Navigating Web3 Due Diligence in 2025: What Founders & Investors Need to Know

Landing Web3 funding in 2025 feels like a boss level, right? Investor scrutiny is at an all-time high. This guide breaks down the new crypto VC landscape, why thorough due diligence is non-negotiable for founders, and how InnMind equips you to win investor trust and secure capital

Let’s be honest—due diligence in Web3 used to be a chaotic mess. Back in the early days, if you had a slick pitch deck, some Telegram buzz and Discord hype, and a fancy token name, you could probably raise a round and receive a fat check pretty fast. But 2025? That’s a whole different game.

The market has matured, investors are battle-scarred, and frankly, everyone's tired of vaporware. If you're a Web3 founder dreaming of closing that crucial funding round, you need to understand the new rules of engagement.

The good news? Funding is still out there. Serious capital is flowing into projects that demonstrate real substance.

The challenge? The bar is incredibly high, and the path is littered with pitfalls. Many founders feel it's nearly impossible to attract capital at an early stage or find active, liquid crypto VCs, let alone convince them to invest in this market.

This is where meticulous preparation and understanding investor expectations become paramount. And a huge part of that preparation is nailing your Due Diligence (DD). It’s no longer a checkbox exercise; it's the bedrock of investor trust.

Why Due Diligence Matters Now

In 2025, the fluff’s been filtered out. Scams, collapses, and regulatory shakeups have pushed everyone—investors and founders—to level up their standards. Due diligence is no longer a “nice to have”—it’s your ticket to building trust, getting funded, and staying out of trouble.

Good DD helps investors make smarter bets and helps founders prove they’re not just the next rug pull. Win-win.

What’s Actually Under the Microscope Now?

Here’s what’s showing up on every serious Web3 due diligence checklist this year:

1. Legal and Regulatory Compliance (yes, still important for solid crypto VCs)

The Landscape: With MiCA fully operational in Europe, clearer (albeit still strict) SEC/CFTC stances in the US, and maturing crypto sandboxes in the UAE and Singapore, ignorance is no longer bliss.

Founders: You must have a clear understanding of your legal jurisdiction, token classification (is it a utility, security, or something else?), and your KYC/AML obligations. The "we're a DAO, lol" excuse? Dead on arrival.

Investors: If a founder can't articulate their legal and compliance strategy concisely and confidently, it’s a massive red flag. This signals potential future headaches they’d rather avoid.

2. Technical Infrastructure

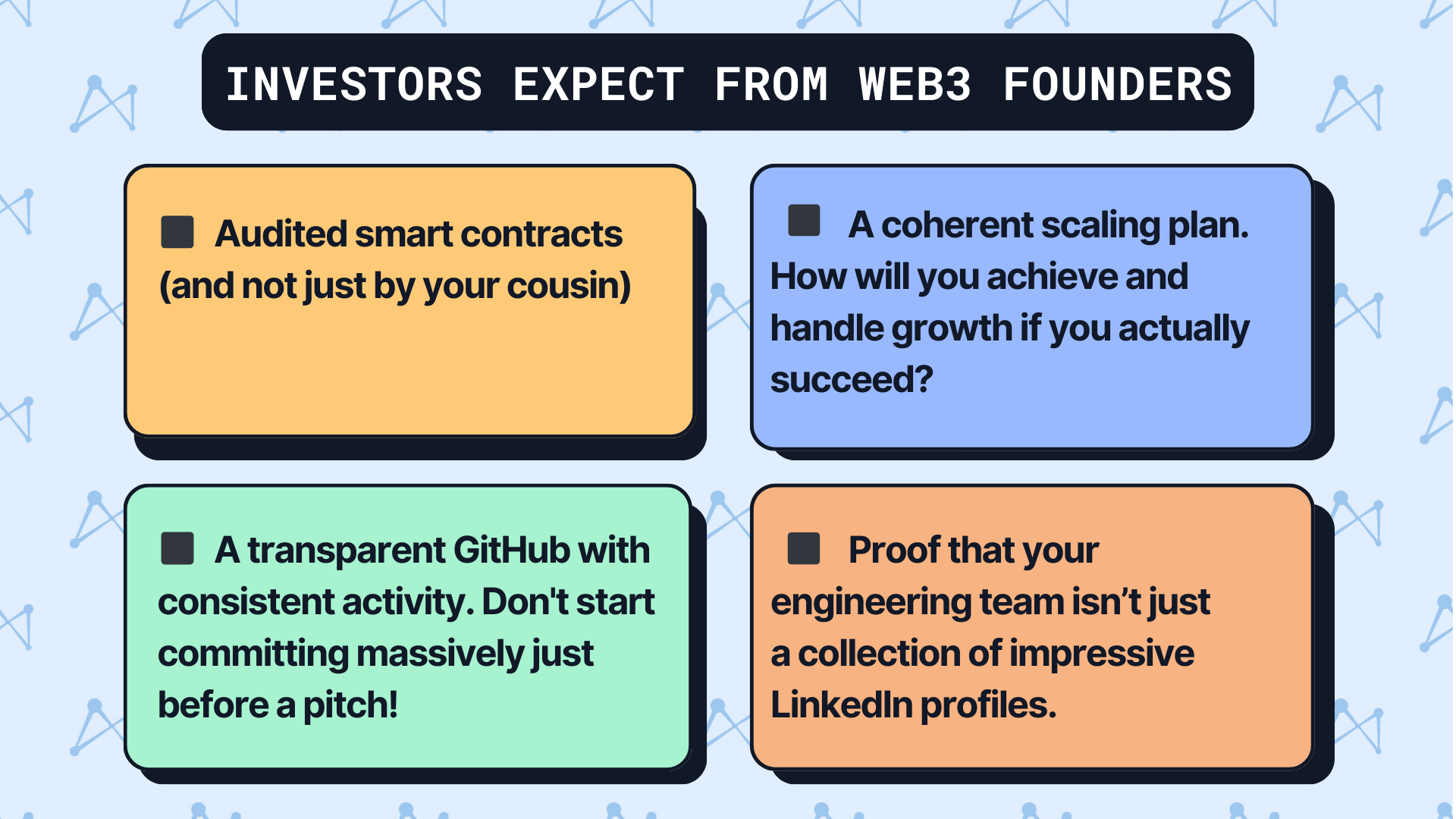

Forget MVPs that barely compile. Today, investors expect:

Layer 2s like Morph are setting the bar here—prioritising scalability, transparency, and actual user experience. Their transparent development process and focus on real-world utility have attracted significant investment, highlighting the importance of clear technical and market strategies.

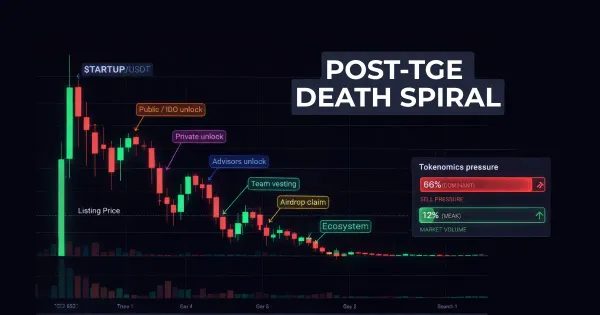

3. Tokenomics & Financial Viability (Does Your Token Have a Pulse?)

- Real Utility: Is your token integral to your ecosystem, or is it just a fundraising mechanism? Does it have a clear purpose that drives demand beyond speculation?

- Sustainable Model: Has serious thought gone into your token’s emission schedule, vesting periods, and treasury management for the long haul (think year 3, year 5)?

- Proof of Concept: Look at most significant raises in the space: Binance’s $2B raise this year showed how serious capital flows to platforms with robust, compliant and battle-tested token strategies, not just convoluted "infinite staking APY" narratives.

>>> Don’t forget to check our tokenomics calculator here.

4. The People & The Plan (Team & Governance)

Authenticity & Accountability:

Are the founders and core team members doxxed and credible? Do they have relevant experience? Crucially, how do they handle tough questions? Evasiveness is a deal-breaker.

Clear Governance:

"Decentralized" doesn't mean chaotic. Investors demand clarity on decision-making processes. Opaque multi-sigs controlled by a handful of anonymous wallets? That’s a hard pass for most serious VCs in 2025. They want to see a clear path to community involvement if it’s a DAO, or clear roles and responsibilities in a traditional structure.

Navigating the Gauntlet: How InnMind Helps You Get Funded

Feeling overwhelmed? That’s understandable. Preparing for this level of scrutiny while also building your project is a monumental task. This is where InnMind steps in. We live and breathe Web3 fundraising. Our team has the deep expertise, battle-tested experience, and network to guide you through this complex journey.

We don't just talk the talk; we help you walk the walk.

- Expert Guidance for Your Fundraising Strategy: We help you understand what VCs are really looking for in 2025 and how to position your project effectively.

- Sharpening Your Pitch & DD Materials: From refining your tokenomics to ensuring your legal framework is sound, we help you prepare a compelling and defensible case for investment.

- Access to Knowledge & Tools: 🔍 Free Resource: If you're unsure what a comprehensive DD process entails from an investor's perspective, you're in luck. We at InnMind have developed The Ultimate Due Diligence Checklist for Web3 Startups Aiming to Raise Capital. This isn't just a list; it's a strategic tool designed to get you investor-ready. 🧠 Check it out here

- Visibility & Investor Network: Beyond the prep, InnMind provides a platform to increase your visibility among active crypto VCs and access a curated database of investors actively looking for the next big thing in Web3. Register here.

Case Studies: How Top Web3 Projects Are Crushing Due Diligence

Let’s talk real-life examples—because theory is nice, but nothing beats seeing how others are doing it.

Take Aptos Labs. These folks have become a textbook example of institutional-grade compliance in Web3. Founded by ex-Meta engineers, they didn’t just build a slick Layer-1 blockchain—they built it with an eye toward regulation from day one. That meant setting up a legal framework that could withstand SEC scrutiny, onboarding heavyweight partners like Google Cloud and Microsoft to bolster credibility, and building a governance model that wasn’t just some vague DAO promise but a transparent, auditable structure. That’s part of why big names like a16z and Franklin Templeton backed them with serious capital this year.

Then there’s Thirdweb, one of the startups quietly revolutionizing the Web3 developer experience. Co-founded by Steven Bartlett, they’ve grown into a go-to platform for spinning up smart contracts with just a few clicks. What’s made them stand out in DD processes? Clean, understandable documentation. No fluff. Just solid, audited code and proactive communication. They don’t just talk security—they schedule it. Third-party audits, clear GitHub trails, and an open, supportive dev community make investors (and users) feel like they’re not walking into a black box.

Another ecosystem worth looking at is Polkastarter. Even as VC-backed rounds slow down in 2025, Polkastarter’s IDO platform is booming. Projects like SuperFarm and MahaDAO nailed their launches by being meticulous in prep: clear tokenomics, regionally compliant KYC processes, and regular post-launch updates. Founders who approach IDOs like proper roadshows—complete with transparency and structure—are attracting savvy investors who know the difference between hype and fundamentals.

Finally, Softstack (formerly Chainsulting) is a behind-the-scenes player helping raise the bar for everyone. They’ve become a gold standard for smart contract audits in 2025. What makes them shine? Their security credentials are no joke—ISO 27001 certified, which is rare in Web3. They’ve audited everything from ApeCoin to the TON ecosystem’s wallets. And they’ve done it in a way that projects love—fast, thorough, and with actionable insights, not just a pretty PDF to slap on a landing page.

It's More Than a Checklist: VC Fundraising in 2025 is About Trust and Substance

Successfully navigating Web3 fundraising in 2025 isn't just about ticking boxes on a DD checklist. It’s about embodying a mindset of transparency, preparedness, and genuine value creation.

For Founders: This means being rigorously honest about your project, knowing your numbers and strategy inside-out, and being ready to answer the toughest questions with clarity. It means seeing DD not as a burden, but as an opportunity to shine.

For Investors (and by extension, for founders to understand them): It's about going deeper than the hype. It's about verifying claims, understanding the risks, and backing teams that demonstrate both vision and the ability to execute responsibly.

The path to securing crypto VC funding is undoubtedly more challenging now. But for those Web3 founders who are serious, well-prepared, and can clearly demonstrate their project's viability and resilience through a comprehensive due diligence process, the opportunities are still immense.

Ready to take on the 2025 fundraising challenge and get your Web3 startup investor-ready?

➡️ Download InnMind's Ultimate Due Diligence Checklist for Web3 Startups.

➡️ Register on InnMind today to gain visibility, access our investor database, and tap into a wealth of knowledge, templates, and expert support designed to help you succeed. Don't navigate this complex landscape alone.

Welcome to the new era of Web3 fundraising. It's serious, it's thorough, and with the right approach and support from InnMind, you can be ready.

Read also: