Tokenomics Calculator & Modeling Guide: Build Sustainable Token Economics for Your Web3 Startup

This guide explains why most token economies collapse after TGE and what founders must change in 2025. Learn the practical framework and tools used by 200+ Web3 teams to build sustainable, investor-ready token models.

Building tokenomics that survive post-TGE is one of the hardest challenges for Web3 founders in 2025. Most teams rely on guesswork or outdated templates, then watch their token collapse within 90 days of launch.

This comprehensive guide shows you how to build a sustainable token model using a structured framework — plus access to the same tokenomics calculator that more than 200 Web3 startups used to raise capital and prepare for successful token launches.

What you'll learn:

- Why 80% of token economies fail within 90 days of TGE (and the 4 fatal flaws behind most crashes)

- The exact 6-step modeling process that creates sustainable token economics

- How to build investor-ready tokenomics in Google Sheets without hiring consultants

- A practical tool to model your entire token economy

Ready to start? Get the Tokenomics Calculator PRO →

If you're building a Web3 project and preparing for fundraising or TGE, understanding tokenomics is critical to your success.

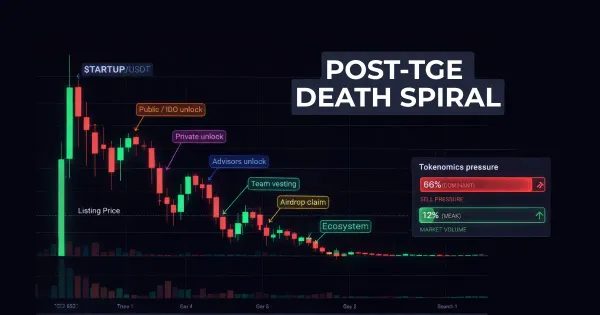

Why 80% of Token Economies Fail After TGE

Tokenomics has quietly become one of the most common reasons Web3 startups crash in 2025. Not the product. Not the team. Not even the market timing. The token model itself.

After reviewing hundreds of early-stage crypto projects over the past year, the same pattern repeats constantly. At the token launch, the price spikes for a brief moment, then starts a long slide that wipes out months of work. Founders blame macro conditions, community sentiment, or big holders dumping. But nearly every time, the real problem sits inside the token economics.

The current market is unforgiving. Investors run deep quantitative checks before writing a check. Users have been through enough hype cycles to spot red flags instantly. Token economies that looked acceptable a few years ago now collapse in weeks.

According to Messari's State of Crypto 2025 Report, tokens without clear utility lose almost 80% of their active users within 90 days of TGE. Poor tokenomics fail faster than ever, regardless of hype, partnerships, or marketing budgets.

This isn't theoretical. This is the reality of building in Web3 today.

The 4 Fatal Tokenomics Flaws Killing Web3 Startups in 2025

1. Emissions Designed to Look Good on Launch Day But Impossible to Sustain

Too many teams inflate early emissions to pump TVL and user numbers. It brings attention fast, but it attracts the wrong crowd. Reward hunters farm the emissions, dump the token, and leave the moment incentives slow down.

What remains is constant sell pressure and a community that was never real in the first place.

Recent industry research shows that projects with poorly structured emissions lose almost 80% of active users within 90 days of TGE. The inflation quickly outpaces demand. Selling pressure becomes permanent. The token economy never stabilises.

What works in 2025: Winners now prefer smoother emission curves and reward systems tied to real usage. Incentives adjust based on on-chain behaviour. Rewards are a byproduct of utility, not speculation. These changes filter out mercenary capital and help attract users who actually stay.

2. Vesting Schedules That Destroy Early Momentum

This is one of the most common reasons investors decline deals in 2025. If unlock events hit the market before the ecosystem has time to stabilise, the price collapses on impact.

Many teams still create early cliffs for insiders or investors, and those cliffs become public landmines on the chart. Even strong projects with great products collapse when liquidity hits too early.

The problem: Cliffs unlocking right after TGE, private investors receiving tokens before traction, or team unlocks arriving during weak market periods all create the same outcome — downward pressure the market has already priced in.

Smart investors reject deals purely based on vesting logic. You can have an amazing product, but broken unlocks will stop you long before TGE.

Healthy projects build the opposite structure:

- Longer cliffs to protect early liquidity (minimum 6-12 months)

- Slow linear unlocks that build trust over 24-48 months

- Release mechanics tied to real milestones, not arbitrary dates

This gives the token time to grow naturally instead of fighting immediate sell pressure from insiders and early investors.

3. Tokens With No Real Purpose or Utility

The era of "launch now, utility later" is gone. Tokens without direct connection to real product usage behave like speculative chips and nothing more. If the token does not fuel product mechanics, governance, or value capture, markets treat it as tradeable noise.

This isn't personal. It's how the ecosystem evolved after too many cycles of hype followed by collapse.

According to Messari's research, utility-driven tokens retain value far longer than speculative tokens. They maintain healthier liquidity. They build stronger post-TGE communities. The difference is not subtle.

Utility today comes from practical functions:

- Unlocking product features or premium tiers

- Enabling meaningful governance over protocol parameters

- Powering staking mechanisms with real yield

- Participating in revenue-sharing or burn loops

- Creating priority access to scarce resources

- Driving recurring internal demand through product mechanics

Tokens without this foundation become simple trading instruments. Traders extract value before moving on.

4. Modeling Guesses Instead of Real Economic Logic

Healthy tokenomics requires math. Circulating supply projections. Inflation curves. Liquidity planning. Scenario modeling. Treasury strategy. Market cap simulations under different growth conditions.

Most struggling projects skip these steps entirely. They rely on old templates or spreadsheets with no underlying logic. Investors notice this within minutes of reviewing the token model.

A major 2025 academic review from TDE.fi listed poor mathematical alignment as the top failure point for token economies. The research analysed hundreds of failed projects and found that the vast majority never built proper economic models.

You cannot build a sustainable token model by guessing. And in 2025, assuming your tokenomics is as dangerous as guessing your CAC, LTV, or revenue model.

How to Model Tokenomics Without Burning €20K on Consultants

After working with hundreds of Web3 teams over the past few years, one thing has become clear: most founders skip the modeling phase entirely.

They reuse old spreadsheets, outdated templates, or AI-generated layouts that look like a model but lack an economic foundation. Some spend tens of thousands on consultant-created PDFs that look professional but contain no actual logic or scenario planning.

The reality is simple: Most founders don't have proper token models. They have guesses dressed up as strategy.

You would never manage your burn rate or customer acquisition costs with guesswork. You would never build financial projections based on intuition alone. So why do it for token supply, inflation, and liquidity — the elements that determine whether your token survives or collapses after TGE?

Tokenomics requires structure. Without it, everything else collapses.

The good news? You don't need to spend €15K-€50K on tokenomics consultants. You don't need complicated financial modeling software. You don't need a PhD in economics.

You need a structured framework and the right tool.

This is exactly why we created the Tokenomics Calculator PRO (2025 Edition). It's a complete modeling system designed for founders who need clarity without wasting money on consultants.

What the Tokenomics Calculator PRO Includes:

Core Modeling Features:

- Supply allocation and distribution across all stakeholder groups

- Full vesting logic with cliffs and linear unlocks

- Emissions and inflation modeling with growth scenarios

- Liquidity planning for AMM pools and market-making

- Market cap and valuation scenarios (bull/base/bear cases)

- Price impact calculations for different trade sizes

- Treasury sustainability and burn rate analysis

- Multiple what-if scenarios for stress testing

Investor-Ready Outputs:

- Automated dashboards that update instantly

- Circulating supply projections over 36 months

- Visual charts for unlock schedules and emissions

- Valuation models across different market conditions

Built entirely in Google Sheets. No complicated software, no formula conflicts, no version issues. Everything updates instantly when you change assumptions. Easy to share with investors and your team.

More than 200 Web3 startups have already successfully used previous editions to raise rounds or prepare for TGE.

Get the Tokenomics Calculator PRO for €199 →is

Or get it FREE with InnMind Premium membership (€49/month annual, €79/month monthly) — which includes 40+ other templates, databases, and tools for Web3 founders.

The 6-Step Tokenomics Modeling Framework That Works in 2025

To build a token model that survives past TGE, founders who succeed in 2025 rely on a structured process rather than intuition. This framework helps them create clarity, reduce unknowns, and build investor confidence long before the token goes live.

Step 1: Define the Token's Purpose and Utility

The strongest projects start by clarifying why the token exists in the first place. This isn't about listing vague use cases. It's about defining the economic role the token plays in your product ecosystem.

Focus on:

- Real utility is the tied directly to product usage. The token unlocks features, enables actions, or gates access to scarce resources.

- Internal sinks that create recurring demand. Users need to acquire and hold tokens to participate in the ecosystem over time.

- Meaningful governance mechanisms. Token holders can influence protocol parameters that actually matter, not symbolic votes.

- Clear value-capture loops. The token's value grows as the product scales, creating alignment between users and holders.

A token with a clear purpose becomes much easier to model and defend in investor conversations. A token without purpose becomes a speculative instrument that collapses under market pressure.

Step 2: Map Supply and Unlocks Over Time

Next, lay out the full supply schedule with precision. This includes:

- Cliffs: Minimum lock periods before any tokens unlock (typically 6-24 months for team and investors)

- Linear vesting: Gradual token releases over 12-48 months after cliff periods

- Milestone-based unlocks: Tokens that release only when specific product or revenue milestones are achieved

This gives investors confidence that no sudden liquidity shocks will undermine early growth. A predictable unlock path is one of the most powerful signals of long-term seriousness.

Vesting schedules that allow early investors or team members to dump tokens immediately after TGE destroy projects before they have a chance to grow. Smart founders protect early liquidity ruthlessly.

Step 3: Model Demand Versus Supply Dynamics

Now comes scenario modeling. This is where most founders fail because they skip this step entirely or do it superficially.

You need to simulate:

- How emissions interact with utility and create or destroy value

- How demand evolves as users adopt the product and need tokens

- How each element affects the circulating supply over 24-36 months

- What happens to the price under different growth scenarios (bull, base, bear)

This step reveals where sell pressure may overwhelm the system long before it becomes a real problem. It shows whether your emissions plan is sustainable or whether it will create permanent downward pressure.

The Tokenomics Calculator PRO includes built-in scenario planning tools that let you test these assumptions instantly.

Step 4: Test Liquidity and Price Impact

Strong teams run liquidity simulations across different market conditions. This means modeling:

- How various pool sizes affect volatility and slippage

- How does price respond under low liquidity during bear markets

- How the treasury should allocate reserves to maintain stability

- What happens when large holders decide to exit positions

This helps avoid common TGE disasters that kill projects in the first 30 days. Many founders launch with insufficient liquidity, then watch their token crash 80% on the first week of trading because they never modeled price impact.

Liquidity planning is not optional. It's the difference between a controlled launch and a catastrophic collapse.

Step 5: Stress-Test Token Distribution

A sustainable token economy requires aligned incentives across teams, investors, the community, and the treasury. Concentration of tokens in the wrong hands creates catastrophic risks.

Test how:

- Distribution shifts over time as different groups unlock and trade

- Various stakeholders interact with the token under different price conditions

- Concentration risks might create unexpected sell pressure

- Power dynamics evolve as governance tokens unlock

This protects the economy against imbalances that only become visible after launch — when it's too late to fix them.

Step 6: Prepare Investor-Ready Outputs

Finally, founders translate the model into clear dashboards and visualisations:

- Unlock timelines showing when each stakeholder group receives tokens

- Valuation scenarios across bull, base, and bear market conditions

- Emissions charts showing inflation over time

- Circulating supply projections for 24-36 months

- Treasury runway showing how long reserves will last

These outputs help investors quickly understand the token's mechanics. More importantly, they demonstrate the founder's mastery of tokenomics — a major advantage in today's fundraising environment.

Founders who can walk through their token model with confidence and clarity stand out immediately. Those who fumble through vague explanations get rejected, regardless of product quality.

What Web3 Teams Are Doing Right in 2025

Trend 1: Utility First, Speculation Second

Projects that require the token for core usage achieve far stronger stability after launch. Think value capture tied to protocol revenue, governance over meaningful parameters, staking tied to product actions, or access logic for premium features.

Hype no longer sustains a token for more than a few weeks. Utility does.

Trend 2: "Proof of Value" Becomes the New Standard

Founders must articulate how their token captures value. Not in vague promises but in clear economic terms. Investors expect the same clarity they expect from SaaS founders presenting unit economics.

The bar has risen dramatically. Fuzzy statements about "community governance" or "future utility" no longer work. Investors want to see the math.

Trend 3: Fundraising Now Requires Complete Tokenomics Clarity

VCs increasingly expect a complete token model before they take the first meeting. That means vesting maps, emissions planning, liquidity runway, market cap simulations, and clear assumptions documented in a spreadsheet.

If you cannot speak in detail about your token model, you are already behind the competition.

Trend 4: Sustainable Economics Outperform Short-Term Pumps

The market is ruthless toward anything that looks like a quick pump. The projects that survive are those with sustainable liquidity, predictable emissions, and a value-capture loop that grows with the product.

Trading volume and hype spikes matter far less than they did in previous cycles. What matters now is whether the token economy can survive 12-24 months of real market conditions.

Common Tokenomics Mistakes (And How to Avoid Them)

The New Tokenomics Standards in 2025

Fundraising today is strict. Generic unlock charts or vague token descriptions immediately stop investor conversations. Many funds now request a complete spreadsheet model before agreeing to a second call.

Founders must show:

- Circulating supply projections over 24-36 months

- Emissions simulations under different growth scenarios

- Liquidity runway calculations and treasury burn rate

- Clear logic behind every assumption with documented reasoning

Investors expect to see how the model performs across different market environments. They want to understand the risks. They want to see that you've thought through edge cases and failure modes.

Vague promises no longer work. The bar has risen dramatically since 2021-2022. What passed for tokenomics during the last bull run gets rejected instantly today.

This is why structured modeling tools matter. The Tokenomics Calculator PRO was built with these investor expectations in mind — giving you interconnected tabs, automated charts, scenario planning, and investor-ready outputs that update instantly when you change assumptions.

Why Most Founders Actually Fail (The Uncomfortable Truth)

Here's the reality: Most founders don't fail because their token model is bad. They fail because they never had a real model to begin with.

After working with hundreds of teams, the pattern is clear. Many rely on:

- Patched-together spreadsheets with broken formulas and inconsistent logic

- Outdated ICO diagrams copied from 2017-2018 projects

- Expensive consultant-created PDFs that look professional but lack mathematical structure

- AI-generated tokenomics tables with no grounding in real economic principles

These aren't token models. They are guesses dressed up as strategy.

And in 2025, guessing your tokenomics is as dangerous as guessing your CAC, LTV, or revenue model. No founder would manage their burn rate or customer acquisition with pure intuition. But somehow, many still approach token economics this way.

The result? Catastrophic post-launch crashes that destroy months or years of work in a few weeks.

Tokenomics requires the same discipline as financial modeling. You need assumptions. You need scenarios. You need stress tests. You need to understand how the pieces fit together and what breaks under pressure.

Without this structure, you're not building a token economy. You're gambling.

Get the Tokenomics Calculator PRO (2025 Edition)

The Tokenomics Calculator PRO gives founders a complete modeling environment with interconnected tabs, automated calculations, and investor-ready outputs.

What's Included:

Core Modeling Features:

- Supply allocation & distribution across team, investors, community, treasury, liquidity

- Complete vesting logic with cliff periods and linear unlock schedules

- Emissions & inflation modeling with multiple growth scenarios

- Liquidity planning worksheets for AMM pools and market-making

- Treasury sustainability analysis with burn rate projections

Investor-Ready Outputs:

- Market cap & valuation scenarios (bull/base/bear cases)

- Circulating supply projections over 36 months

- Price impact calculations for different trade sizes

- Automated dashboards that update instantly

- Visual charts for unlock schedules and emissions

Built for Founders:

- Everything lives in Google Sheets — no installation needed

- Works on any device

- Easy to share with investors and team

- Instant updates when you change assumptions

- Clear documentation for every calculation

Pricing:

Option 1: €199 one-time purchase Buy Tokenomics Calculator PRO →

Option 2: Get it FREE with InnMind Premium InnMind Premium includes the Tokenomics Calculator PRO + 40+ other templates, databases, and tools for €49/month (annual plan) or €79/month (monthly).

What Founders Are Saying:

"This calculator saved us weeks of work and €30K in consultant fees. We used it to prepare our investor deck and closed a €2M seed round." — Crypto Startup Founder

"Finally, a tokenomics tool that actually works. The scenario planning feature helped us identify problems before TGE." — DeFi Protocol Team

More than 200 Web3 startups have already used previous editions to raise capital or prepare for successful token launches.

Founders who adopt structured modeling early: ✓ Raise faster because investor conversations are clearer ✓ Avoid catastrophic post-launch crashes ✓ Build healthier, more engaged communities ✓ Create token economies that survive beyond the first hype cycle

Get the Tokenomics Calculator PRO Now →

Need Help Customising Your Token Model?

The InnMind team works with 100+ Web3 startups every year on tokenomics design, fundraising strategy, and investor readiness.

If you need support beyond the calculator, we offer:

- Tokenomics consulting — custom model design and stress testing

- Fundraising strategy — investor targeting and pitch deck optimisation

- Investor readiness — prepare for due diligence and term sheet negotiations

Related Resources for Web3 Founders

Essential Tools:

- InnMind Premium Membership — 40+ templates, databases & tools

- AI Angel Investor Database — 500+ verified Web3/AI investor contacts

- All InnMind Templates & Tools — Complete founder toolkit

Further Reading:

- How to Avoid Common Fundraising Mistakes for Web3 Startups (replace with actual blog URL)

- Building a Crypto Investor Outreach Pipeline (replace with actual blog URL)

- The Complete Guide to TGE Preparation (replace with actual blog URL)

Bottom Line: Your Token's Survival Depends on This

Tokenomics is no longer something founders can postpone or handle superficially. It has become one of the strongest predictors of Web3 startup success or failure.

Founders who model their token economy early stand out immediately to investors. They avoid the collapses that destroy most projects after TGE. They build communities that stay engaged beyond the initial hype. They create sustainable economics that grow with their product.

Those who rely on guesswork rarely survive the first few months after launch.

If you're building in Web3, the right time to structure your token economy is now. Not after your next milestone. Not after fundraising. Not after TGE.

Now. Get Started with the Tokenomics Calculator PRO →

About InnMind: We're a platform serving Web3, crypto, and AI startup founders and VC investors. InnMind provides tools, templates, databases, and advisory services to help founders raise capital and build sustainable businesses. Learn more →