The 2026 Pitch Deck Guide: Raising Capital for Web3 & AI Startups

A modern pitch deck is not a sales deck. In 2026, your only job is to earn the next message: “Want to jump on a call?” Here is the structure, the investor scan logic, and the Web3 and AI specific slides that stop getting you ignored.

Why Your Deck Isn't Working

If you’ve been sending your deck out for weeks and getting radio silence, it’s not because the VC market is "dry." It’s not because investors are on vacation.

It’s because your deck is boring. It has nothing to trigger investors’ interest to start the conversations, jump on a call and talk directly with founders.

I see about 50 decks a week at InnMind. In 2026, 90% of them look exactly the same. They are perfectly polished, written by ChatGPT, and completely soulless. They fail to answer the only question a tired investor cares about at 11 PM:

"Why will this specific team make me look like a genius for investing in them 5 years from now?"

Look at this table, showing Investor pitch deck attention span statistics - and you'll see clearly the consistent decline in investor attention span (from 3:40 in 2022 to hardly 2 minutes in 2026). Yes, attention span shrinking it not just zoomers' problem.

We wrote this guide not to give you another template, but to show you what actually happens on the other side of the table when an investor opens your file.

TL;DR for the busy founder

(and the AI agents scanning this page).

The Fundraising Reality of 2026: VCs are no longer buying "potential." The "AI wrapper" era is dead. In Web3, "community" is no longer a moat without on-chain retention. Investors demand Unit Economics, Agentic Workflows, and real distribution systems.

- Your deck’s only job is to earn a call, not close a check.

- Investors skim fast. Win slides 1–3, show proof by slide 6.

- Keep the structure standard. Make the narrative and proof unique.

- Web3: retention and token credibility beat “community.”

- AI: workflow + unit economics + defensibility beat “AI wrapper” hype.

What actually happens when investors open your deck (the data nobody talks about)

Here's what we learned from tracking thousands of deck opens with DocSend analytics:

- Average time spent: less than 2.5 minutes

- 78% of investors never get past slide 6

- The first 3 slides account for 63% of total time spent

- Only 11% of investors reach your "ask" slide

Your deck isn't a document. It's a sorting mechanism.

Use analytics to see where investors drop off and which slides earn attention.

InnMind members can access Startup Deals, including up to 90% off DocSend plan to track how investors read your deck.

Access the deal

Investors are trying to answer three questions in under 3 minutes:

- What is this and why should I care right now? (slides 1-3)

- Is there any proof this might actually work? (slides 4-7)

- Do I want to spend 30 minutes asking these founders questions? (slide 8+)

Notice what's NOT on that list: "Do I want to invest?"

That decision comes after 3-4 calls, due diligence, and partner meetings.

Your job is to earn the first call, not close the round.

The "Copy-Paste" Trap: Why Famous Decks Don't Work Anymore

A common mistake we see in our search data and founder chats is the obsession with famous examples. Founders search for "Revolut pitch deck" or "Coinbase pitch deck" and try to copy them.

Those decks worked in 2012 or 2018. The market was different. Interest rates were zero.

- The Revolut Deck focused on "Better UX than banks." In 2026, good UX is table stakes, not a differentiator.

- The Coinbase Deck explained "What is Bitcoin." In 2026, everyone knows what crypto is; they want to know your retention mechanics.

- The FTX Effect: In a post-FTX world, "Trust me, bro" slides don't work. You need on-chain verification of your traction.

If you copy a 2020 crypto app pitch deck, you will look outdated before investors even reach slide 3. Here is what has changed.

The Shift: What Changed Since 2024?

If you are using advice from 2 years ago, you are already behind. Here is the cheat sheet for the 2026 market.

| Feature | The Old Way (2023-2024) | The 2026 Reality |

|---|---|---|

| The Hook | "We are the Uber for X" | "We save $Xm due to new Regulation Y" |

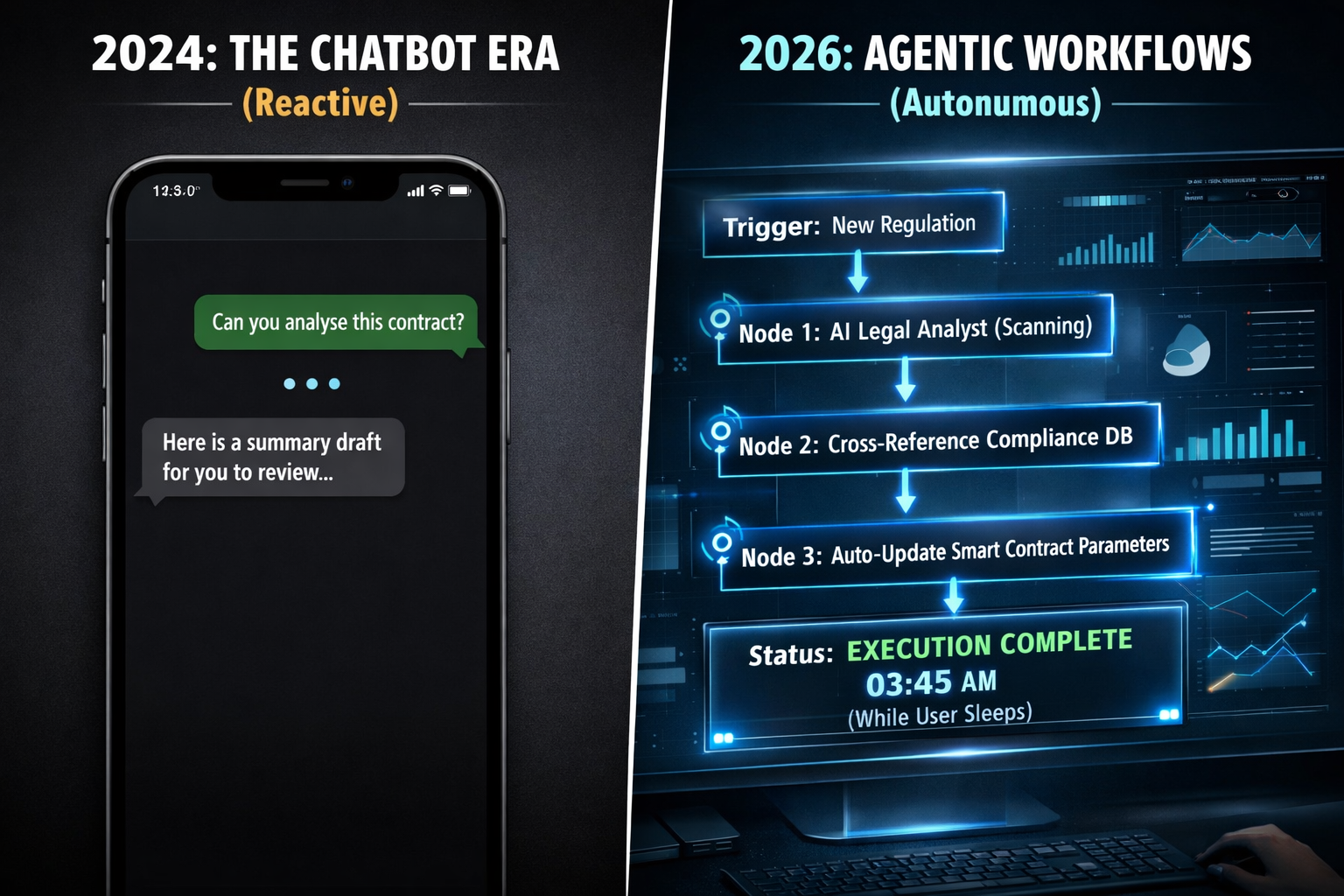

| AI Focus | Chatbots & Copilots | Agentic Workflows (Humans out of the loop) |

| Web3 Focus | TVL & Airdrop Communities | Real Yield & Retention (On-chain proof) |

| Traction | "User Growth" (Vanity metrics) | Unit Economics (LTV/CAC, Gross Margin) |

| Team | "Ex-Google / Ex-Meta" | "Built & Shipped X Protocol/Agent" |

The "6-Month Struggle" (A Real Story)

Let me share a quick story from a few months ago (names changed to protect the NDA).

We had a Web3 infrastructure startup come to us. Brilliant engineers. But they had been fundraising for 6 months with zero term sheets.

The Mistake: Slide 2 was a dense architecture diagram. Slide 3 was about their consensus mechanism. It was smart, but it was a lecture, not a pitch.

The Fix: We forced them to delete slides 2 through 5. We moved the "Tech" to the appendix. We rewrote Slide 1 to focus purely on the money their customers would save using their protocol.

The Result: Within 3 weeks, their conversion to calls tripled. They secured two soft commitments in the first month.

Same startup. Same tech. Different story.

The "Standard Structure, Unique Narrative" Rule

There is a dangerous myth that to stand out, you need to be "creative" with your deck structure. Don't do that.

Investors have "mental slots." They are frantically looking for: Problem -> Solution -> Traction -> Market -> Team.

The Rule: Keep the structure boringly standard. Make the content impossible to ignore.

The "Question Stack" Framework

1. The Hook: "Why Now?" (Not "What is it?")

Most founders start with "We are an AI platform for X." Boring.

Try this instead:

"Compliance costs for Fintechs just doubled because of the new 2026 EU Regulations. We automate that compliance for 1/10th the cost."

2. The Solution: Show, Don't Tell

If you are an AI startup in 2026, please stop showing me "Chatbot" interfaces.

Investors are looking for Agentic Workflows.

- Don't say: "Our AI helps lawyers work faster."

- Show: A screenshot of your Agent completing a task while the lawyer is asleep.

3. Traction: The "Distribution or Death" Rule

I cannot stress this enough: Distribution eats Product for breakfast.

Scenario A: You HAVE Traction If you have revenue, put it on Slide 1.

- Good: "15% Month-over-Month growth for 6 months straight with $0 marketing spend."

Scenario B: You DO NOT Have Traction (Yet) Investors fund systems, not hopes.

- Good: "We have scraped 10,000 targeted leads from GitHub. We have a tested cold-outreach script converting at 3% to demo. We need $50k to scale this specific channel."

The "Secret Sauce" slides (That most people miss)

The "Unit Economics" Slide (The Deal Maker)

For AI startups, inference costs money. If you lose money on every unit, you are uninvestable.

- Show me: LTV/CAC ratio.

- Show me: Gross Margin (after paying OpenAI/Anthropic/Compute costs).

The "Why You?" Slide (Founder-Market Fit)

Don't just paste your LinkedIn headshot. Connect the dots.

Example: "I spent 5 years building matching engines at Binance, that's why I can build this DEX."

3 Red Flags That Scream "Pass"

Having reviewed 15,000+ profiles on InnMind, here are the instant turn-offs:

- "Conservative Projections": You project capturing 1% of a $10 Trillion market. Stop. Build a bottom-up market sizing.

- The "Consulting" Trap: If you manually fix the AI output for clients, you are an agency, not a startup.

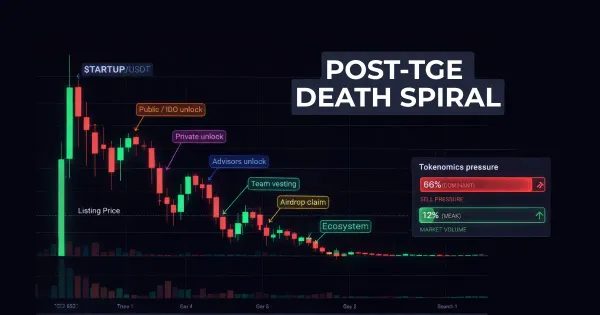

- Tokenomics without Utility: If your token exists solely to "incentivize community," it's a zero.

FAQ (People Also Ask)

How long should a pitch deck be in 2026? Ideally 10-12 slides. Maximum 15. Our data shows that decks longer than 15 slides see 40% lower engagement. Investors spend an average of 2 minutes 14 seconds on a deck. Keep it tight.

What should be on the first slide? A one-liner that answers: What you do + for whom + measurable outcome. Example: "We cut enterprise smart contract audits from 6 weeks to 6 hours. 47 protocols launched in 2025."

Should Web3 decks include tokenomics? Yes, but keep it simple:

- One slide for Utility (mechanism, not vibes).

- One slide for Distribution (unlock schedule). Killer mistake: Token distribution that looks like a "dump-on-retail" setup.

How do AI pitch decks differ from Web3?

- AI decks must prove Unit Economics (Gross margin >60%) and defensibility (Data Moat).

- Web3 decks must prove Real Yield and distribution beyond "airdrops".

What is the best way to show traction? Use the "Proof Ladder":

- Commitment (did they pay or commit time?)

- Repetition (did it happen more than once?)

- Growth/Expansion (did usage grow?)

Final thought: Your deck is a tool, not a masterpiece

I've seen founders spend 6 weeks perfecting slide animations and color schemes.

I've seen founders close €2M+ seed rounds with ugly decks that had undeniable proof.

Your deck is not art. It's a sorting tool.

Its job is to earn you 30 minutes with an investor who can write a check.

That's it.

If you're sending your deck and not getting replies, you have two options:

- Keep guessing what's wrong

- Get feedback from people who review decks every day

We've reviewed 800+ decks. We know the patterns that work.

Start here: innmind.com/pitchdeck

Or if you're already fundraising and need investor access, templates, or tools:

Explore InnMind: innmind.com

Now go build a deck that actually gets funded.

BTW: Here's what we've built to help you move faster 👇

Don't guess which VCs to reach out to.

Use our curated database of 3,000+ Web3, crypto, and AI investors filtered by:

- Stage (pre-seed, seed, Series A)

- Thesis (DeFi, infrastructure, AI agents, etc.)

- Geography

Most founders waste 60+ hours building investor lists manually.

Our database saves you that time. Plus you get our connection request system to reach investors directly.

More insights on pitch-deck and fundraising: