DePIN Fundraising Playbook: How to Raise for DePIN + Build an Investor List That Converts (2026 Edition)

Complete DePIN fundraising guide: 150+ active VCs, $744M in deals analyzed, real case studies, pitch templates, and tokenomics models. Updated Jan 2026.

📅 Last Updated

January 22, 2025

📊 Active DePIN VCs

150+ Investors

⏱️ Reading Time

12 minutes

Let's start with the uncomfortable truth: most DePIN founders are pitching the wrong investors.

You've probably noticed this already. You send 50 cold emails to "Top Crypto VCs" and get back... nothing. Maybe a few polite passes. The occasional "not our thesis right now."

Here's why: majority of search results for "DePIN investors" in Google are aimed at retail token buyers ("Top 10 DePIN Coins to Buy"), not founders looking for venture capital. The generic "Top 50 Web3 VC" lists include funds that have never touched a hardware project and never will. And the specialized DePIN investors? They're getting hundreds of inbound decks per month.

DePIN fundraising is fundamentally different from raising for a typical crypto project. You're not building a token - you're building infrastructure. Physical hardware. Deployment networks. Real-world unit economics. Supply chains. Regulatory exposure. Most crypto investors don't understand this. The ones who do are highly selective.

This guide is for founders who are serious about closing a round in 2026. Not vanity metrics. Not hopeful cold outreach. A practical playbook for finding, qualifying, and converting the investors who actually write checks into decentralized infrastructure.

We'll cover:

- The actual state of DePIN funding as of December 2025 (with sourced numbers)

- How DePIN-native investors evaluate startups differently

- The investor map: who's writing checks, at what stage, and for what thesis

- Recent funding rounds and what they tell us about what's getting funded

- A step-by-step method to build your target list in 60 minutes

- A free sample from our verified database of 150+ DePIN investors

Let's get into it.

🎯 Need the investor list NOW? Skip the reading, download 150+ verified DePIN investors with decision-maker contacts, Twitter/LinkedIn profiles, and sub-vertical tags. Or keep reading for the full playbook ↓

📖 Table of Contents

🎯 TL;DR for Founders

Market: $744M invested in 165+ DePIN startups (only publicly disclosed deals in 2024-2025)

What Changed: Revenue > Nodes. Investors want enterprise contracts, not just network growth.

Hottest Sectors: AI-Infra DePIN (GPU/compute), DeWi (wireless), Sensors

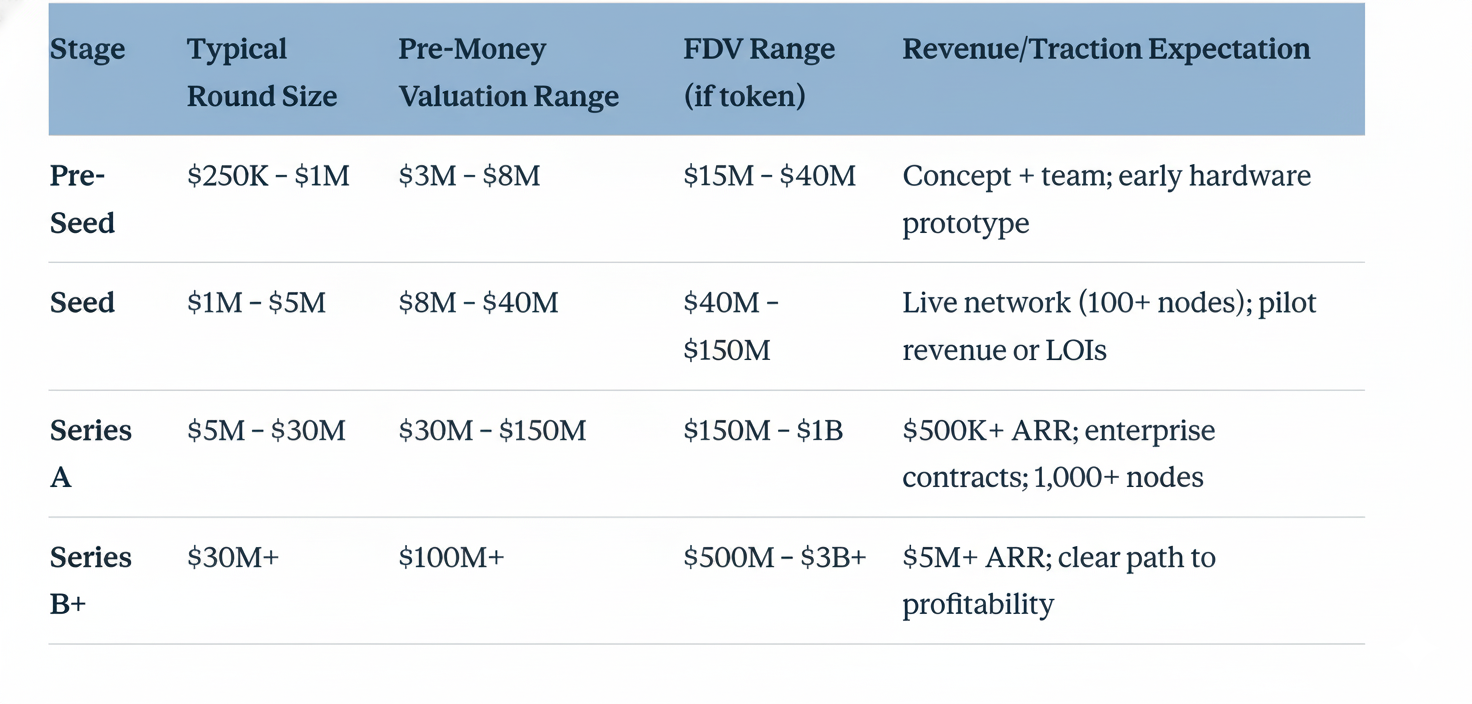

Typical Raise:

- Pre-seed: $250K-$1M at $5-10M cap

- Seed: $1M-$5M at $15-50M FDV

- Series A: $5M-$30M at $150M-$1B FDV

What Investors Want:

- Live network with real revenue ($50K+ ARR for seed)

- Enterprise customers or LOIs

- Sustainable tokenomics (not emission-dependent)

- Team with hardware/infra experience

Resources: 150+ verified DePIN investors, contacts, thesis, portfolio examples 👇

The State of DePIN Funding (December 2025)

Market Size & Capital Flows

The DePIN sector has matured significantly. As of late 2025, the numbers tell a clear story:

Market Capitalization: CoinGecko tracks approximately $19-33 billion in combined market cap across nearly 250 DePIN projects—up from just $5.2 billion in September 2024. The sector now represents a meaningful slice of the total crypto market.

Venture Funding: According to The Block Pro Research, over $744 million was invested in 165+ DePIN startups between January 2024 and July 2025, with an additional 89+ undisclosed deals. Messari tracked approximately $350 million in pre-seed to Series A rounds in the 12 months through late 2025, with DePIN attracting the highest share of crypto-VC inflows in early 2025.

Dedicated Funds: Major institutional commitments continue:

- Borderless Capital's $100M DePIN Fund III (September 2024) — backed by peaq, Solana Foundation, Jump Crypto, IoTeX

- Entrée Capital's $300M Fund (December 2025) — explicitly targeting AI agents and DePIN infrastructure at pre-seed through Series A (CoinDesk)

- Aethir's $100M Ecosystem Fund — supporting AI and gaming projects on decentralized compute

Valuations: Newer DePIN projects are achieving average Fully Diluted Valuations (FDV) of $760 million in 2025—nearly double the valuations of protocols launched two years earlier.

What Changed in the Last 12 Months

The DePIN investment landscape has shifted from "hype" to "prove it." Here's what's different:

1. Revenue Is King

Early DePIN investments were often thesis-driven bets on network effects. In H2 2025, investors demand actual revenue. The leaders are proving the model works:

- Aethir: $39.8 million in Q3 2025 revenue alone, ARR exceeding $166 million across 150+ enterprise clients (Aethir Blog)

- Helium: $1.7 million in network fees in October 2025—driving the sector to a record $2.5 million total monthly fees (Artemis)

- DePIN fees up 273% year-over-year as real usage scales

The message is clear: if you're raising without demonstrable demand-side traction, you'll struggle.

2. The "Web2.5" Model Wins

The most successful 2025 rounds went to projects that bridge Web2 enterprise demand with Web3 infrastructure. Investors want to see enterprise contracts, not just community nodes. Aethir's $344 million Strategic Compute Reserve from NASDAQ-listed Predictive Oncology exemplifies this institutional-grade approach.

3. AI x DePIN Is the Hottest Sub-Sector

The convergence of AI infrastructure demand and decentralized compute has created a clear funding leader. GPU/compute DePIN projects dominated H2 2025 capital allocation, with Grayscale naming DePIN as a Q2 2025 focus area.

4. Regulatory Clarity Emerging

A major milestone: in September 2025, the SEC issued a no-action letter for DoubleZero's 2Z token, recognizing DePIN utility tokens as distinct from securities under certain conditions. This precedent signals reduced regulatory risk for compliant projects.

The Sub-Sectors Getting Funded Right Now

Based on our analysis of 200+ early-stage DePIN deals in 2025 (which informed the DePIN Investor Database), here are the hottest sub-sectors:

What Is a DePIN Investor?

A DePIN investor is a venture capital fund, angel investor, ecosystem grant program, or strategic capital allocator that deploys capital specifically into Decentralized Physical Infrastructure Networks—blockchain-coordinated systems that incentivize the deployment, operation, and maintenance of real-world physical infrastructure such as GPU compute clusters, wireless networks, sensor arrays, energy grids, and storage networks.

Unlike general crypto investors focused on DeFi protocols or NFT platforms, DePIN investors evaluate hardware unit economics, supply-side deployment velocity, demand-side revenue, and physical network effects. They typically require domain expertise in both blockchain tokenomics and traditional infrastructure economics.

How DePIN Investors Evaluate Startups in 2026

The 6-Point Due Diligence Framework

In 2026, DePIN investors underwrite a small set of risk buckets fast: supply, demand, unit economics, token value capture, and execution realism. Based on conversations with DePIN-native VCs and our analysis of recent term sheets, here's what top investors look for:

1. Supply-Side Scalability

- Can you scale node deployment without bottlenecking on hardware availability?

- Is your hardware commoditized (good) or custom/proprietary (risky)?

- What's the unit economics per node (cost to deploy vs. expected returns)?

2. Demand-Side Revenue

- Who is paying for your network's output?

- Do you have signed enterprise contracts or letters of intent?

- What's the revenue run rate, and how much is "real" vs. token emissions?

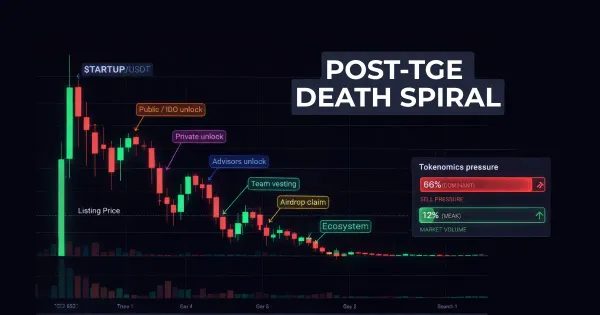

3. Tokenomics Sustainability

- Does your token have genuine utility beyond speculation?

- How do you prevent token inflation from outpacing network growth?

- Is there a clear path to protocol revenue that accrues to token holders?

4. Deployment Reality

- How many nodes are actually live and producing?

- Can you show a live deployment map + uptime/utilization snapshot (not screenshots, but verifiable links)?

- Can you prove uptime, quality, and utilization metrics?

5. Team & Execution

- Do founders have hardware/infrastructure experience?

- Have they operated networks at scale before?

- What's the engineering velocity?

6. Regulatory Preparedness

- Have you taken legal advice on token classification?

- Are you compliant with local hardware deployment regulations?

- What's your plan for different jurisdictions?

Red Flags That Kill Deals

- No live network — Concept decks without deployed nodes rarely close in 2025

- Custom hardware dependency — Supply chain risk is a dealbreaker

- Token emissions > Revenue — The "Ponzi economics" concern

- No enterprise demand pipeline — "Build it and they will come" doesn't work anymore

- Vague tokenomics — If you can't explain value accrual simply, investors assume there isn't any

- Team without hardware experience — DeFi backgrounds alone aren't enough

What Strong DePIN Decks Prove

The best decks we've seen answer these questions immediately:

- "Why can't AWS/Helium/Filecoin do this?" — Clear competitive moat

- "Who's already paying?" — Named customers or signed LOIs

- "What's the unit economics per node?" — Specific numbers, not projections

- "How does the token capture value?" — Direct protocol revenue connection

- "Why this team?" — Relevant hardware/infrastructure track record

💡 Quick Takeaways for Your Pitch:

✅ Show revenue first — Token emissions ≠ revenue

✅ Name your customers — LOIs count, vague "pipeline" doesn't

✅ Prove the network is live — Links to deployment maps, not screenshots

✅ Have one sentence for "Why not AWS/Helium?" — Your competitive moat

✅ Match investor thesis — Don't pitch wireless VCs with GPU projects

The DePIN Investor Map: Types, Thesis & Where Founders Waste Time

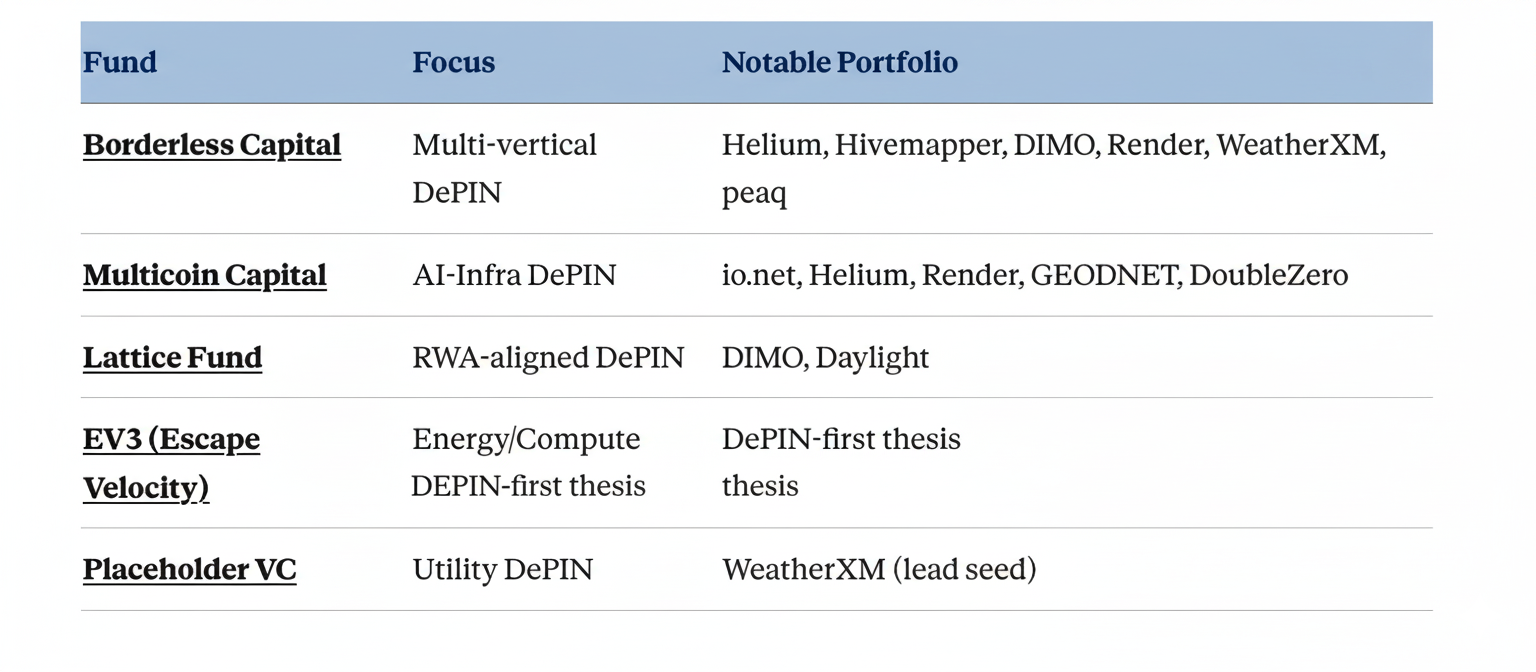

Tier 1: DePIN-Native VCs

These funds have explicit DePIN mandates and deep sector expertise:

Why they matter: They understand the hardware, won't waste your time with basic questions, and can add strategic value beyond capital.

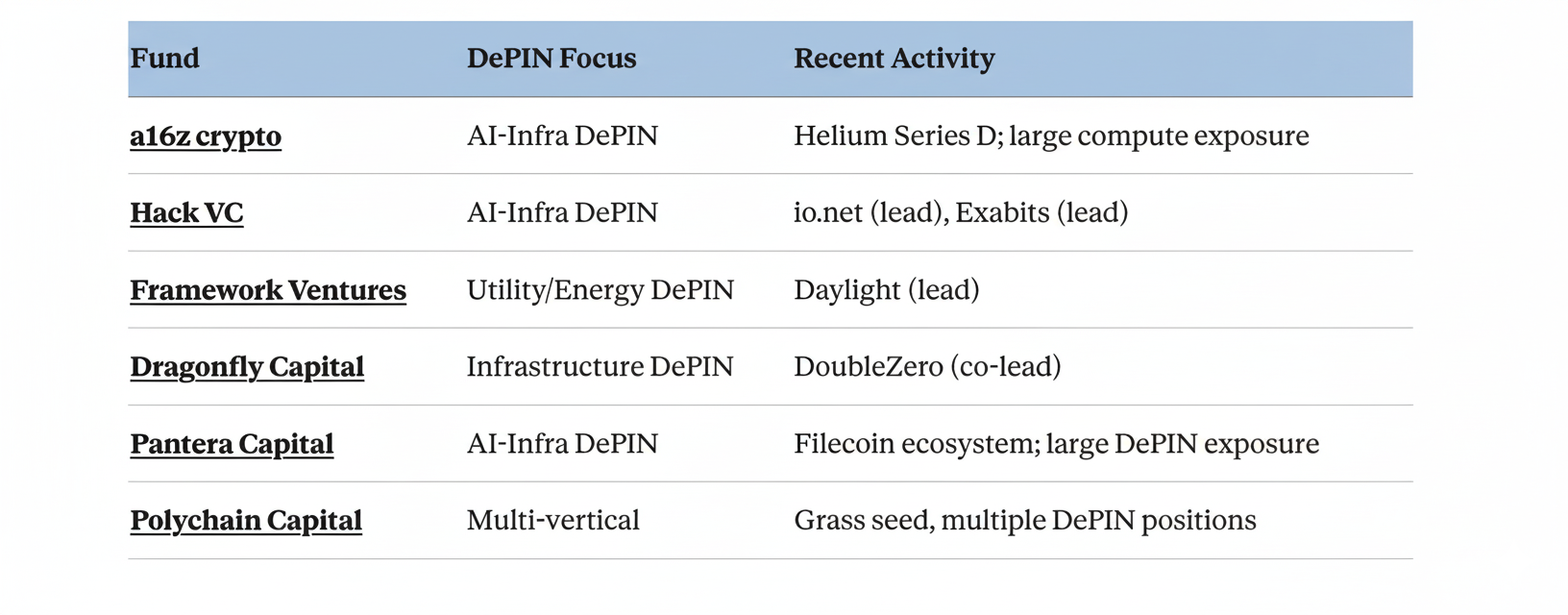

Tier 2: Crypto Generalists with DePIN Exposure

Large crypto funds with dedicated DePIN allocations:

Why they matter: Larger check sizes, strong brand signal, extensive LP relationships for follow-ons.

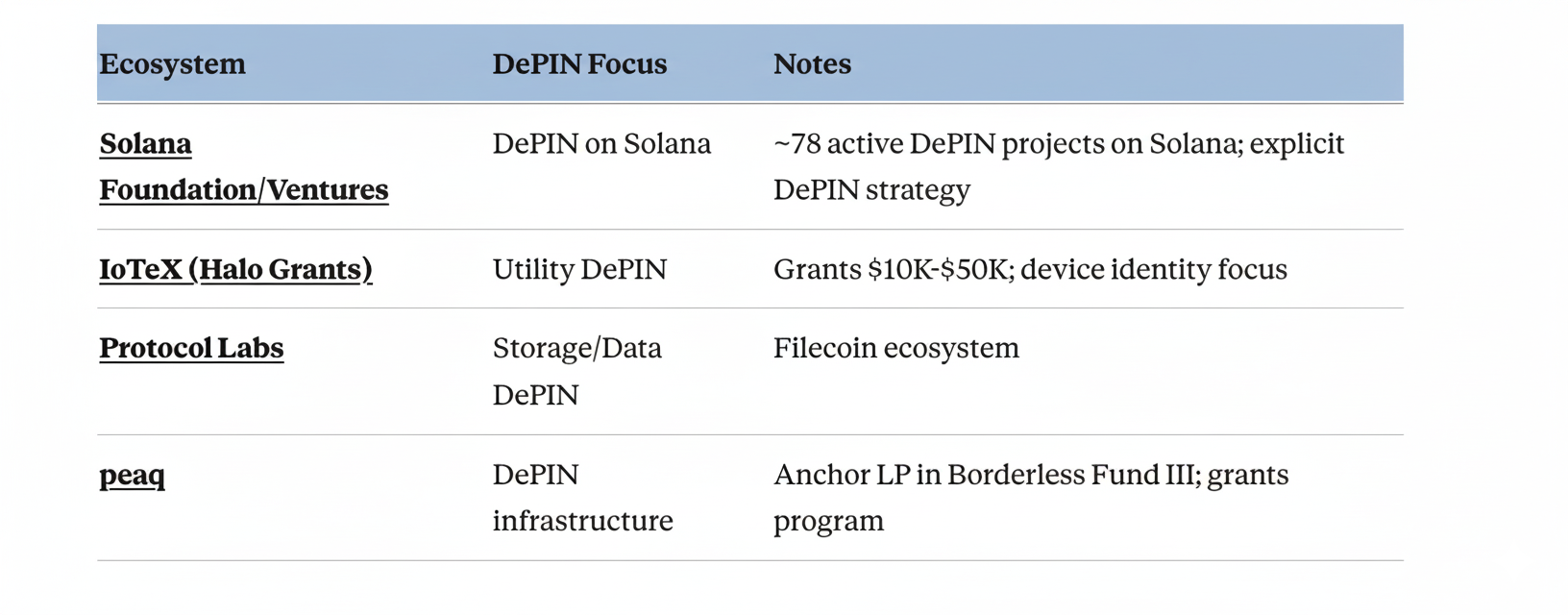

Tier 3: Ecosystem Funds & Grants

Non-dilutive or strategic capital from blockchain ecosystems:

Why they matter: Non-dilutive (grants) or strategic (ecosystem investment). Often faster to close than traditional VC.

Tier 4: Angels & Operators

Individual investors, often founders/operators from successful DePIN projects:

- Helium co-founders (Sean Carey now at Borderless)

- Solana co-founders (Anatoly Yakovenko, Raj Gokal are also active DePIN angels including DoubleZero)

- Protocol Labs founder (Juan Benet)

Why they matter: Smaller checks but valuable signal, introductions, and operational advice.

Now that you know who's investing, let's look at what they've actually funded in 2025.

Recent Funding Rounds: What's Actually Getting Funded (2025)

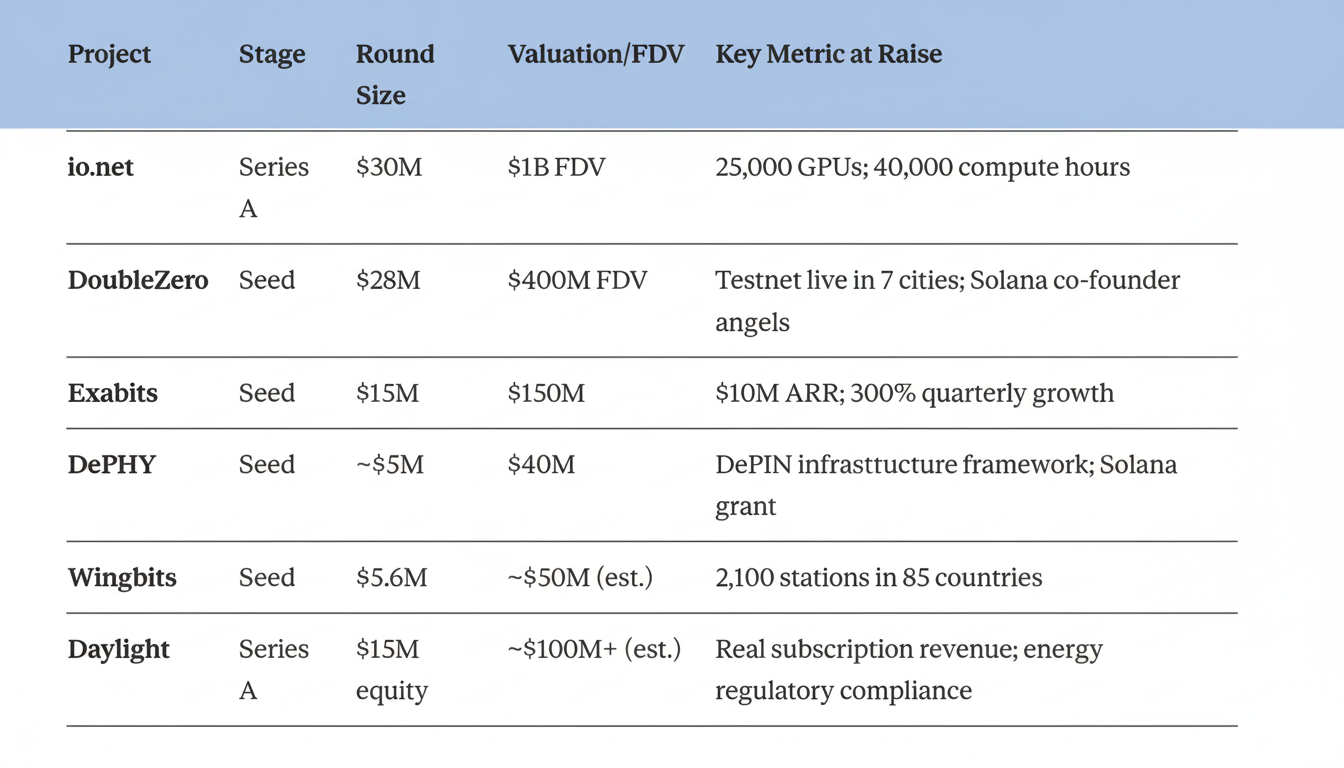

Let's look at specific rounds from the past 6 months to understand what's closing:

DoubleZero: $28M Token Round (Spring 2025)

What they do: Decentralized fiber backbone for high-performance blockchain networking

Round details: raised $28M at $400M valuation; co-led by Multicoin Capital and Dragonfly Capital; Foundation Capital, Borderless Capital, Jump Crypto participating. Angels include Solana co-founders Anatoly Yakovenko and Raj Gokal.

Why it closed:

- Former Solana Foundation Head of Strategy (Austin Federa) as co-founder

- Clear technical moat: addresses latency/bandwidth issues for blockchain validators

- First DePIN to receive SEC no-action letter (September 2025)

- Testnet live in 7 global cities before raising

Daylight: $75M Total (October 2025)

What they do: Distributed solar energy grid / "virtual power plant" DePIN

Round details: raised $15M equity round led by Framework Ventures (a16z crypto, Coinbase Ventures participating) + $60M project development facility from Turtle Hill Capital

Why it closed:

- Massive TAM (energy infrastructure)

- Real subscription revenue, not token-dependent

- Clear path to enterprise integration and regulatory compliance

- Hybrid "crypto rails + traditional energy markets" model

Exabits: $15M Seed (December 2024)

What they do: GPU tokenization platform for AI compute infrastructure

Round details: $15M seed led by Hack VC at $150M valuation; total funding now $20M

Why it closed:

- 300% quarterly revenue growth, $10M ARR at close

- Hardware-first approach: tokenizing actual GPU compute, not just marketplace

- Stanford Blockchain Accelerator + Harvard Innovation Labs backing

- Integration of 4,000 NVIDIA H200 GPUs with TEE capabilities

Roam: TGE + Network Milestone (March 2025)

While not a traditional VC round, Roam's TGE demonstrates what successful network scaling looks like.

What they do: Decentralized WiFi and eSIM network

Round details: TGE across 8 exchanges (Bybit, Bitget, KuCoin, Gate.io, MEXC)

Why it matters:

- 2.3 million users, 2+ million WiFi nodes across 190+ countries

- Ranked #4 in Messari's 2024 DePIN report for projects with 1M+ active nodes

- #1 on DePINscan for hardware nodes

- Solana-native with strong ecosystem backing

Key Patterns Across Recent Rounds

- Revenue > Nodes — Investors prioritize revenue metrics over raw deployment numbers

- Institutional bridges — Projects connecting Web3 to enterprise/traditional markets win

- Regulatory clarity — SEC no-action letters and compliance frameworks are competitive advantages

- DePIN-native leads — Borderless, Multicoin, Hack VC, Dragonfly leading the largest rounds

- Ecosystem alignment — Solana dominates (78 DePIN projects), but multi-chain flexibility matters

💡 Ready to reach these investors?

The investors who funded DoubleZero ($28M), Daylight ($75M), and Exabits ($15M) are in our verified database. Download the full list here →

Or continue reading to see exactly what these investors look for ↓

150+ DePIN investors Database: Data, Patterns, Insights from 2025 deals

While putting together the 2025 DePIN investors database, that covers most active venture capitalists, angels and corporate VCs in this vertical, we tried to identify patterns most articles miss, and saw the following :

Near one third of active backers in DePIN in 2025 were Crypto VC funds. Meanwhile, traditional VCs back ~11%-13% deals in this vertical, family offices & strategic investors - 16% respectively.

Angels represent approx. a quarter of active DePIN investors, while often being overlooked in founder outreach strategy. Many are former operators from Helium, Filecoin, and Solana ecosystems.

Subvertical focus

AI-Infra DePIN and Utility DePIN are roughly equal in investor attention in 2025 (49% and ~43% respectively), but AI-Infra is growing faster. RWA-aligned DePIN remains niche (below 10%), but it’s strategically important.

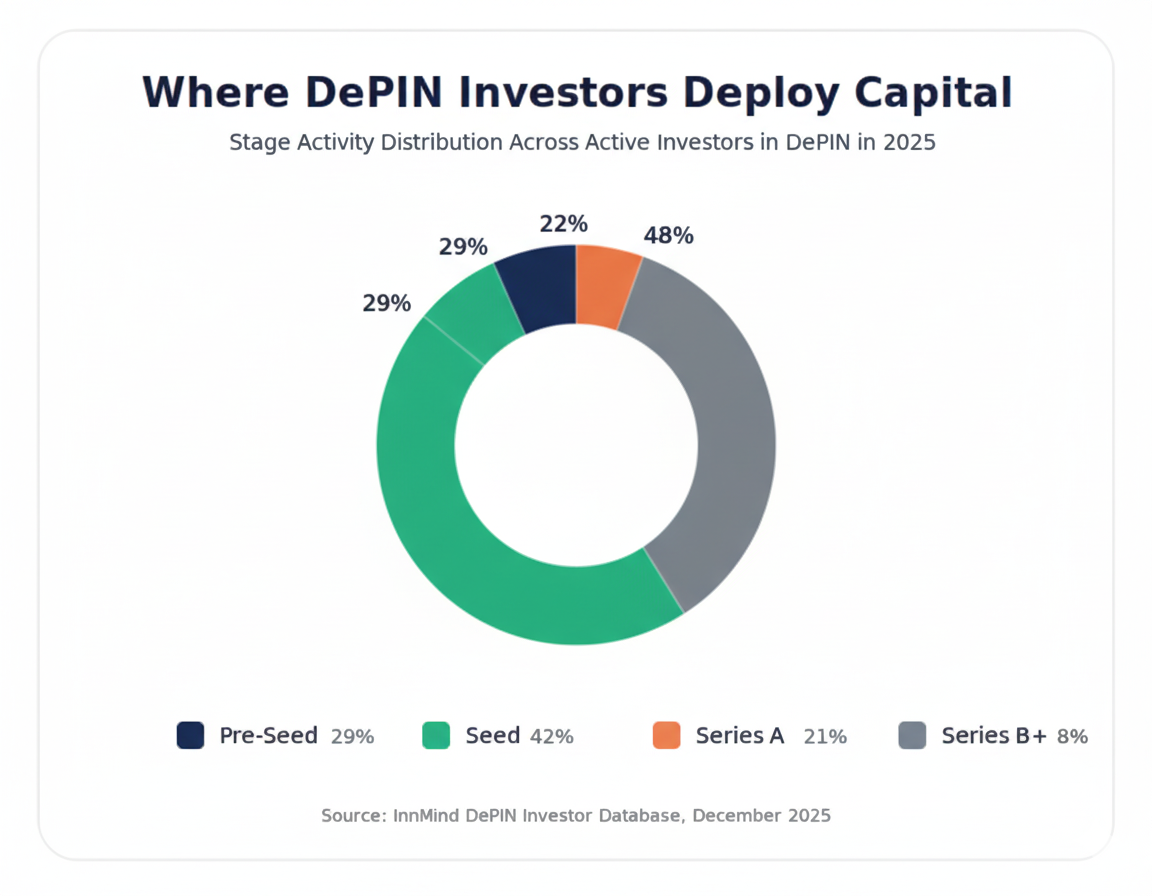

Stage Preferences

Insight: The majority of DePIN-active investors operate at pre-seed and seed. Series A+ requires significant traction and proof-of-market-fit, thus most founders should target smaller funds first.

DePIN Revenue & Valuation Benchmarks: What Investors Actually Expect (2025 Data)

One of the most common founder questions: "What valuation should I expect at my stage?"

The problem is that most benchmark data comes from general startup ecosystems- SaaS, fintech, biotech.

DePIN is different.

Hardware economics, token mechanics, and network effects create a unique valuation dynamic.

Here's what our analysis of 2025 DePIN term sheets reveals:

Key Trend: DePIN Valuations Are Running Hot

According to Messari's Q1 2025 DePIN report, DePIN projects launched in the past 12 months achieved average FDVs of $760 million - nearly double the valuations of protocols launched two years ago. This reflects:

- Learned tokenomics: newer projects avoid the emission mistakes of early DePIN (e.g., excessive inflation)

- AI narrative premium: GPU/compute DePIN commands 2-3x valuations vs. utility DePIN

- Solana ecosystem tailwind: ~78 DePIN projects on Solana benefit from ecosystem support

We've put together a few real-world valuation examples in DePIN from 2024-2025 in a simple table to give you a better understanding of valuations:

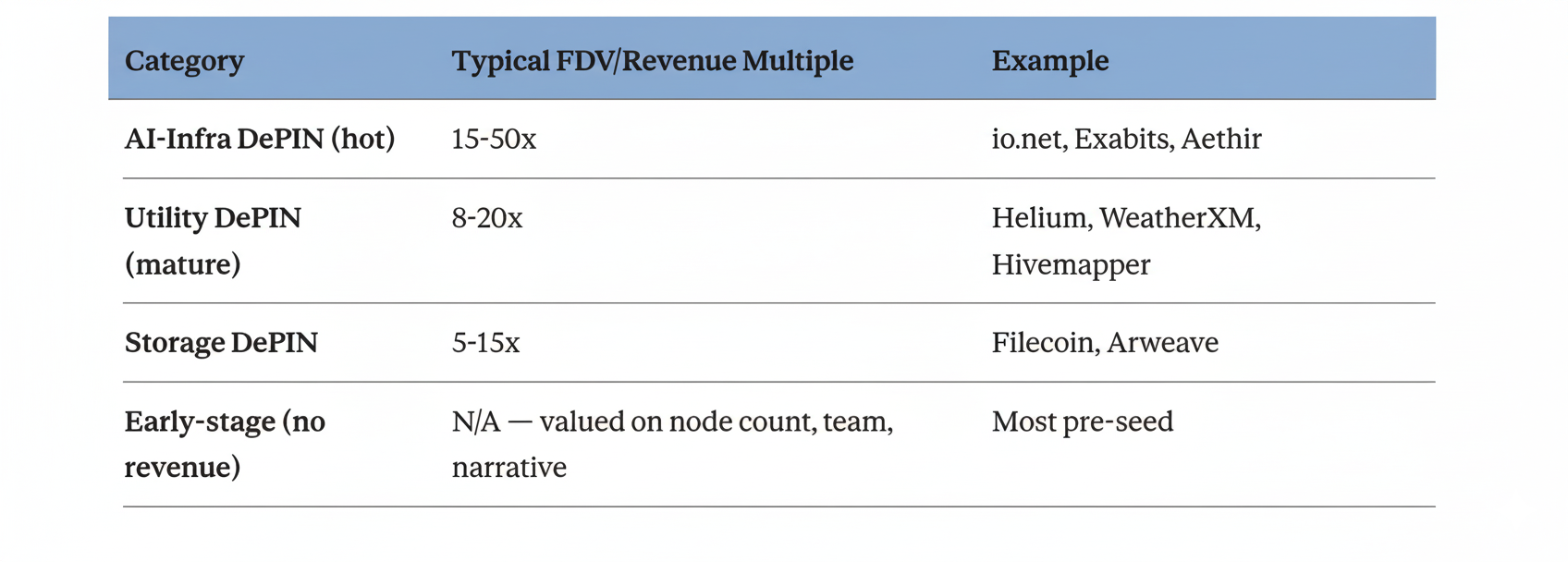

Insight: The gap between "hot" AI-Infra DePIN and "utility" DePIN is widening. io.net and Exabits command premium valuations (15-20x revenue multiples), while sensor/data DePIN like Wingbits and WeatherXM trade at more traditional 8-12x multiples.

FDV & Revenue Multiples: What's "Normal" in DePIN?

Unlike traditional SaaS (8-15x ARR), DePIN valuations are driven by FDV/Revenue ratios that factor in token emissions and network growth potential:

Critical caveat: These multiples apply to real revenue, not token emissions. Aethir's $166M ARR comes from enterprise customers paying for compute—not from protocol inflation. Projects with high "revenue" but low actual demand-side spending will face valuation compression.

The Aethir Benchmark: What "Category Leader" Looks Like

Aethir's Q3 2025 performance sets the bar for what DePIN investors now expect from category leaders:

- $39.8M quarterly revenue (22% QoQ growth)

- $166M ARR (13x increase from $12M one year prior)

- 435,000+ GPU containers across 93 countries

- 150+ enterprise clients (AI, gaming, Web3)

- Rev/MC ratio of ~6% — 2.3x better than Filecoin, 5.5x better than Render

For founders: If you're raising Series A, investors will ask how your trajectory compares to Aethir's early growth. If you're at seed, they want to see a path to similar metrics within 18-24 months.

What This Means for Your Raise

Pre-Seed ($250K-$1M):

- Valuation caps of $5-10M are standard for crypto/Web3 (Carta data shows crypto pre-seed has among the highest median caps)

- Focus on team, thesis, and hardware prototype—not revenue

- Ecosystem grants often provide better terms than priced rounds

Seed ($1M-$5M):

- Expect $15-50M FDV depending on sub-sector and traction

- Investors want to see 100+ nodes live, ideally with pilot revenue

- The "no revenue, high FDV" era is over—show demand-side validation

Series A ($5M-$30M):

- FDV of $150M-$1B is achievable for high-growth AI-Infra DePIN

- Minimum bar: $500K ARR or clear path to it within 12 months

- Enterprise contracts > community nodes for valuation purposes

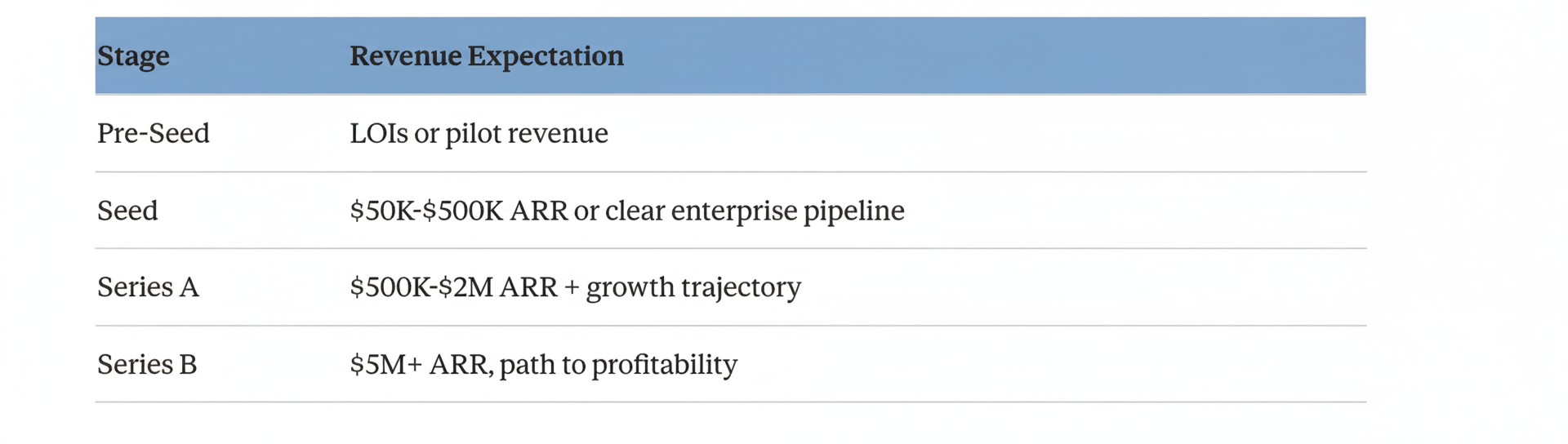

Revenue Expectations by Stage (What Closes Rounds)

Insight: The bar has risen significantly. Pre-2024, seed rounds closed on network potential alone. Now, even seed investors want to see demand-side validation.

Note: "Revenue" means actual demand-side payments... NOT token emissions, not internal transfers, not "protocol fees" from your own treasury.

Now that you understand what investors expect, here's how to find and reach them systematically:

Build Your DePIN Target List in 60 Minutes

If you're planning to start fundraising for your early-stage DePIN startup, you should pitch to as many relevant investors, as possible, collect feedback and understand investors sentiment before signing the first term sheet.

But how to do it if you don't have right investors in your network?

Here's the step-by-step process to build a qualified target list of investors for your fundraising outreach:

Step 1: Define Your Sub-Vertical (5 minutes)

DePIN is not one category. Investors specialize, they have specific mandate and thesis. You need to know which bucket you're in:

- AI-Infra DePIN: GPU/compute, inference, AI training, storage

- Utility DePIN: Wireless, sensors, weather, mapping, mobility

- RWA-aligned DePIN: Energy, tokenized data, regulated sectors

If you're building a GPU marketplace, don't waste time on investors focused on sensor networks.

Step 2: Filter by Stage & Check Size (10 minutes)

Clarify where you are:

- Pre-seed ($250K–$1M): Angels, ecosystem grants, small DePIN-native funds

- Seed ($1M–$5M): Lattice, Placeholder, EV3, Borderless

- Series A ($5M–$30M): Hack VC, Multicoin, Framework, Dragonfly

Pitching top-tier mega funds (like a16z, etc) at true pre-seed is usually low ROI (or a waste of time to be brutally direct) unless you have an outlier signal (ex-Category founders, clear distribution wedge, or early enterprise pull). And if you struggle identifying what stage you're in - register on InnMind and ask professional advisors in our Pro group.

Step 3: Research Thesis Alignment (20 minutes)

For each investor on your shortlist:

- Read their thesis posts (Borderless has "DePIN Thesis 2.0"; Multicoin publishes regularly)

- Look at recent portfolio additions (past 12 months)

- Check if they've invested in competitive projects

- Note any geographic or sub-sector preferences

Step 4: Identify Decision Makers (15 minutes)

Generic fund emails get ignored. You need the partner name:

- Check the fund's team page

- Look at who announced recent deals (Twitter/X, press releases)

- Cross-reference with the decision-maker names in our database

Step 5: Build Your Target Outreach Sequence (10 minutes)

Structure your outreach:

First touch (LinkedIn connection request or X DM):

"Hi [Name], noticed your [specific portfolio company] investment and your focus on [sub-sector]. Building [your project], a [sub-vertical] DePIN for [asset type]. We have [traction signal]. Open to connect?"

Follow-up rule: every follow-up must include one new datapoint (pilot, revenue, deployments, utilization, LOI). No ‘just checking in’

Cold email (if no warm intro available):

"[One sentence on why you're reaching out to them specifically]. We're building [project name], a [sub-vertical] DePIN that [one-liner]. We can share: (1) unit economics per node, (2) demand pipeline, (3) sustainable tokenomics. Here's our deck link: [your docsend link]. Would you be open to a 15-min fit check?"

and finally:

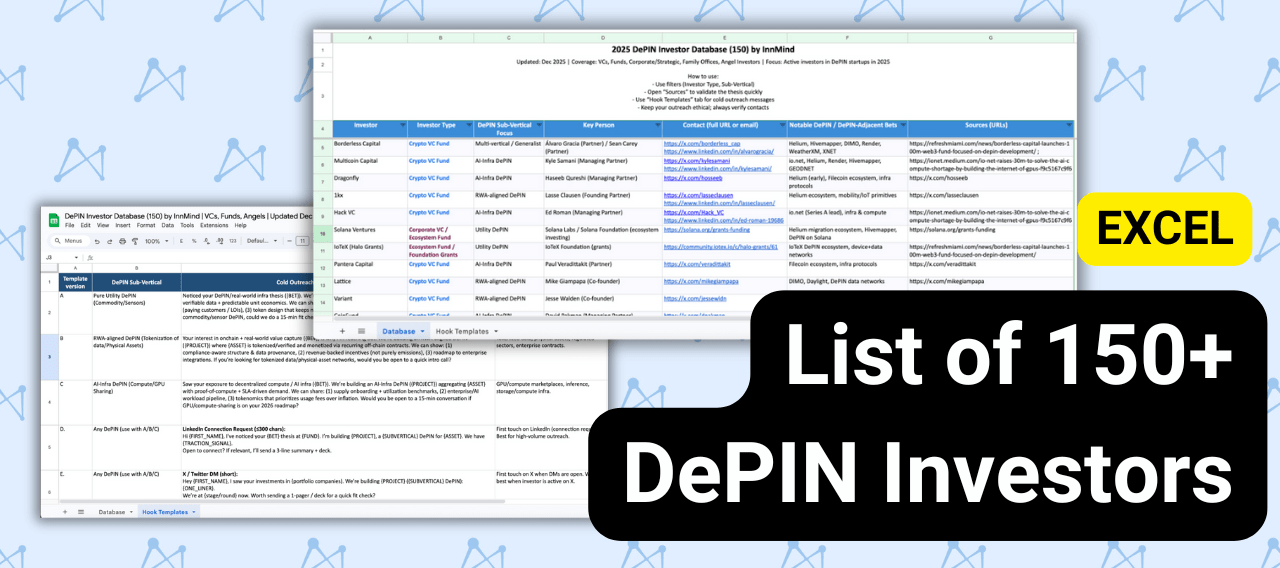

Get the Full Database: 150+ Verified DePIN Investors

What's in the InnMind DePIN Investor Database:

- 150+ verified investors (VCs, angels, ecosystem funds, family offices)

- Decision-maker names

- DePIN sub-vertical focus (AI-Infra, Utility, RWA-aligned, etc.)

- Portfolio examples with source links

- Contact information (Twitter/X, LinkedIn)

- Cold outreach templates for each sub-vertical

Or Get Unlimited Access with InnMind Fundraising Subscription: if you're raising for DePIN (or any Web3/AI startup), the DePIN database is just one of 50+ resources included in Fundraising plans.

InnMind Fundraising Core (€49/month) includes:

- Full access to ALL investor databases (DePIN, AI Angels, Web3 VCs, etc.)

- Pitch deck templates, tokenomics calculators, legal templates

- 70 connection requests/month to InnMind's verified investor network

- Investor Digest listing (900+ active VCs/angels, sent bi-weekly)

- Save over $200K+ in startup perks

InnMind Fundraising Pro (€89/month) adds:

- Unlimited connection requests

- Full CSV export of all investor lists

- Weekly office hours advisor calls

- Private founder Telegram PRO group

For most DePIN founders actively raising, the subscription pays for itself in one investor intro.

FAQ: DePIN Fundraising Questions

How much money can I raise for a DePIN startup in 2026?

- Pre-seed rounds: $250K-$1M at $5-10M valuation caps

- Seed rounds: $1M-$5M at $15-50M FDV

- Series A: $5M-$30M at $150M-$1B FDV

Recent examples: DoubleZero raised $28M at $400M (Spring 2025), Daylight raised $75M total (October 2025), Exabits raised $15M seed at $150M valuation (December 2024).

Who are the top DePIN investors actively writing checks in 2026?

Top DePIN-native VCs: Borderless Capital ($100M DePIN Fund III), Multicoin Capital, Hack VC, Lattice Fund, EV3, Placeholder VC.

Crypto generalists with DePIN exposure: a16z crypto, Framework Ventures, Dragonfly Capital, Pantera Capital.

Ecosystem funds: Solana Foundation, IoTeX Halo Grants, Protocol Labs, peaq Ecosystem Fund.

View the full list of 150+ investors with contacts.

What traction do I need to raise seed funding for DePIN in 2026?

Minimum bar for seed in 2026: $50K-$500K ARR or signed enterprise LOIs (letters of intent).

Investors want to see:

- 100+ live nodes (not just testnet)

- Demand-side revenue (actual customers paying, not token emissions)

- Unit economics per node (cost to deploy vs. expected returns)

- Clear token utility beyond speculation

Gone are the days of raising seed on "network potential" alone. Revenue or clear enterprise pipeline is now required.

Which VCs invest in DePIN?

Top DePIN-native funds include Borderless Capital, Multicoin Capital, Hack VC, Lattice Fund, and EV3. Crypto generalists with DePIN exposure include a16z crypto, Framework Ventures, Dragonfly, and Pantera.

How is DePIN fundraising different from other crypto?

DePIN involves physical hardware, real-world unit economics, supply chains, and regulatory exposure. Investors need to understand infrastructure economics, not just token mechanics.

What DePIN sub-sectors are getting funded?

AI-Infra/GPU compute is the hottest sector in H2 2025, followed by wireless/DeWi, sensors/data, and energy. Storage is more mature with established players.

Should I apply for ecosystem grants first?

Often yes. Grants from Solana, IoTeX, peaq, or Protocol Labs are non-dilutive and provide ecosystem credibility before approaching VCs.

How do I find DePIN angel investors?

Many are former operators from Helium, Filecoin, or Solana ecosystems. The InnMind DePIN Investor Database contains 150+ verified investors (VCs and angels) with decision-maker contacts, thesis details, and portfolio examples.

What's the average valuation for DePIN seed rounds?

Average FDV for 2025 DePIN projects is approximately $760 million, nearly double 2023 levels. Seed valuations typically range from $10M-$50M depending on traction.

Is regulatory risk a concern for DePIN investors?

Yes, but improving. The SEC's September 2025 no-action letter for DoubleZero provided regulatory clarity for utility-focused DePIN tokens.

📤 Found this guide helpful?

Share it with other DePIN founders:

Share on Twitter · Share on LinkedIn

Or bookmark for later: Press Cmd+D (Mac) or Ctrl+D (Windows)

Other useful resources for startups: