Top Crypto VC Investment Narratives in 2024

Wassup fellow founders,

I am back to bring you some positive fundraising vibes, and some tips in your uneasy journey. One notable change for the crypto market of 2024, is that as you noticed not all coins are running. On previous bullrun, the altcoin market mostly ran as a whole, bringing profits to holders of all the projects in the space.

Unfortunately since then, the amount of tokens has tripled and crypto VC investors have become much more selective in their agenda. but don't panic, folks.

You're probably thinking oh shit, how am I going to exchange my pixels for bills if our dear friends start to think before they invest? But don't worry, nothing really changed.

The only thing is that now to get on their radar you need to mention that you correspond to a fancy narrative, despite being a crypto project. And today I will show you what combinations of letters open the door to the hearts of investors.

Here are the top crypto narratives that are driving the market & attracting investors’ interest in 2024.

Where Crypto Investors Deploy Capital? The Top Crypto VC Investment Narratives in H1 2024

1. Real World Assets (RWAs)

Tokenizing real-world assets has become a significant trend, as it brings traditional assets onto the blockchain, enhancing liquidity, accessibility, and efficiency. This narrative has gained traction due to its potential to revolutionize sectors like real estate, commodities, and securities by making them more accessible to a broader audience. In 2023 tokenized US Treasuries grew by 641%, reflecting increasing institutional interest in integrating traditional finance with blockchain technology.

Top Deals:

- Ondo Finance: Raised $20 million in a Series A round in February 2024, led by Pantera Capital. Ondo Finance is focused on providing tokenized securities and structured financial products on the blockchain.

- Polymesh: Secured $15 million in a funding round in March 2024, led by Polychain Capital. Polymesh is a blockchain specifically designed for regulated assets, making it easier to create, issue, and manage security tokens.

- Total Investment: Approximately $200 million has been invested in RWA projects in H1 2024. Major stakes include $50 million from BlackRock and $40 million from Sequoia Capital.

2. Layer 2 Solutions

Layer 2 solutions address scalability issues in blockchain networks, providing faster and cheaper transactions. This narrative has gained momentum as blockchain adoption increases, and the need for scalable solutions becomes critical to handle the growing number of transactions without compromising speed or cost.

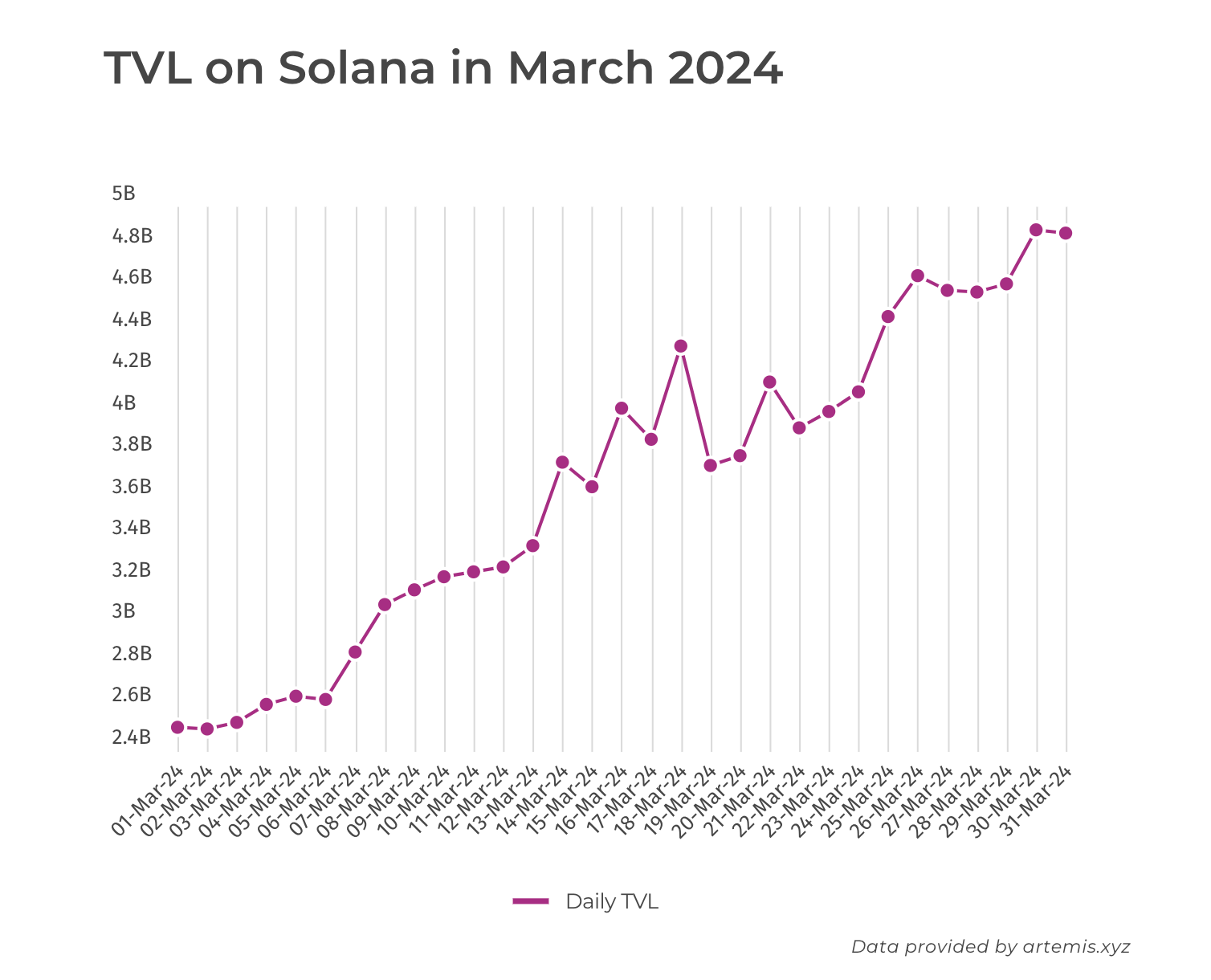

A notable fact is that Solana recorded 884,000 ( x3 increase) active addresses on January 31, 2024, reflecting significant growth driven by airdrops and increased activity in decentralized exchanges.

Top Deals:

- Arbitrum: Raised $120 million in a Series B round in January 2024, led by Lightspeed Venture Partners. Arbitrum enhances Ethereum's capabilities through its optimistic rollup technology.

- Optimism: Raised $100 million in a Series A round in February 2024, led by Andreessen Horowitz (a16z). Optimism focuses on scalable Ethereum solutions, reducing transaction costs and improving throughput.

- Total Attracted: Around $500 million has been directed towards Layer 2 projects. Notable contributions include $150 million from a16z and $120 million from Sequoia Capital.

3. AI and Blockchain Integration

Integrating artificial intelligence with blockchain technology is gaining traction, offering new utilities and efficiencies. This combination enhances the capabilities of both technologies, enabling autonomous decision-making, predictive analytics, and more secure data management. The AI sector's valuation has more than doubled over the past year, highlighting the growing synergy between AI and blockchain.

Top Deals:

- Fetch.AI: Raised $40 million in a Series C round in March 2024, led by Outlier Ventures. Fetch.AI focuses on creating a decentralized machine learning network that enables autonomous "agents" to perform useful economic work.

- Bittensor: Secured $35 million in a Series B round in April 2024, led by Dragonfly Capital. Bittensor aims to create a decentralized network for AI models to train and share knowledge.

- Total Attracted: Over $250 million has been funneled into AI and blockchain integration projects. Major stakes include $60 million from Outlier Ventures and $50 million from Digital Currency Group (DCG).

4. Decentralized Science (DeSci)

DeSci aims to transform scientific research and collaboration through blockchain's transparency and decentralization. This narrative is driven by the need for more open and collaborative research environments, breaking down traditional barriers in scientific funding and data sharing.

An interesting fact is that the decentralized science sector funded 200 projects through blockchain platforms in the past year, marking an increase by half.

Top Deals:

- LabDAO: Raised $25 million in a Series A round in January 2024, led by Paradigm. LabDAO creates a decentralized research infrastructure that allows scientists to share and monetize their work.

- VitaDAO: Raised $30 million in a Series B round in March 2024, led by Pantera Capital. VitaDAO funds decentralized biomedical research, focusing on longevity and healthspan.

- Total Attracted: Approximately $100 million has been invested in DeSci projects. Significant contributions include $30 million from Paradigm and $25 million from Pantera Capital.

5. Decentralized Physical Infrastructure Networks (DePIN)

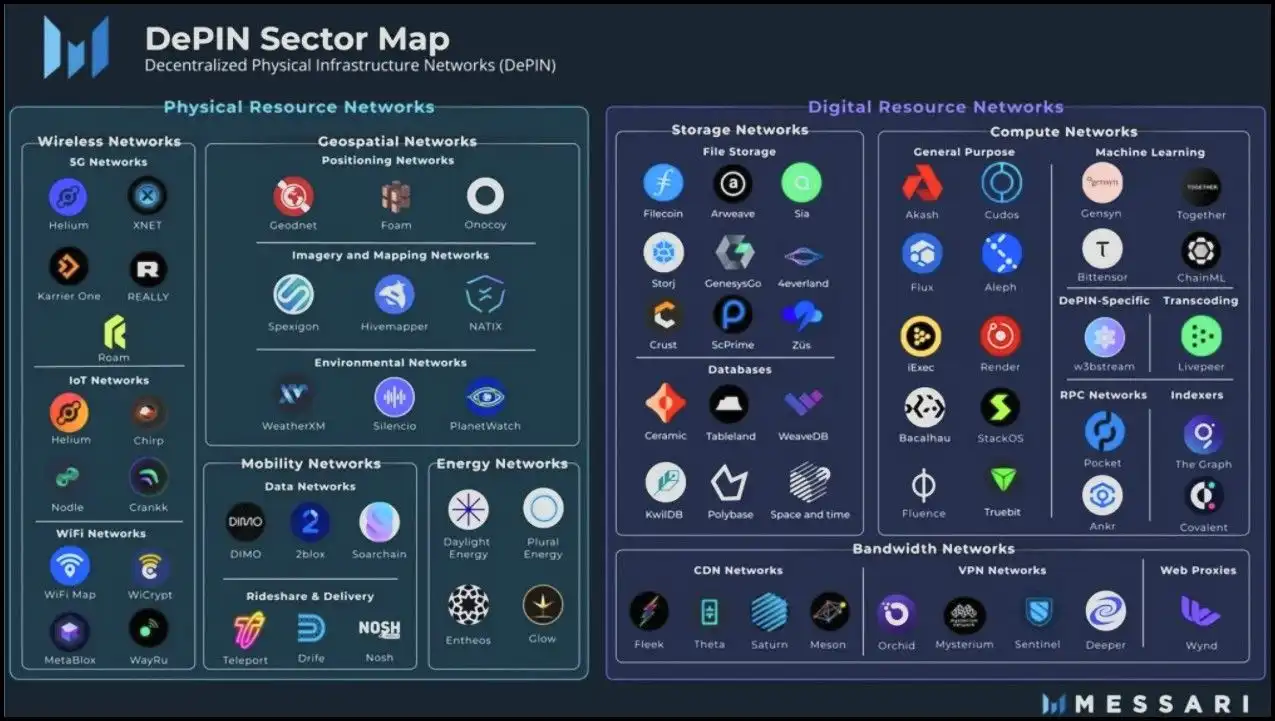

DePIN focuses on building decentralized infrastructure networks, such as for energy and communications. This narrative is becoming prominent as the need for decentralized infrastructure grows, providing more resilient and accessible solutions for critical services.

The Helium Network expanded its user base by 1.6 million addresses in the first quarter of 2024, highlighting the increasing demand for decentralized connectivity solutions.

Top Deals:

- Helium Network: Raised $50 million in a Series C round in February 2024, led by Andreessen Horowitz (a16z). Helium is a decentralized wireless network that allows devices to connect to the internet using blockchain technology.

- EnergyWeb: Secured $45 million in a Series B round in April 2024, led by Blockchain Capital. EnergyWeb focuses on creating a blockchain-based energy grid that promotes clean energy usage.

- Total Attracted: Around $150 million has been directed towards DePIN projects. Notable stakes include $50 million from a16z and $40 million from Blockchain Capital.

These are the top 5 VC investment narratives in 2024, reflecting the current trends and strategic interests within the crypto space.

This article is the second in our series of updates on the increasing investment activities this year. All the data points to a huge fundraising bull run underway. So, don't miss the train to Wall Street, and I remind you about the unfair advantage you can get on InnMinds pitch sessions.

Stay tuned!

Read also: