High-Potential Web3 Startups to Watch in 2026 (Social, AI Ops, RWAs, Trust, DeFi)

Startups to Watch on InnMind in Jan 2026: 5 teams solving real market gaps across Web3 social, AI ops, tokenized RWAs, trust infrastructure, and retail DeFi.

Part of our ongoing “Startups to Watch on InnMind” series. We publish these spotlights to help founders discover useful tools and to give our member startups extra visibility.

Web3 and AI are moving out of the experimentation phase and into something more serious: infrastructure.

The next wave of breakout startups is not built on hype cycles. It is built on clear market gaps, real demand, and products that scale with real usage.

Across social engagement, AI-driven media ops, tokenized real-world assets, trust automation, and retail-friendly DeFi, the same pattern keeps showing up. Markets are growing, users are more selective, and capital is flowing toward teams that turn attention into action and complexity into usable products.

Below are five startups on InnMind that sit right at that intersection.

TL;DR

- Web3 social is becoming an actual product category, not a side feature.

- Distribution is shifting from “post more” to systems: prediction loops, community gamification, reputation layers, and AI-driven content ops.

- AI is turning social presence into an operational system, not a manual job.

- If you’re fundraising, these tools also help you do the one thing investors quietly care about: prove demand & momentum.

- RWAs and AI infrastructure are converging through tokenization.

- Trust automation is becoming a baseline requirement for digital business.

- Retail DeFi is moving toward simpler, guided experiences.

If you are fundraising right now, use this list as a shortcut: pick one idea, test it for 30 days, and collect proof (engagement, signups, holders, retention) that you can reuse in your narrative.

Web3 social engagement and AI-driven media operations

The market opportunity

Social engagement in Web3 is evolving from passive consumption into interactive, incentive-driven participation. Some market research providers forecast Web3 social media platforms could grow very rapidly over the next decade (for example, one forecast estimates $471B by 2034, at 50%+ CAGR). Treat this as directional, not a guarantee, since forecasts vary.

At the same time, brands and founders face a different challenge. Over 84% of users engage across multiple social platforms, which makes consistent presence, engagement, and monetization increasingly complex.

Two different but complementary approaches stand out.

FOLIO prediction games for community attention

FOLIO is a gamified growth and loyalty platform that turns prediction-based polls into real, verifiable actions like token buys, sign-ups, and trading activity.

Instead of ads, quests, or low-quality tasks, FOLIO uses predictions gated by on-chain and off-chain actions such as token ownership, wallet activity, exchange usage, or social behavior. Predictions are naturally engaging, and when they are tied to verifiable actions, every interaction becomes measurable.

For partners, this means growth campaigns that produce holders, volume, sign-ups, and followers rather than impressions. For users, correct predictions unlock points that convert into meaningful crypto rewards.

With more than 40,000 monthly active users, FOLIO has already shown stronger engagement and retention than many traditional crypto marketing tools. Its fixed-value points system lets partners control costs while giving users consistent incentives.

Why it matters in 2026: If reach is down, you need engagement loops. Prediction mechanics are one of the cleanest loops because they create:

- repeat visits,

- community discussion,

- creator-driven content moments,

- a measurable “signal” you can reuse for product and narrative.

Best for: Web3 founders who want to grow an active community, not just impressions.

FOLIO is available as an exclusive perk for startups inside Startup Deals → Perks Club.

NotPeople: AI Social Ops for Always-On Distribution

NotPeople is an operational layer for social media powered by AI agents.

While FOLIO focuses on participatory engagement, NotPeople tackles the operational side of social presence.

As platforms multiply and real-time interaction becomes expected, brands and creators struggle to stay consistent without constantly expanding their teams. NotPeople is building an AI-powered operational layer for social media, using agents that generate content, manage replies, handle engagement, and support outreach across X, LinkedIn, Telegram, Threads, and Facebook.

Each agent operates with a defined brand context, tone, and goals. The result is social media that feels less like manual labor and more like a programmable system.

The opportunity here is structural. Communication scales faster than teams can grow. AI-driven social operations are becoming infrastructure rather than a nice-to-have.

Why it matters in 2026: Nuance: NotPeople is not a Web3 or blockchain startup (no token, no on-chain product). We include it because many Web3 teams still rely on X for visibility, and crypto reach became harder after Twitter algorithm changes in late 2025 and early 2026, cutting off major metrics for crypto-related accounts.

Social distribution is a compounding advantage, but most teams cannot scale “always-on presence” with headcount. Tools that make social execution consistent without founder burnout are becoming infrastructure.

Best for: Web3 founders building in public, teams running community-led growth, and projects trying to recover visibility on X.

AI infrastructure and tokenized real-world assets

The market opportunity

AI infrastructure is entering a multi-year build cycle. Demand for compute, GPUs, and data centers keeps rising, while capacity is constrained by hardware, energy, and deployment timelines.

At the same time, capital markets are embracing tokenized real-world assets to unlock liquidity, transparency, and yield. According to a Q3 2025 Real World Asset Tokenization market report, tokenized RWAs crossed $30B in total value in Q3 2025 (about 10x growth since 2022), with strong concentration in income-generating assets such as private credit, U.S. Treasuries, and infrastructure.

This creates a rare convergence point between AI demand and on-chain financial rails.

EDITH: Tokenized Ownership for AI Infrastructure and RWAs

EDITH is building the ownership and liquidity layer for AI infrastructure and other high-value real-world assets.

The platform starts with fractional ownership of revenue-generating AI infrastructure such as GPUs and data centers, and expands toward a broader trading layer for institutional-grade assets, including real estate and renewable energy.

A key design choice is separating platform equity from asset-level ownership. This helps avoid governance conflicts while allowing scalable deployment. By focusing on cash-flow-generating assets instead of speculative tokens, EDITH positions itself as foundational infrastructure rather than a short-term trade.

As institutions search for yield and AI infrastructure struggles to keep up with demand, EDITH sits where capital, compute, and tokenization meet.

Why you need this in 2026: Compute is becoming the new scarce resource. The teams that can finance and scale AI infrastructure will win. EDITH sits in a rare spot where tokenization can turn expensive, cash-flow assets like GPUs and data centers into investable, liquid positions.

Best for: Investors and operators exploring tokenized RWAs, founders building AI infra or DePIN-adjacent products, and anyone looking for yield narratives backed by real cash-flow assets.

Web3 trust, identity, and programmable agreements

The market opportunity

Despite decades of digitization, business agreements remain fragmented across contracts, identity checks, invoices, and payments. According to World Commerce and Contracting, up to 9% of annual enterprise revenue is lost due to inefficiencies, disputes, and poor contract management.

At the same time, the digital identity market is projected to exceed $90B by 2030 (Fortune Business Insights), while programmable payments are expected to unlock significant value by reducing settlement delays and operational overhead.

As compliance and auditability become baseline requirements, “trust infrastructure” shifts from optional to essential.

TrustMe: Trust Infrastructure for Contracts, Identity, and Payments

TrustMe is a digital trust infrastructure that unifies contracts, identity, and payments.

TrustMe is building a unified trust layer that connects identity, contracts, and payments into a single Web3-native system.

With over 3,000 companies already using the platform, TrustMe enables businesses to automate real-world agreements end-to-end while maintaining legal certainty.

The positioning is straightforward. Just as Stripe became payment infrastructure and DocuSign became contract infrastructure, TrustMe is aiming to become the trust backbone for digital business.

Why you need this in 2026: As Web3 matures, counterparties care less about “on-chain” and more about certainty. TrustMe addresses the boring but lethal friction: identity, agreements, and payments that must hold up under audits, disputes, and real business operations.

Best for: Teams doing B2B or regulated-adjacent Web3, founders who need contracts and payments that stand up to real counterparties, and operators reducing disputes, chargebacks, and manual reconciliation.

AI-powered trading and retail-friendly DeFi

The market opportunity

Crypto trading remains one of the largest value pools in Web3. According to CoinGecko, DEX volumes exceeded $1 trillion in 2024, driven by multi-chain liquidity and continued retail participation.

Yet complexity remains the biggest barrier for new traders, while retention remains the hardest problem for existing platforms.

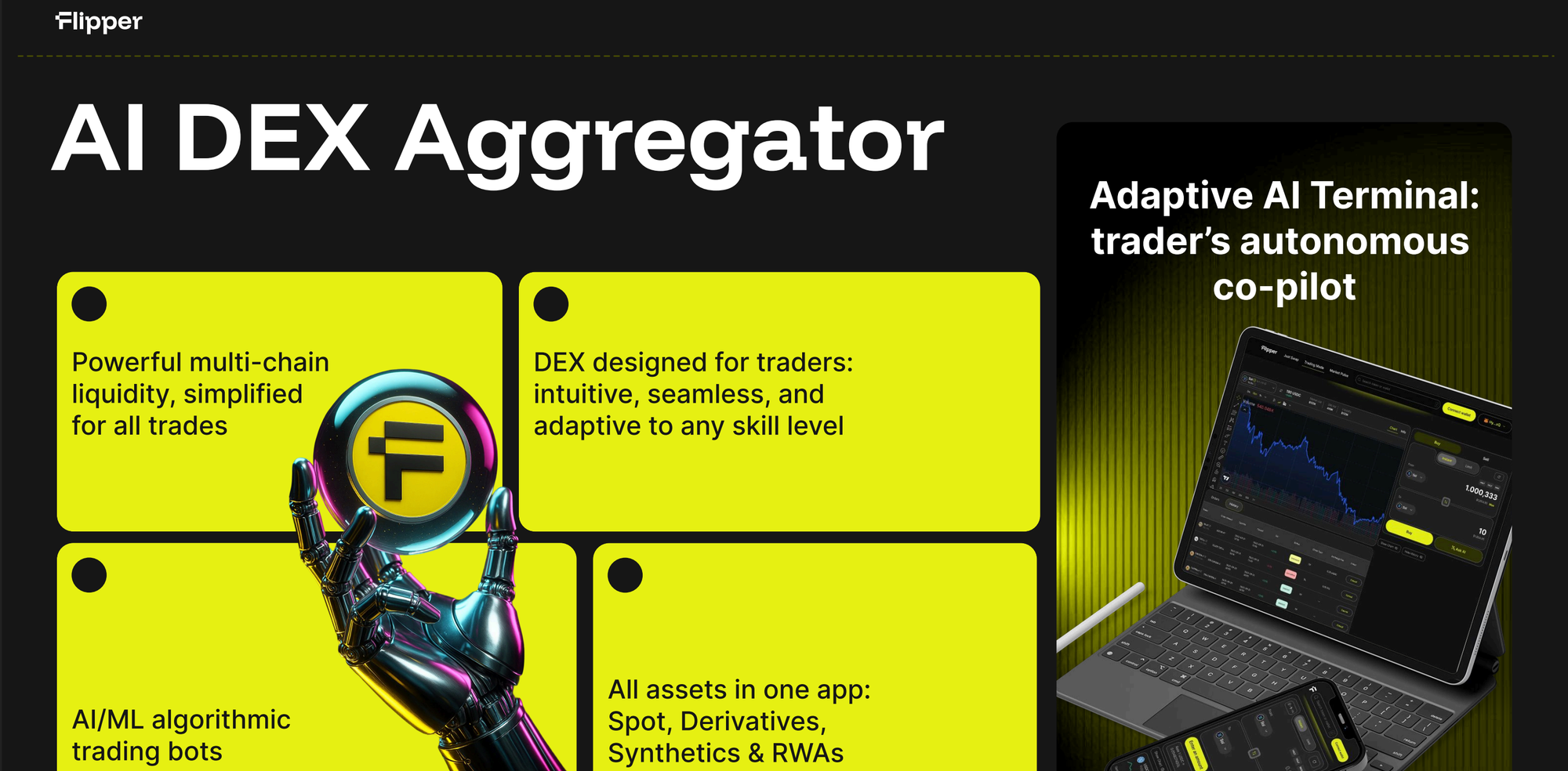

Flipper: User-Friendly AI Trading for Retail DeFi

Flipper is a multi-chain DEX aggregator with an AI co-pilot, designed to make crypto trading simple and accessible for everyone.

Flipper addresses both challenges by combining a multi-chain DEX aggregator with an AI co-pilot, wrapped inside a gamified Telegram trading experience. Instead of onboarding users through complex interfaces, Flipper starts where users already are and builds trading confidence through automation and guided strategies.

The platform focuses less on execution speed and more on conversion, retention, and accessibility. With AI bots, agents, and a Telegram-native distribution model, Flipper aims for near-zero customer acquisition cost while lowering the barrier to advanced trading.

Why you need this in 2026: Retail does not want another complex trading dashboard. They want a guided experience where decisions are simplified and execution happens where they already spend time. Flipper’s Telegram-native flow and AI co-pilot are built for that reality.

Best for: Retail-facing DeFi products, growth teams using Telegram as a distribution channel, and traders who want multi-chain execution with less cognitive load.

Why these startups matter

Across very different sectors, these teams share the same fundamentals.

- They operate in fast-growing markets.

- They solve structural problems, not cosmetic ones.

- They focus on turning demand into measurable outcomes.

This is the type of startup we consistently see gaining traction with users, partners, and investors on InnMind.

Want to discover more startups like this?

InnMind is where founders, investors, and operators connect to discover promising startups, fundraising opportunities, and growth partnerships across Web3, AI, and crypto infrastructure.

Discover over 30,000 startups, building in web3 and AI verticals, and connect with them to build partnership, create win-win collab, or explore investment opporunity.

Why these startups matter

Across very different sectors, these teams share the same fundamentals.

- They operate in fast-growing markets.

- They solve structural problems, not cosmetic ones.

- They focus on turning demand into measurable outcomes.

This is the type of startup we consistently see gaining traction with users, partners, and investors on InnMind.

What to do next

If you want this post to be useful, not just interesting, pick the path that matches you:

- Founder (raising or preparing to raise): Create a free startup profile so investors can evaluate you fast, then use Membership to build a focused investor shortlist and outreach workflow.

- Create your profile

- View Membership plans

- Find your match among active investors

- Try Tokenomics Calculator

- Founder (saving burn): Check Startup Deals for perks and discounts. If you want to try FOLIO, start from the Perks Club page.

- Explore Startup Deals (Perks Club)

- Get FOLIO perk: https://app.innmind.com/perks-club/folio-prediction-games

- Investor / operator: Use the startup profiles above as a starting point, then browse similar teams by theme.

Read also: