Venture Investor Economic Forecast 2020-2021

Pavel Cherkashin, investor and managing partner at Mindrock Capital, was interviewed by InnMind and spoke about his forecast related to the situation on the venture market related to the Coronavirus pandemic.

During last weeks we were facing a massive stock markets crash driven by #coronavirus pandemic and oil prices fall. The crash of Dow Jones Industrial Average, S&P 500 Index and the NASDAQ-100 on March 9th were compared with Great Recession in 2008. Three days later the ongoing fall of US and UK stock indexes were called the worst single-day percentage drop since 1987. Capital Economics, a UK-based economic research consultancy, forecasts recession of the eurozone, Japan and with high probability in the US.

InnMind decided to ask for an opinion of venture investors about the future of economic development and its effects on venture market and startups’ perspectives.

Our second interviewee about this topic is Pavel Cherkashin, managing partner at Mindrock Capital.

You can watch our first interview with Aleksander Galitsky, founder at Almaz Capital VC, here.

How do you estimate the effect of stock markets decline and how long do you think it may take to recover?

I believe we passed the bottom, the economy received a very healthy shakeup after a long growth period and will start growing slowly now. The recession will take at least 12-24 months, following the domino effect: large companies report losses and cut costs > their smaller supplies experience difficulties > consumers cut costs and investments. We will feel the shaking underneath for at least a year.

How it will affect venture business and startups perspectives of fundraising? Are you going to pause / freeze your own investment activity? Or, maybe, change the focus?

The venture industry will experience immediate negative effects:

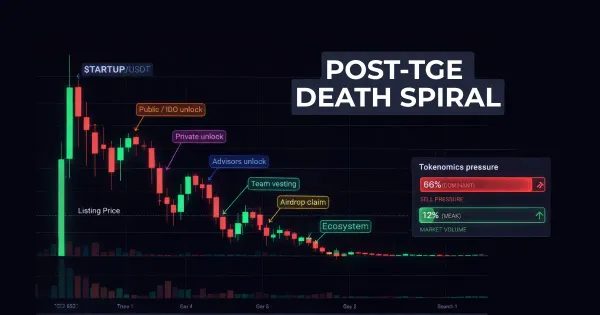

- Re-evaluation of many companies with $200-300B of market value evaporating now

- Cut of LP interests (money flow into the industry)

- More conservative estimates on the new rounds (harder fundraising)

The upsides for the industry are actually more material:

- Higher competition among venture firms, access to the market for smaller investors and investment managers

- More even distribution of capital over stages (lately there was a strong disbalance towards huge “megarounds” into large late-stage decacorns and lack of capital on Series A and B)

- Less cash from large PE firms and corporate investors will result into more realistic valuations (better returns for smaller investors)

- More democratic access for international investors into Silicon Valley club

Overall, we increase our investment activity, looking for new opportunities in the opening niches. As if we can get into a time machine, return back 3 years ago and start investing with all the knowledge and capital access we have now. For new investors it is hard to think of better timing to step in.

Are there any fields (for example travel industry) which will be affected more or some – less by this crisis? What industries or business models may die and which may fly as a result of the current situation?

A lot of traditional industries (travel, hospitality, real estate, entertainment, event management, etc.) take a big hit, but this is temporary. Those who manage to survive and have enough capital to keep growing will become even stronger, weak will be wiped out. I don’t see much opportunity there yet.

Where I see a lot of new opportunities is in “Loneliness Economy”. Billions of people around the world are forced to stay home and use Internet for all of their needs.

A billion new users will make their first purchase online and be surprised with how easy and pleasant the experience is comparing to traditional shopping.

A billion new users will connect video streaming service for the first time, see their favorite blockbusters and new shows and throw away their old cables and antennas.

A billion new people will try online education and be surprised with how advanced it is now

A billion new people will try working from home for the first time. Their companies will realize that the productivity can be even higher with the right management, while the costs go down.

A billion new people will try using digital currencies (including crypto), as they realize that banknotes are the main mechanism to spread viruses

A billion new people will try get medical help or other professional service online

This is going to have a huge effect (very positive) on the global adoption of Internet in general and venture economy in particular. Overnight our addressable markets are growing 2-5-10-100 times.

There is a saying “any crisis can become an opportunity”. What potential opportunities (in which sectors or business models) can the current situation bring to startup entrepreneurs?

There are several other spheres where innovation will be boosted with new demand:

- Prediction modeling with AI on global scale (Governments and corporations will want to be better prepared for such social disasters and will invest billions in prediction systems).

- Rapid drug development based on computer modeling rather than experimenting. The vaccine for COVID-19 was produced in less than 48 hours, another 6-12 months is required to do all the testing and paper work. In the near future, mobile labs will 3D-print vaccine on the spot for any new virus.

- Re-evaluation of global healthcare system. It is obvious now that the current system is outdated and doesn’t meet the requirements of the new interconnected world. Regulations will change, allowing for a new wave of startups offer more services online, doing more of predictive healthcare, then reactive syndrome-based treatment.

- Re-thinking of Media business. People don’t trust public media any more, not only in emerging countries with lack of basic human rights, but now in developed world. Rumors (true or false) spread over social media across billions of people in minutes! The new types of media will have to learn how to deal with this: work faster, more transparent, use crowd force to curate and check facts, index trusted sources, etc. This will result in new formats of content consumption, new content formats, new advertising models.

- Boost in remote work and online productivity tools. The tools are out there for many years, but for most people it was easier to do business “the old way”. If you could hire a person to do something in-house for a reasonable fee, why would you need automation. Now that such option becomes unavailable, a lot of businesses (large and small) turn to online resources for optimization.

- Virtual money and decentralized economy. Not only cash is the main source of virus spread, but also it is very inefficient for online / remote work. The current global banking system as a whole is completely inefficient when it comes to global online trade. Try paying $0.10 for a service you receive from a contractor in Bangladesh. Wire transfer costs $20, credit card transaction is at least $0.03. New currencies, new platforms, new ways of exchange will go mass market, as politicians are losing their main argument that digital currencies are made for drug trading only.

- Space exploration. Elon Mask now has a billion more supporters for the idea that humanity needs a second base in case something wrong happens on Earth. Coronavirus is just a drill, more catastrophic events are coming our way. Imagine Ebola virus mutating to the level of virality of Coronavirus. If people know their chance of survival in case of infection is less than 20%, next time they go shopping for toilet paper and hand sanitizers, they will take a gun with them to the local store and use it without hesitation.

We believe this is a great opportunity for a lot of new investors to come to the market without the baggage of previous devalued investments. We already invested in Coursera and SpaceX, looking to do more investments in online education, space, digital health, digital currencies, online productivity.

What advice can you give to tech startups to secure and maintain their businesses in the current situation?

Like in any difficult time, the startups should focus on cash, unit economics and sales. Most startups are losing money on their P&L and it’s ok, but they should be able to demonstrate strong unit economics. For example, if your customer acquisition cost (CAC) is $50 for a client that brings $500 in life-time value (LTV), investors will be happy to pour as much money as you need to grow the business. However, if you have to subsidize $100 for every purchase that brings you $50 in sale, hoping that one day the economy of scale will make you the market leader, you may have hard times raising capital or getting board approval for additional investments.

Use this time to accelerate your business online!! Here are new digital opportunities available during quarantine:

Agriculture Innovation Challenges launched by the World Bank’s Ag Observatory & Draper University with support from InnMind is your perfect chance to push your agritech research forward without jeopardizing your health.

Apply via an online form before 2nd April, 2020 to get your innovative ideas in the field of data collection & agriculture accelerated by the key market players while working at your home office.

>>> LEARN MORE & SUBMIT A PROPOSAL NOW

Silicon Valley Startup Bootcamp, a 5-day intensive acceleration & crash course in business and entrepreneurship, is organized by InnMind & Draper University and designed to bring a combination of knowledge & practice to startup founders and transform outstanding ideas into successful companies, providing resources, know-how and network.

Apply now before the end of an Early Bird period to ensure your place at the top event for tech innovators supported by the Government of Catalonia and other key ecosystem players!