AlphaMind ROI Simulator: The Smart Tokenomics Tool Every Web3 Founder Needs

Discover the AlphaMind ROI Simulator, the essential tokenomics tool for Web3 founders. Simulate token unlocks, investor ROI, and market impact before launch to avoid costly mistakes and build investor trust.

Every Web3 founder knows the feeling — the pitch decks are polished, the hype is building, and you’re gearing up for that first big presale. But there’s one thing that’s harder to plan for: what actually happens after the TGE.

That’s where things get tricky. Because even with the best vision, the most passionate team, and a killer product, many projects stumble at the same hurdle: token unlocks & tokenomics.

The symptoms are familiar: token price dumps on TGE, community sentiment flips overnight, KOLs who hyped the sale suddenly vanish, and VCs quietly offload into shallow liquidity. What started as momentum turns into silence. Discord goes quiet. Charts turn red. And founders are left explaining vesting mechanics to angry holders instead of building the roadmap.

At AlphaMind, we’ve seen it time and time again. Founders unintentionally set up tokenomics that look solid on paper, but turn into pain points for their early believers. Investors left confused. Communities frustrated. And teams forced into reactive mode just to hold the floor.

So we built something different: the AlphaMind ROI Simulator. A simple, powerful tool to help you understand what your presale investors will actually experience - month by month, unlock by unlock.

📩 And don’t forget to subscribe to our weekly newsletter: no spam, just practical tips and tools for your business development.

From Presale Dream to Post-TGE Reality

Let’s be real: most people think TGE is the payday. But if you’ve ever launched a token, you know the real challenge begins after the first listing. Vesting kicks in. FDVs start to look disconnected from demand. The market gets jittery. And your investors? Many end up deep in the red before their first unlock even hits.

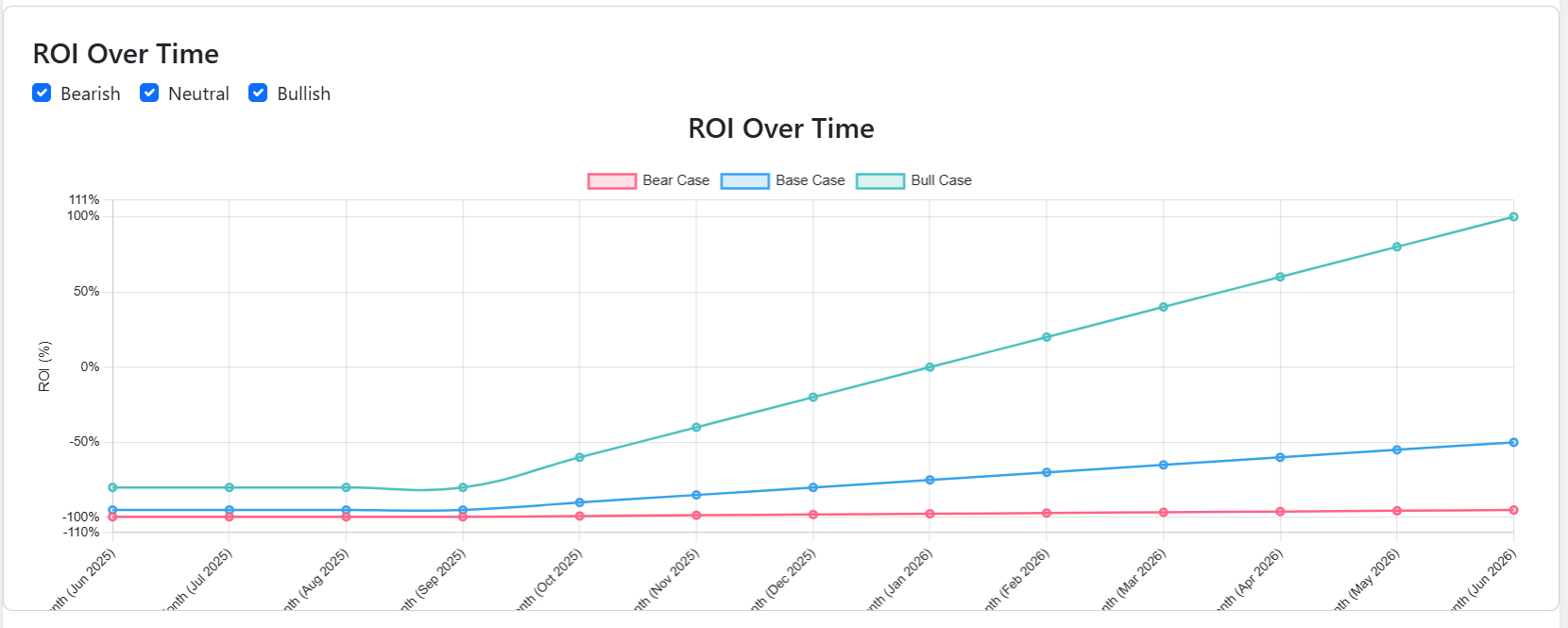

The ROI Simulator doesn’t just model investor returns, it shows how your token may perform once it hits the open market. It’s a way for founders to simulate the consequences of their tokenomics, stress-test unlock schedules, and anticipate liquidity pressure before it becomes a problem.

Whether you're pitching to VCs, optimizing your vesting logic, or preparing for a launchpad, this tool helps you answer the question every smart founder should ask: If I released this token structure today , what would happen in the real world?

It’s been used in live pitch meetings, tokenomics audits, and even Discord AMAs. Because when you bring clarity, you build trust.

What the ROI Simulator Does (and Why Founders Use It to Win Trust)

You don’t need to be a spreadsheet wizard or tokenomics consultant to get real insights. The ROI Simulator helps founders bridge the gap between token design and market execution.

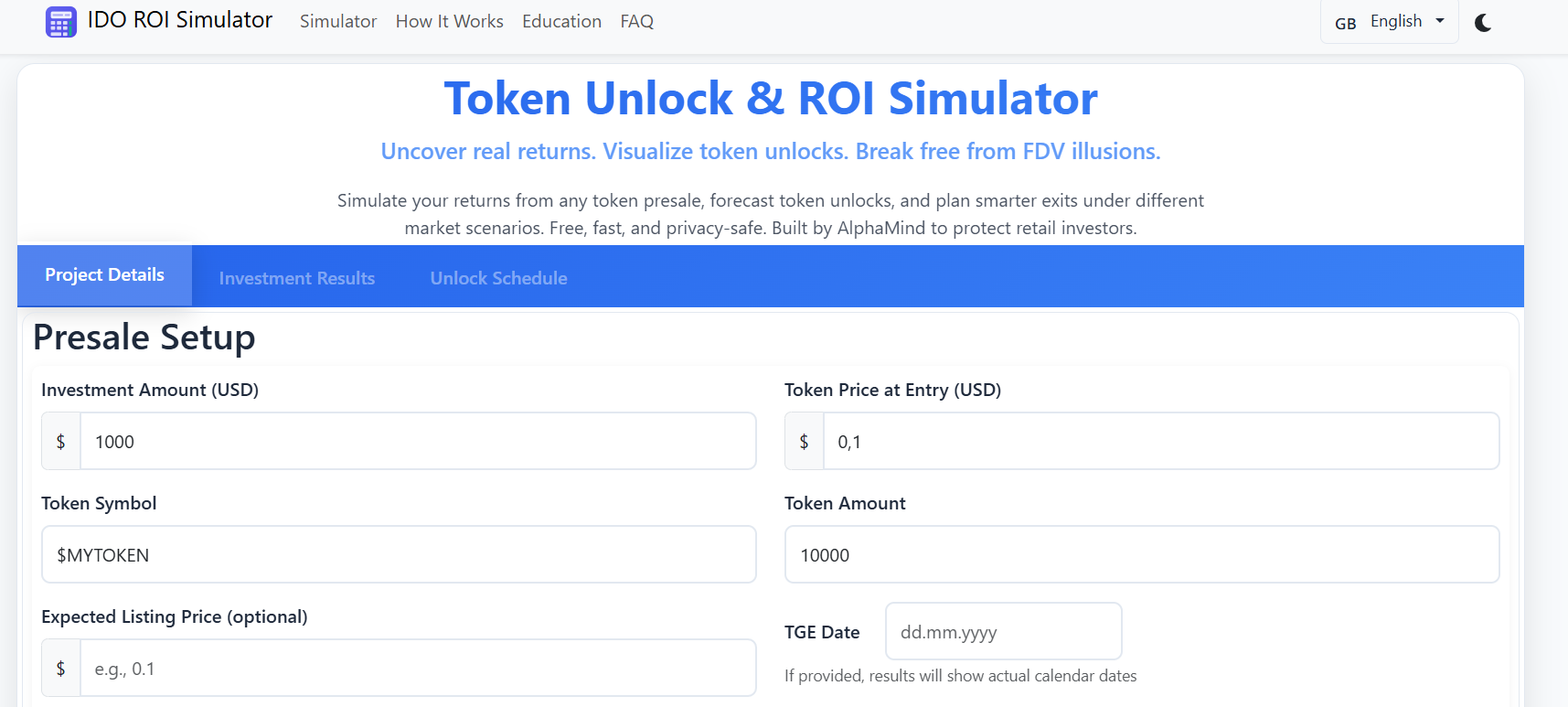

Here’s what it lets you do quickly and without technical headaches:

- Plug in your vesting terms (cliffs, linear schedules, lockups);

- Add entry price, token allocation, and fundraising round;

- Input the investment terms.

In seconds, you’ll get a clear visual breakdown of:

- When tokens unlock and in what percentages;

- What they’re likely worth across different market conditions;

- When (or if) your investors break even.

But it’s more than just a simulator, it’s a communication tool! A way to show investors, partners, and even your team that you’ve thought through the journey. That you’re not just designing for hype, but for survivability.

When you sit across the table from a potential investor and say, “Here’s exactly how your ROI unfolds, month by month, in real market terms,”.

Real-World Use Cases for Founders

We built the ROI Simulator with one goal: to help Web3 builders see around corners. Here’s how founders are using it right now to de-risk launches, build investor confidence, and stand out from the noise:

Fixing Tokenomics Before It’s Too Late

One founder told us they were days away from launching their token sale when they ran it through the simulator "just to double-check." What they saw shocked them: their unlock schedule would dump over 25% of tokens in the first two months, in a bearish scenario, that would've nuked their price and lost community trust instantly. They reworked the vesting terms, balanced out emissions, and avoided a launch-day disaster.

Aligning With Strategic Investors

Imagine sitting across the table from a major backer and saying, “here’s exactly how your ROI might play out based on our current tokenomics.” That’s the kind of transparency that turns maybe into a yes. Founders are using the simulator live in investor meetings to model multiple scenarios, not just to look smart, but to build trust with data. It shifts the conversation from speculation to alignment, which is what serious capital is looking for.

Navigating Launchpad or Exchange Due Diligence

One project told us their launchpad passed on them… until they added a simulator snapshot into their data room. It showed a well-balanced unlock curve, clear breakeven timelines, and a sustainable emissions schedule, all of which flipped the conversation. More and more launchpads & exchanges are starting to expect this level of modeling. If you’re serious about going public, this isn’t a nice-to-have. It’s the new standard.

The best part? It’s free. No wallet connect, no sign-up, no nonsense. Just go to roi.alphamind.co and simulate your token reality.

What’s Coming Next

We’re just getting started. The current version of the ROI Simulator is the MVP with a much bigger vision.

Here's what’s coming down the pipeline:

Custom Sell Strategy Modeling

Simulate complex exit strategies including partial sales, delayed selling, or tailored distributions based on real project behavior. See how staggered sell-offs can reduce pressure and extend ROI timelines.

Multi-Round Investor Scenarios

Model seed, private, and public round unlocks in parallel. Founders will be able to compare how each round's vesting impacts market dynamics and community perception, all in one dashboard.

VC & KOL Dump Pressure Simulation

Estimate the impact of large unlocks hitting thin liquidity. Visualize how concentrated token holders might influence short-term price action, before it happens.

Token-Gated Pro Tools

A premium toolkit for founders, token engineers, and VCs. Expect integrations with fundraising dashboards, downloadable charts, advanced ROI forecasting, and snapshot exports for pitch decks.

We’re building for the long term, and we want your feedback to shape what comes next.

Want to influence the roadmap? Join the discussion in our InnMind space, drop us your suggestions, or reach out at support@innmind.com

The next generation of token launches won’t rely on guesswork. They’ll rely on simulation. Let’s build that future, together.

Final Thoughts

You don’t need to be a tokenomics expert to build something sustainable. You just need tools that tell the truth. So before you hit launch, raise another round, or publish that whitepaper, plug in your numbers. See what your token model really looks like under the hood.

Because smart founders don’t just dream big. They plan smarter.

Try the simulator: roi.alphamind.co

Read also: