In the shadow of the 2023 crypto winter, a quiet recalibration of the web3 startup valuations is underway. The plummeting numbers might be daunting, but in a way, it's a refreshing reprieve from the irrational exuberance of the bull market spikes we've grown accustomed to. But the stormy weather has exposed an unsettling trend: an alarming number of founders (and, worryingly, some investors) are navigating these icy waters with little to no understanding of how to evaluate the worth of web3 and crypto initiatives.

Relying heavily on industry averages or mirroring the valuations of public deals in analogous sectors seems to be the de facto modus operandi. It's a makeshift solution that can often hit the mark, but it's hardly foolproof. Founders armed with a granular grasp of valuation mechanics invariably hold the upper hand in talks with investors. When you know your numbers inside out, you're not just quoting figures – you're building a compelling narrative that can sway terms in your favor.

So, why does this matter? Understanding the inherent value of your Web3 startup transcends the confines of a cap table. It's the lens through which you can discern traction trends, measure the magnitude of your impact, and plot a trajectory in an ecosystem that's in a constant state of flux.

With this imperative in mind, we're launching a series aimed squarely at demystifying the art (and science) of web3 startup valuation for fundraising. Today, let's start with an exploration of pivotal valuation metrics, elucidated with real-world examples for added clarity.

Stay with InnMind, and ensure you're registered to get all updates on the new posts, valuation guides, and document templates. Valuation metrics are just the tip of the iceberg, and you won't want to miss what follows! 😉

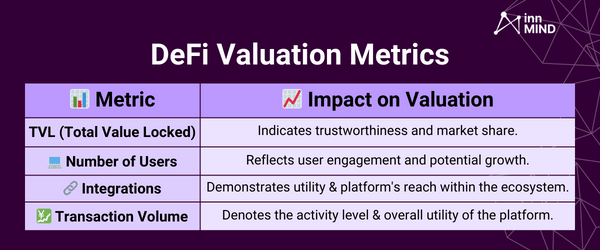

DeFi Valuation Metrics

1. Total Value Locked (TVL):

TVL indicates the crypto assets' value deposited in a DeFi protocol.

Impact on Valuation: A direct indicator of the trust and confidence users have in your protocol. A higher TVL suggests that more users are depositing their assets, signalling a belief in the platform's utility and security.

Example: Aave, a decentralized lending protocol, has consistently showcased high TVL, indicating significant user trust and active engagement.

2. Active Wallets:

Analogous to DAUs and MAUs in traditional systems.

Impact on Valuation: Reflects user engagement and activity. Consistently high numbers are a sign of a sticky user base, whereas fluctuations can indicate the opposite.

Example: Uniswap's explosive growth was mirrored by its swelling daily and monthly active wallets, showcasing real user activity and adoption.

3. Number of Integrations:

Measures the DeFi app's adaptability with other platforms.

Impact on Valuation: Indicates how well your platform plays with others. The more integrations, especially with prominent players, the more utility and reach your project likely has.

Example: Chainlink, with its oracles integrated across multiple DeFi projects, is a prime instance. Each new integration not only expanded its service scope but also invariably bumped its valuation in successive funding rounds.

4. Transaction Volume Per User:

This metric evaluates the average transaction volume initiated by each user on a DeFi platform over a specific period.

Impact on Valuation: High transaction volumes per user indicate strong user engagement and trust in the platform. It may signify that users are conducting substantial financial activities, suggesting that the platform offers value and utility to its user base. A higher transaction volume per user can also indicate the platform's efficiency in addressing the specific needs and preferences of its users, thus making the platform more appealing to potential investors.

Example: Uniswap, a decentralized exchange, experienced a surge in its valuation as the average transaction volume per user grew. This growth signaled both a loyal user base and an increased trust in the platform's capability to handle large transactions safely.

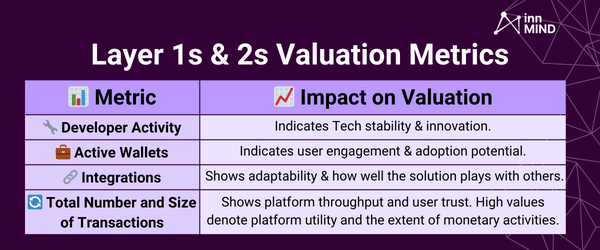

Layer 1s and Layer 2s Valuation Metrics

1. Developer Activity:

The number of developers and applications is a reflection of the protocol's popularity among developers.

Impact on Valuation: An active developer community is often a sign of continuous innovation, upkeep, and a project's vibrancy. Investors love platforms that are continually evolving.

Example: Ethereum, despite the competition, remains invaluable partly due to its bustling developer community. Its consistent developer activity has been a magnet for institutional investments.

2. Number Of Integrations

This measures the extent to which the Layer 1 or Layer 2 solution is adopted by and integrated with dApps, other blockchain projects, and interfaces.

Impact on Valuation: A high number of integrations indicates that the Layer 1 or Layer 2 solution is seen as reliable, scalable, and user-friendly. It also demonstrates that the layer is versatile enough to accommodate various dApp functionalities and use cases. The more integrations, especially with high-profile projects or those that have substantial user bases, the more widespread utility, adoption, and demand your solution likely commands.

Example: Chainlink's wide-spanning integrations across DeFi projects enhanced its valuation in every subsequent funding round.

3. Number of Active Wallets:

Indicates user engagement and trust in the protocol.

Impact on Valuation: It's a direct reflection of user trust and adoption rate. A steadily increasing number points to robust growth.

Example: Last year Solana, with its growing active wallets, signaled to investors a rising community and user trust in the platform's potential. In another example, the surge in active wallets for Binance Smart Chain in early 2021 showcased its fast adoption rate, which was reflected in its token value and overall platform valuation.

4. Total Number and Size of Transactions:

It offers insight into the network's utility and activity.

Impact on Valuation: Demonstrates network activity, and a rising total suggests growing trust and use cases on the blockchain protocol.

Example: Despite being relatively new, when Avalanche entered the market it saw a rapid rise in the number and size of transactions, signaling both adoption and utilization.

By the way, if you find yourself eager for more tips and insights, consider this: every week, we curate a special web3 digest packed with useful tools and events, market insights, and exclusive opportunities tailored for web3 founders and investors. Take a moment to subscribe to our weekly web3 digest.

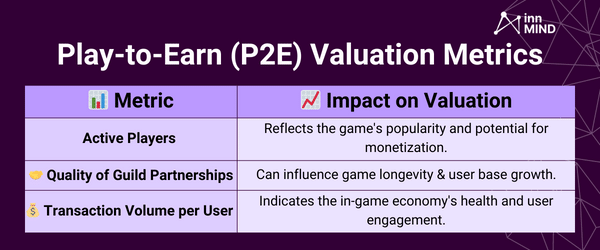

Play to Earn (P2E) Gaming Valuation Metrics

1. Number of Active Players:

A direct reflection of the game's popularity.

Impact on Valuation: Reflects the game's popularity and user engagement potential.

Example: Remember 2021, when Axie Infinity witnessed a surge in daily active players, signaling its emerging dominance in the P2E landscape.

2. Transaction Volume Per User:

Showcases player engagement and the game's token design effectiveness.

Impact on Valuation: Measures the monetary activity of individual users, revealing the average revenue potential from each player.

Example: A game with high transaction volume per user indicates strong in-game economic activity. Games like Star Atlas, which emphasize on decentralized economies, might see higher transaction volumes per user, increasing their perceived value in the eyes of investors.

3. Number and Quality of Guild Partnerships:

It indicates the game's integration and acceptance within the larger P2E ecosystem.

Example: Yield Guild Games' partnerships with various P2E platforms not only boost player numbers but also enhances the game’s credibility in the community.

Additional aspects to consider for web3 startup valuation

Competitive Analysis: Understand where your startup stands compared to competitors. For instance, SushiSwap, although similar to Uniswap, differentiates itself with unique features and community governance.

Network Security: Projects with robust security measures, like Chainlink's decentralized oracles, naturally command higher trust and valuation.

Community Engagement: A proactive community can significantly boost a project's value. MakerDAO's governance proposals, steered by community voting, is a perfect example of impactful community engagement.

In Summary:

Valuing a Web3 startup isn't a task to be taken lightly, and it's more nuanced than many anticipate. These metrics, while essential, are just the tip of the iceberg. Each startup's journey is unique, and while the metrics guide the path, the stories behind those numbers are just as critical.

At InnMind, we're committed to shedding light on the intricacies of the Web3 world. This post marks the beginning of a series delving deeper into the world of Web3 valuations, providing insights that go beyond the surface. But our content library isn't limited to just valuations. From pitch deck templates that have garnered millions in funding to go-to-market strategies that have driven startups to become industry leaders, InnMind is your treasure trove of insights and resources.

So, as you navigate the challenging waters of the Web3 landscape, remember you're not alone. With every hurdle you encounter, we aim to equip you with the knowledge and tools to leap higher. Subscribe to our platform, delve into our knowledge base, and let's shape the future of Web3 together.

Stay tuned for our next piece in this series.

And remember: Knowledge isn't just power; it's the fuel for your startup's journey.

Read also: