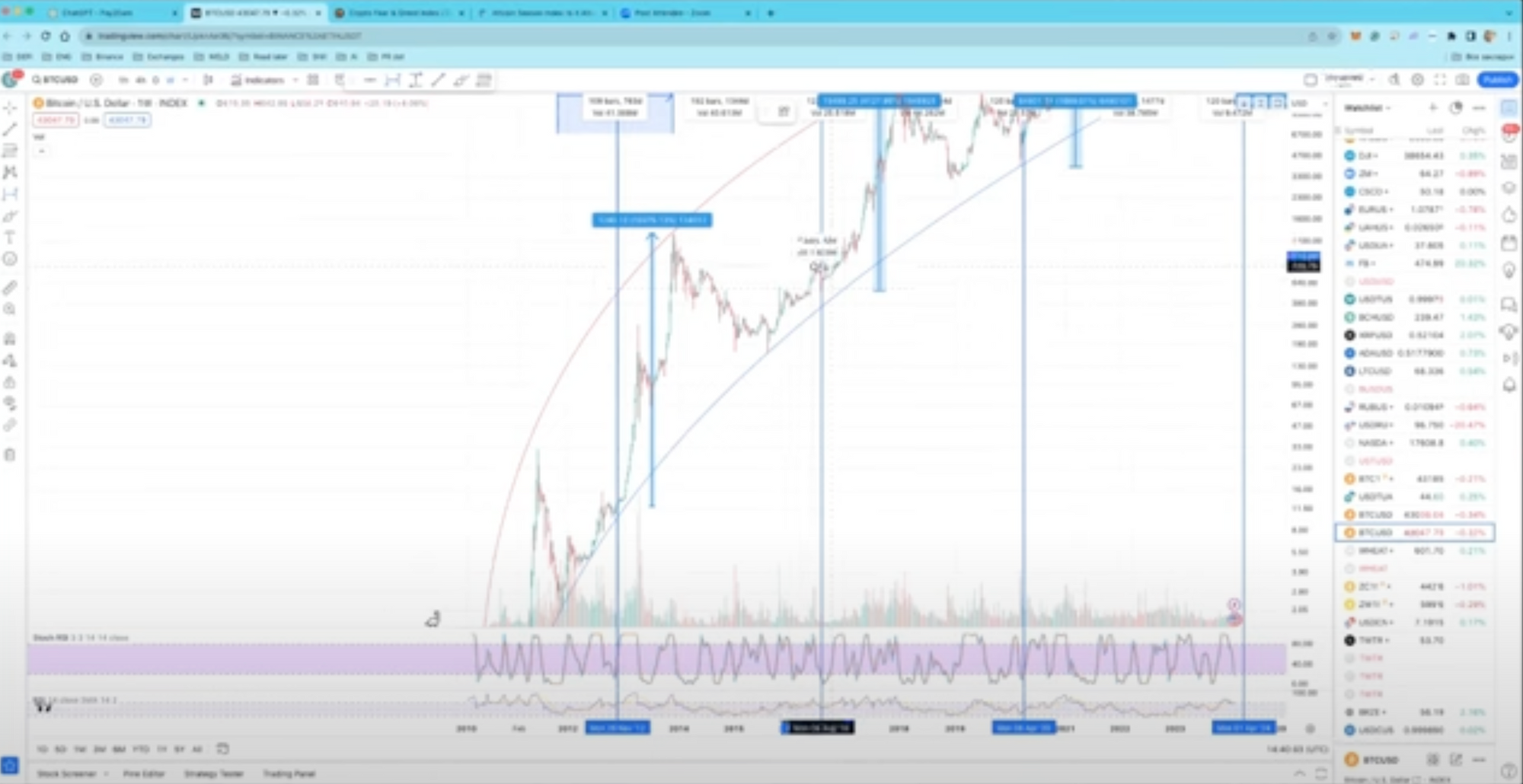

Bitcoin Halving and Market Dynamics: The Clock Is Ticking

A pivotal event on every crypto enthusiast's calendar, the Bitcoin halving, is expected to significantly impact the market.

In the video Iryna elaborates on historical patterns showing that halvings lead to bullish markets, with the upcoming event likely to push Bitcoin prices to new heights, indirectly catalyzing the altcoin market.

Furthermore, the discussion covers how Bitcoin's dominance index and its relationship with altcoins provide insights into market mood shifts. A strategic approach to these dynamics can help in making informed investment decisions.

2024 Market Predictions: A Glimpse into the Future

Looking ahead, Iryna shares her bullish outlook for Bitcoin, predicting a potential surge to over $100,000 mark post-halving. This optimistic scenario is backed by analysis of past trends and current market indicators, offering a beacon for investors navigating the 2024 crypto landscape.

However, the conversation doesn't stop at Bitcoin. She stresses the importance of diversification, recommending investment across various blockchain ecosystems such as Ethereum, Polygon, Avalanche, Solana and others. This diversified approach not only spreads risk but also maximizes potential gains from the market's volatility.

Solana's Saga and the Alameda Elephant in the Room

Solana has emerged as a key player in the blockchain universe, attracting attention for its scalability and speed. However, navigating investment decisions in such ecosystems requires not just enthusiasm but also a discerning eye for potential risks.

Iryna, our seasoned crypto expert, shares her optimistic yet cautious view on Solana, especially concerning the potential impact of Alameda's holdings on its price.

Solana's Promise: Everyone should acknowledge Solana's technological advancements and its growing ecosystem, which have positioned it as a strong competitor in the blockchain space. With significant developments and an increasing number of projects choosing Solana as their home, the platform's future seems bright.

A Note of Caution: Despite the optimism, Iryna raises a critical concern regarding Alameda Research's substantial holdings of Solana tokens. Given the interconnected histories of Alameda and Solana, the potential liquidation or movement of these holdings could introduce volatility to Solana's price. Iryna advises investors to be mindful of this factor, as it could lead to significant market movements.

Navigating Solana Investments: For those considering Solana as part of their investment portfolio, Iryna suggests a balanced approach. While acknowledging Solana's potential for growth and innovation, she emphasizes the importance of staying informed about factors that could impact its market dynamics, such as the actions of major holders like Alameda.

In short, while Solana presents an exciting opportunity for blockchain enthusiasts and investors, Iryna's insights remind us of the importance of cautious optimism. Being aware of the broader market influences and potential risks is crucial in making informed decisions and navigating the crypto market's uncertainties.

Portfolio Management: Balancing Risk and Reward

In the volatile world of crypto, managing your investment portfolio is akin to steering a ship through stormy seas. Our advice? Diversify, but do so judaciously. Iryna advocates for a balanced portfolio that includes both established cryptocurrencies and promising altcoins within robust blockchain ecosystems.

Moreover, the discussion emphasizes the need to stay updated on market indicators and trends. For Web3 founders and crypto investors, leveraging tools like the crypto fear and greed index and keeping an eye on Bitcoin's dominance can provide crucial insights into market sentiment and potential shifts.

As we chart our course through the 2024 crypto market's dynamic waters, leveraging the wisdom of seasoned investors like Iryna is indispensable. From decoding the onset of the altcoin season to preparing for Bitcoin's halving impacts, the actionable insights offered are a lighthouse for Web3 founders and investors aiming for informed decision-making.

The journey through the crypto market is one of continuous learning and adaptation. By diversifying your investment portfolio and staying abreast of market indicators and trends, you position yourself to not just survive but thrive in the volatile crypto environment.

But why stop here?

Dive deeper into these insights by watching the full video. And there's more where that came from! We're rolling out new episodes every weekend, featuring a lineup of incredible guests – traders, investors, experts, and protocols – all ready to share their invaluable insights with our community.

Don't miss out on learning how to maximize the potential of the upcoming bull run and navigate the 2024 crypto season efficiently. Subscribe to our YouTube channel and turn on notifications 🔔 to be alerted every time a new episode goes live.

Let's not just watch from the sidelines; let's dive in, headfirst, into the transformative storm that is 2024. Armed with insights from this and upcoming videos, we're not just spectators; we're pioneers.

Together, we're on a journey not just to witness history but to write it. Here's to making bold choices, embracing the uncertainty, and building a future where crypto isn't just an asset class, but a new way of envisioning the world.

Don't miss: