How to Design Token Utility: Expert Insights from Mezen Researchers

This article offers a strategy for creating a token utility using examples to describe each stage. We talked with experts from Mezen, a reliable web3 advisory agency specializing in token economy design & financial services since 2017, for practical recommendations regarding the implementation of token utility.

We’ll also share examples, illustrating principles and concepts, of token utility design, and describe solutions for various token use cases, helping to better understand its possibilities and potential in different industries and projects.

This guide will help you develop and implement a token utility strategy based on examples and best practices from the web3 market. Additionally, we emphasize the importance of careful planning and analysis in the development of token utility to ensure its effectiveness and deliver maximum value to users.

Take a moment to subscribe to our weekly web3 digest. We curate a special web3 digest packed with useful tools, market insights, and exclusive opportunities tailored for founders and investors.

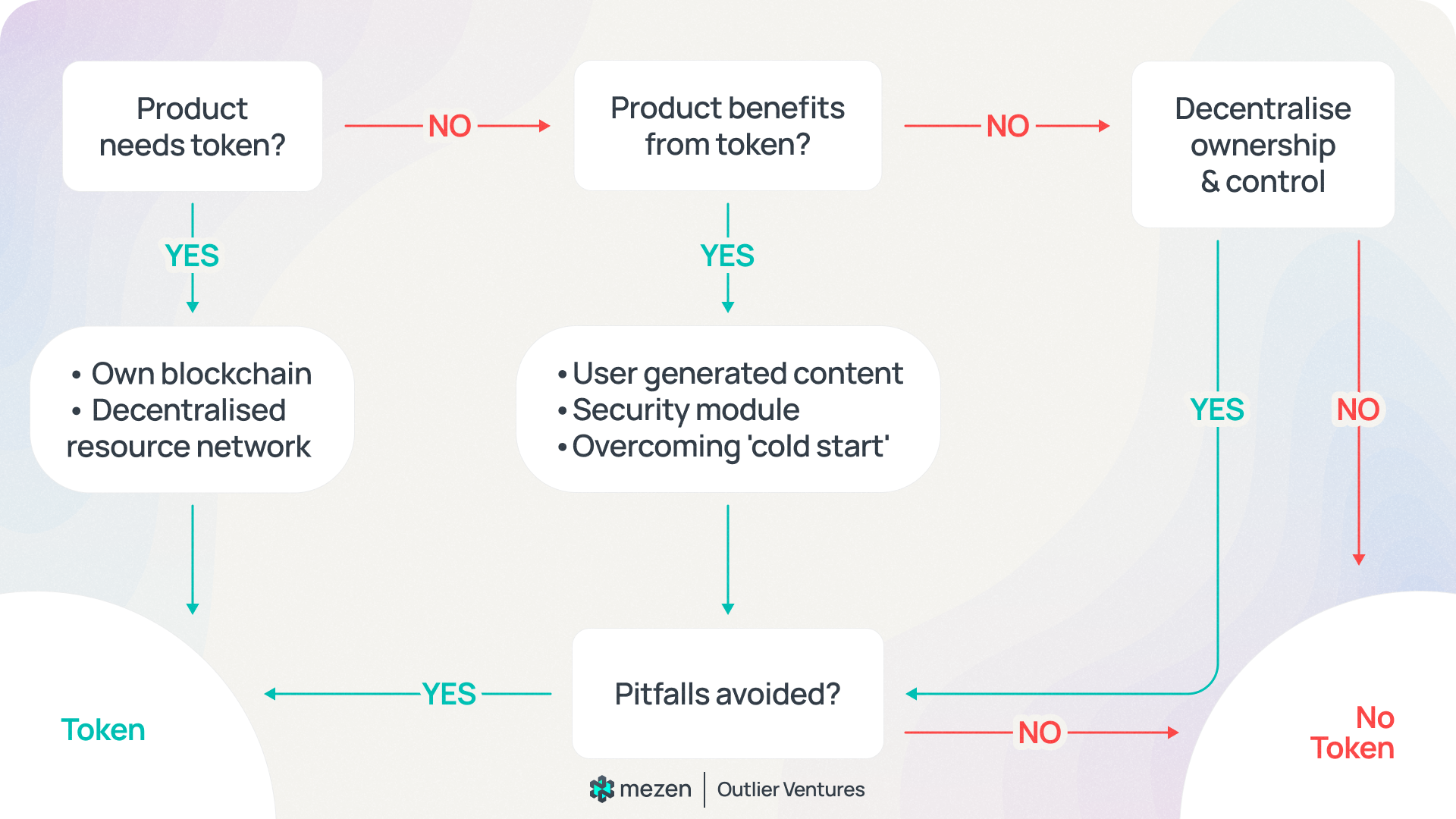

Do all crypto projects need the token?

Tokenization, or implementation of tokens in business models, has become a popular way for many web3 and crypto projects to raise funds (incl. Seed funding from crypto VCs and public token sale), build community, and incentivize user participation.

However, it is important to recognize that not every crypto project necessarily needs a token to fulfill its purpose or achieve success. Moreover, having a token just to raise funding more easily during the crypto bull market often leads to a future economic collapse of the project.

Tokens are typically created as a part of blockchain ecosystems, providing utility within specific platforms, applications, or networks. They serve different functions, such as granting access to services, facilitating transactions, and incentivizing user engagement. While tokens can be an effective tool for many projects, they are not always irreplaceable for the functionality or viability of every crypto venture.

Some projects require tokens for their promotion and direct operation of the project itself. For example, GameFi projects need a token to facilitate in-game purchases and regulate the gameplay, but for all decentralized finance projects, a token is a way to attract funding and stimulate liquidity.

Other projects may be better off without a token if their primary focus lies outside blockchain technology. For instance, if a project's core objective is to develop a technology or software that is unrelated to cryptocurrency or decentralized finance, creating a token may not provide any additional value or enhance the project's offerings. For instance, projects like marketplaces for NFT or any project in SocialFi don't necessarily need tokens. In such cases, resources and efforts might be allocated towards building and improving the core technology rather than developing, managing, and maintaining a token.

The decision to issue tokens should be considered from the perspective of investors, community members, and product users who will invest in or use the tokens. It could be preferable to not issue any tokens at all if their presence detracts from the value or experience for these stakeholders in comparison to what they could have received.

Legal, regulatory, and compliance considerations must also be carefully considered before developing a token. Issuing tokens could expose a project to different legal requirements and regulatory attention, depending on the jurisdiction. Compliance with regulations like securities laws is difficult and time-consuming, and there might be severe consequences in case of charges: prohibition on conducting business, delisting, fines, and others. Therefore, initiatives with tight rules or those working in resource-constrained areas might decide against developing a token because doing so could add needless legal complications.

So, no, not every project needs to have its own token. But if it does or plans to have it, the project team should carefully consider its utility.

What is token utility?

Token utility refers to the usefulness or value of a token within a particular ecosystem or platform. It describes how the token can be used and what benefits or privileges it provides to its holders.

The utility of a token can vary depending on the project or platform, but commonly includes functions such as profit sharing, payment for goods or services, access to exclusive features or content, staking prizes, voting rights, or participation in a decentralized governance system.

The token utility is an important factor that determines its demand and hence its market value.

Why is it important to design a token utility?

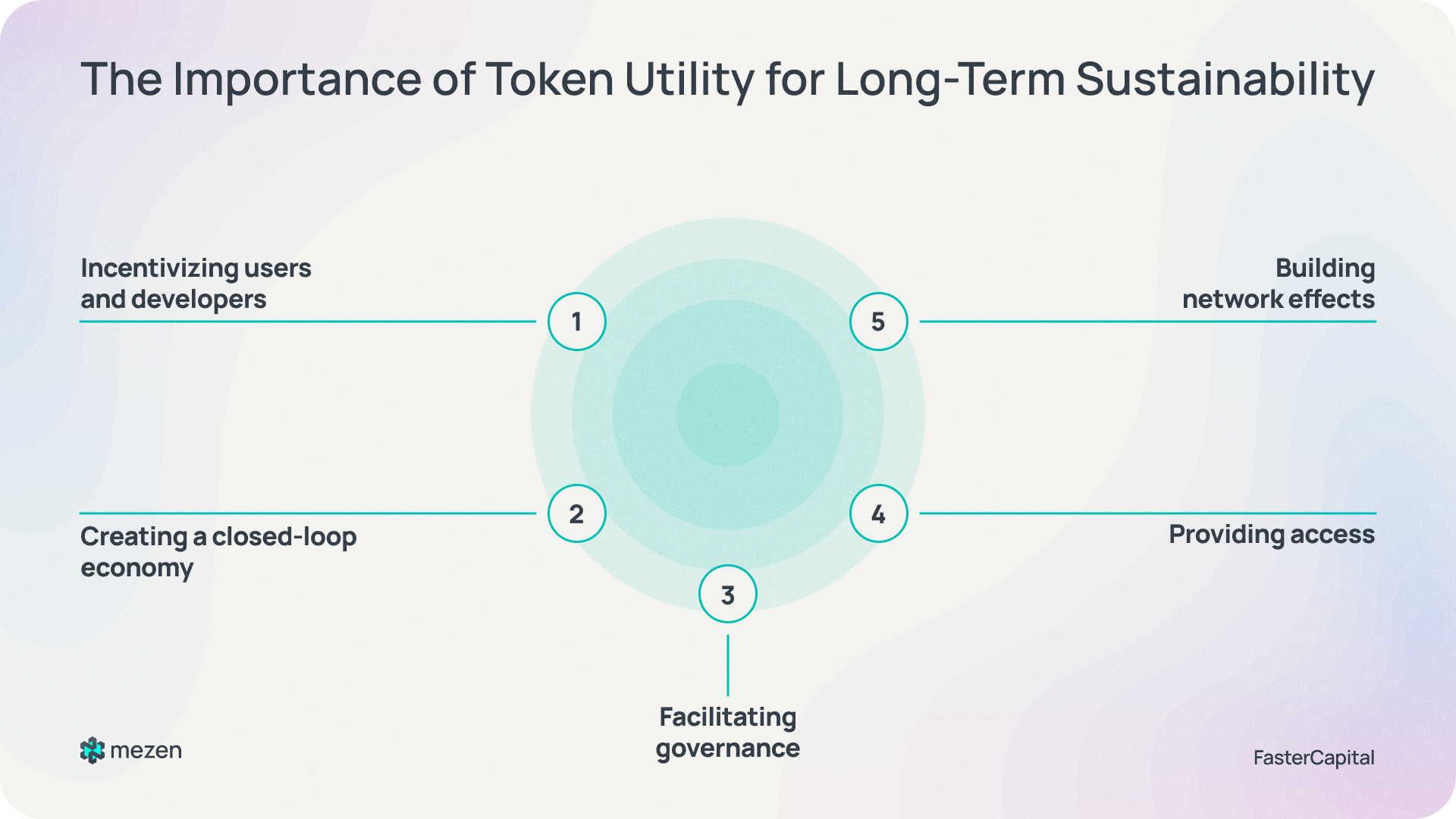

Designing a token utility is crucial for various reasons:

- High-quality and user-friendly token utility contributes to attracting investors, as well as liquidity to the protocol;

- The token utility can help attract user flow to the protocol, significantly reducing marketing costs;

- Tokens can incentivize users who contribute productively to a network with financial rewards and/or equity, promoting long-term relationships.

By considering these factors and designing a utility that solves real-world problems and provides genuine value, token projects can increase their chances of success and establish themselves in the market.

How to design a token utility?

- Identify the purpose: Determine the specific purpose of the project token within the project ecosystem. Consider whether it will be used as a means of payment, for access to certain features, for voting rights, as a loyalty reward, or any other specific utility.

- Functional utility: Define the functions and capabilities that the token provides within your project. For example, it could be used for fee discounts, access to premium features, or as a staking mechanism for governance rights. It’s important to remember that token's different functions should not contradict or limit in any way.

- Best practices: Look at the most commonly used utilities in projects similar in business model and purpose. This stage allows us to identify the best and most in-demand practices in the market, as well as understand the mechanism of their application.

- Long list: Create a long list of all utilities used in the market. Creating a long list will help determine the main and additional utilities based on project criteria. The long list may include utilities from other projects as well as your ideas.

- Pros and cons: For each utility, list its positive and negative aspects for the project. By weighing all the pros and cons, you can determine to what extent the utility's usefulness outweighs its costs and risks.

- Utility Division: The next step is to identify the core utilities that are most important for the project at this stage. Core utilities are the essential utilities that are most important for the functionality of the project and should be prioritized for resource allocation and funding first. The remaining utilities can be put into an additional utilities group, which can be added as the project develops.

- Incentivize token holders: Create mechanisms, incentivising token holders to hold and use the token. This can include staking rewards or discounts on project-related products or services.

- Avoid excessive speculation: Design token utility in a way that discourages excessive speculation and promotes real-world usage. This can be achieved by setting reasonable fees, ensuring regular token burns, or implementing other mechanisms that maintain a balance between supply and demand.

- Transition to tokenomics: After creating the utility, the next step is to design tokenomics: calculate and specify token allocations, vestings, and reward systems, as well as model all of the above to better understand the number of tokens required for the project.

Important Tokenomics Factors

Among things you should pay attention to while designing your token economy & token utility, keep in mind the following:

- Control of inflation and deflation: It is important to incorporate mechanisms to address inflation and deflation in the utility token, enabling the protocol to regulate them. For example, it can be a good idea to include utilities such as token burning and fixed issuance, which would not only control the circulating supply of tokens but also impact their price in case of a decline.

- Incentives for token holders: It is important to consider not only incentives for purchasing tokens but also for holding them. For example, a good incentive could be earning rewards through token staking or gaining access to various protocol functionalities and products in exchange for tokens. Having incentives for token retention is crucial to avoid speculation and constant token dumping into the market.

- Economic Model: When creating a utility token, it is crucial not only to outline the main provisions and mechanisms of operation but also to model it. By creating an economic model for their utility, a project has the opportunity to understand all the intricacies of its functioning and avoid mistakes during the launch. The economic model will demonstrate the mechanism of token redistribution and the sources of rewards for users, which will help determine allocations in the future.

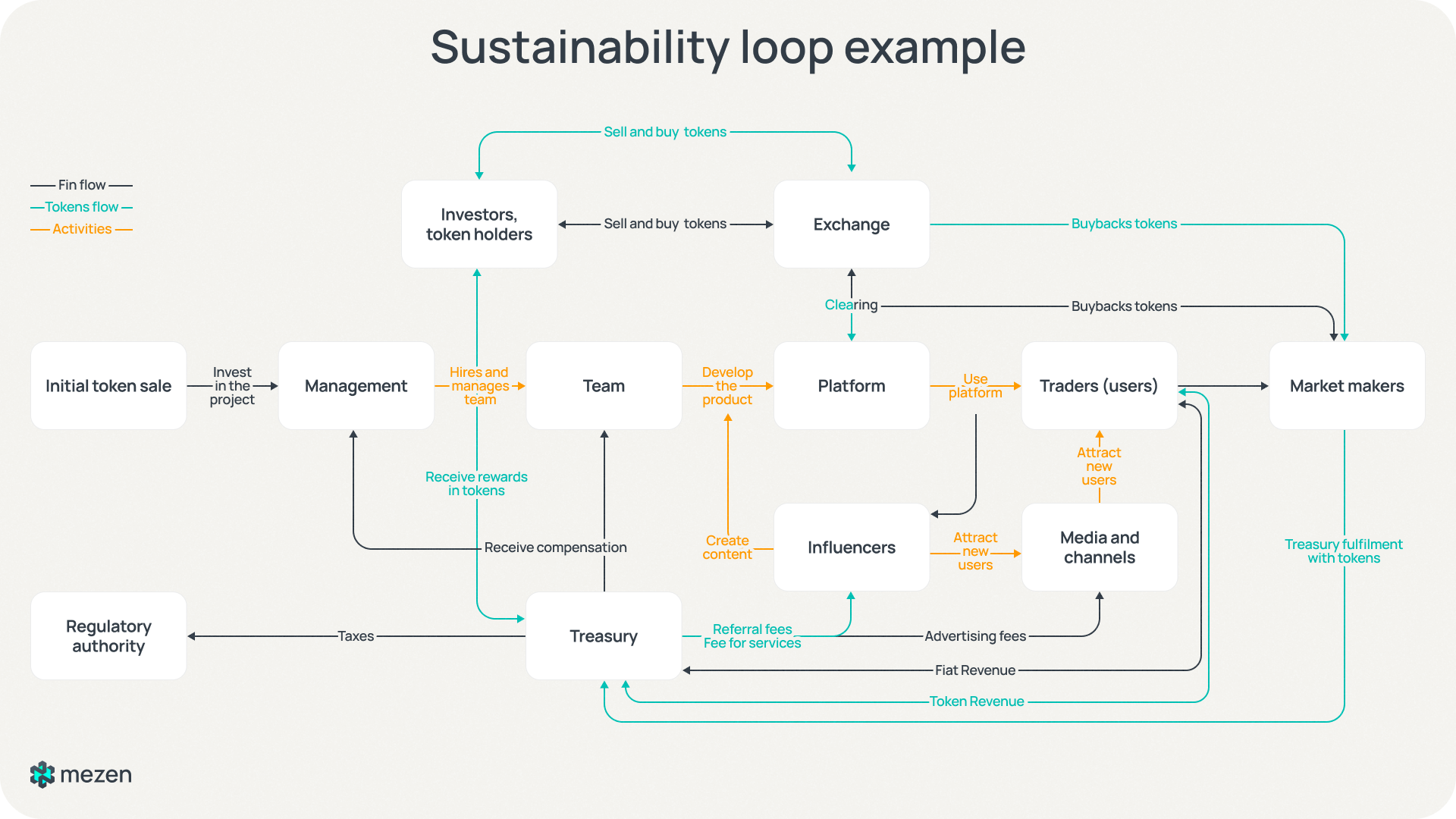

- Sustainability loop: It is important to effectively align the project's mechanism with the utility token to ensure a spiraling growth of the protocol and prevent situations where there is a one-time economic downturn and token price decline.

Top 5 token utility mistakes to avoid

- Absence of purpose for the token: If you don't fully understand why your project needs a token and whether it is necessary at all, it is better to postpone its creation and issuance until better times. The project can exist without a token, but it cannot exist with an underdeveloped token, because the token is the face of your project. If it is not well thought out or useless, investors will avoid your project. It is not as scary to delay the creation of the token as it is to create a bad token and then cancel it, sending it for further development. This will significantly affect the reputation of the entire project.

- Lack of long-term plan: Just releasing a token is not enough. It is necessary to have a plan for maintaining and using it for several periods ahead, especially after the token is released into the market and a large portion of tokens are distributed to investors.

- Unplanned worst-case scenarios: When token price increases and investors enter the project, it is great, sadly, it will not always be the case. There will be periods when the price drops and tokens are dumped onto the market in large quantities, and it is crucial to consider backup ideas for the token and determine the best course of action in such a situation.

- Legal Issues: Lately, there have been an increasing number of cases of misunderstanding of securities laws, so it is crucial for projects to carefully consider this aspect of their token and create utility in accordance with the legislation.

- Half-baked utility: You should not create a utility that you are not completely sure about or don't fully understand how to implement. All token utilities should be clear to you and the target audience, so there is no need to make them more complicated.

Example of designing token utility

Let's consider that we have a trading platform named “Fantradic”: it plans to launch its own token to attract funding from investors and increase user activity on the platform.

- To begin with, it is worth defining the strategy of the project itself and linking it to the token. For our trading platform, the main task is to attract liquidity and funds from investors. Therefore, the token should be directly linked to the protocol's goals and serve as a means to attract funds.

- The next thing we, as a trading platform, want to do is look into the most popular trading protocols on the market that have already launched their tokens. Specifically, we would pay attention to GMX, gTrade, Uniswap, dydx, and their tokens, as they are the most successful projects in this segment with high token demand.

- After reviewing major market players, we look at all the utilities found:

- Profit sharing

- Governance

- Reduced fees

- Access to the private chat with other investors

- Rewards for traders

- Rewards for liquidity providers

- Now, for each utility, we list the pros and cons in terms of implementation and operation for our project, for example:

- Profit sharing:

“+” Increases demand for the token

“-” Faces legal restrictions from SEC laws - Rewards for traders:

“+” Increases traders interest in the platform

“-” Dilutes token share, may lead to sudden market dumping and decrease in token price

2. After weighing all the risks and benefits, we eliminate utilities that do not suit us in terms of costs and negative aspects and divide the remaining ones into core and additional utilities.

Core utilities include profit sharing, governance, traders’ rewards, and liquidity providers’ rewards. In the core utilities, we define these goals as they play a dominant role for us and we want to allocate more resources to their achievement, as they go hand in hand with the tasks of our platform.

Additional utilities would include reduced fees and access to private chat with other investors. These ideas have been included in additional utility as they are not a priority for us, but we understand that they can still play an important role for our token. However, they currently hold the second position on the implementation priority list.

3. As a result, you get a designed token utility. Next, it is necessary to consider the mechanisms for implementing these utilities, as well as to determine the number of tokens, allocations, and vestings.

Once you’ve mapped out your token utility and core loops, the next step is to translate that design into real numbers: emissions, rewards, fees, treasury inflows and outflows.

To make this practical, use Tokenomics Calculator PRO – a plug-and-play model where you can test different reward levels, fee splits and token sinks before you ship anything on-chain.

Conclusion

The token utility is undoubtedly a crucial aspect of any token in the cryptocurrency space. It serves as the backbone for the functionality, value, and purpose of tokens within a specific ecosystem. However, it is important to note that each project is unique and requires a tailor-made approach to token utility.

While some projects may emphasize the use of tokens as a means of access, others might focus on governance, rewards, or even as a medium of exchange. The design and implementation of token utility heavily depend on the goals, objectives, and target audience of the project.

Token utility plays a vital role in promoting user engagement, incentivizing participation, and ensuring sustainability in a platform. It offers users various benefits such as discounted fees, voting rights, exclusive services, or access to special features, consequently fostering a stronger sense of community and enhancing user experience.

In conclusion, while token utility forms an integral part of any project within the crypto industry, it is imperative to recognize that each project is unique and requires a customized approach in terms of designing and implementing token utility. By carefully considering the project's objectives and target audience, a token utility can be leveraged to enhance user engagement, incentivize participation, and ultimately contribute to the project's overall success.

Read also: