Do you have a pitch deck for your startup?

Probably yes.

But if you are an early-stage startup founder (pre-seed, seed and even series A), attracting your first venture capital investments, be 99% sure: your current pitch deck sucks.

Every active investor reviews hundreds of startup pitch decks every month. And 9 out of 10 end up going into the trash.

It is frustrating for me to see startup founders spending so many hours making useless decks that no one will read till the end.

And even more frustrating to see again and again that despite the limitless knowledge base on the internet teaching how to make a good pitch and what are the mist-haves in a perfect pitch deck, entrepreneurs repeat the same mistakes, failing chance to attract investors' attention and funding.

On InnMind we collected the critical mistakes that we see in startup pitch decks too often. And combined them into a set of harmful advice for startup founders on how to make the worst pitch deck. Probably, learning from examples will help you better understand what exactly drives investors nuts and makes them say NO in the middle of your slides.

By the way, subscribe to InnMind weeekly digest tailored for founders and investors. Every week, we curate a special web3 digest packed with useful tools and events, market insights, and exclusive opportunities for startups.

So, let's go through the 8 critical mistakes in an investor pitch deck every second startup is still making. Below we will go through each of them, quoting popular misconceptions in a form of harmful advice, and explaining what is wrong there.

1. How long should be investor pitch deck? No limits!

Don’t limit yourself while working on your pitch deck. Impossible to explain all the unique ideas in a few slides. The investors’ main mission is to dig deep into the details while exploring the potential of the future unicorn, so 25-40 slides is considered to be a “good read”, appreciated by the VC.

WRONG!

In reality, this can be even considered rude from your side: a sign that you simply don’t respect the investor’s time. The shortest - the better.

From Guy Kawasaki to Andreessen Horowitz, all the leading venture capitalists recommend: the golden rule for startup pitch decks is up to 10 slides.

2. Ignore templates and standards, be creative!

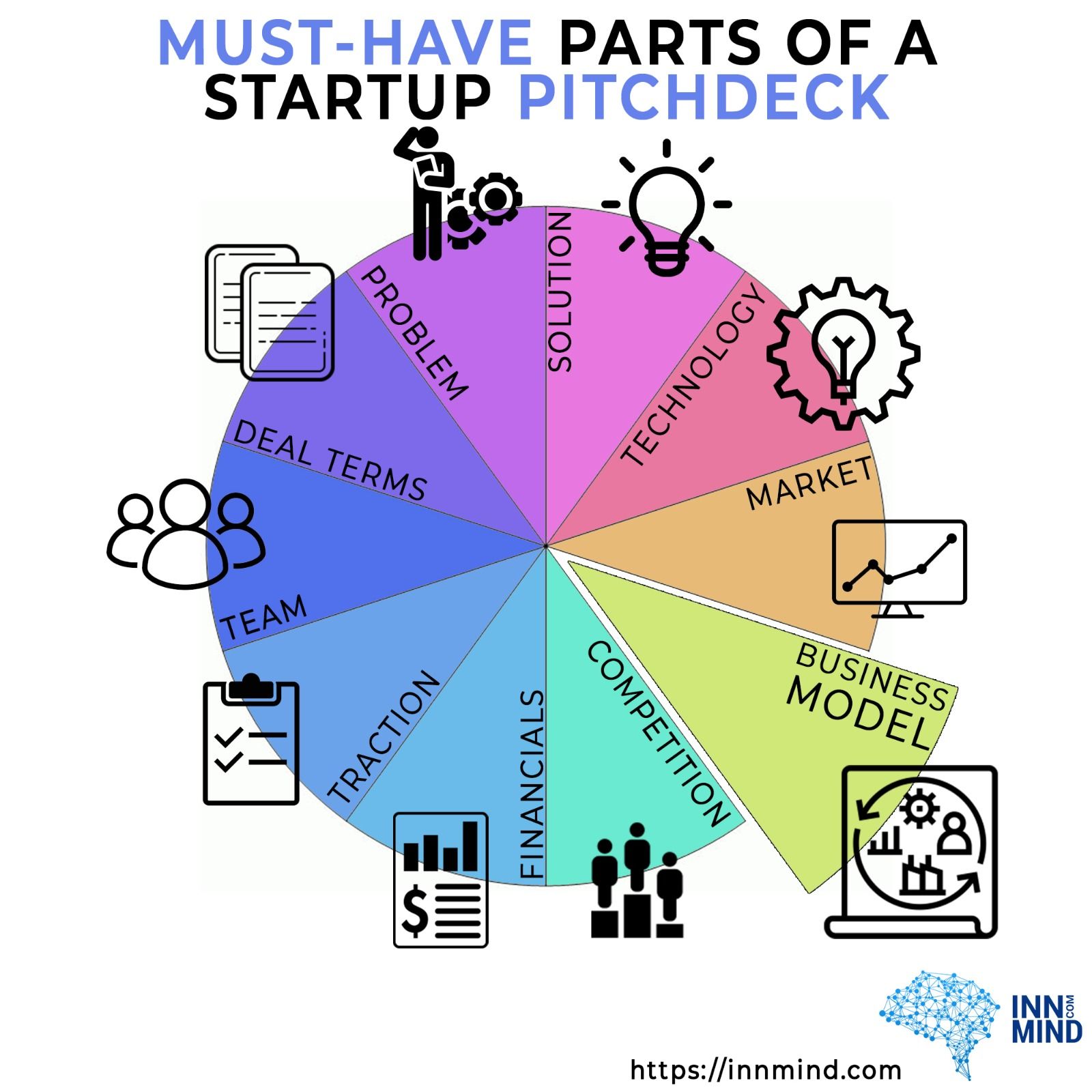

There is a standard structure for a pitch deck: problem - solution - market - business model - team - traction - etc. But it’s boring. Prove that you’re a creative founder. Throw off all this boring structure and make your pitch deck unique. Investors will remember it for weeks after the first read!

WRONG!

Don’t waste your time and energy on being creative, it can do more harm than good. Professional investors think in standard terms. Imagine that they have “a library of startups” in their heads, structured according to the stage, sector, technology, business model, etc. And when reading your pitch deck or listening to your presentation, they should be able to immediately identify what “shell” in that library is your startup from. If it suits their priority focus and mandate or not.

If you’re too creative, it would be hard for an investor to make a “stop-go” decision fast, and instead of spending extra time on understanding your startup, the majority of them will just skip it and switch to another one. That is why we need a standard structure of presentation.

As you can see from the picture above👆, essential slides of a startup pitch include problem, solution & technology, market, business model, competition landscape, traction, team, and funding needs or deal terms. Ensure you have them all in your deck!

3. Storytelling will enrich the pitch deck:

Did you hear that storytelling helps to sell? Every marketer knows that! You should include storytelling in your pitch deck, explaining the background of your idea and telling a beautiful story on how it came to your mind, and sharing the detailed company overview since it's early days. The best practice is to make 3-5 dedicated slides (adding photos of you when the idea just came into your mind will be a good fit).

WRONG!

Storytelling is good for marketing or personal meetings with venture capitalists when there is enough time and interest from the audience to understand your inner motivation and background.

In a seed pitch deck, your main goal is to trigger investors’ attention and interest in a short period of time and make them want to have the next conversation, where you could share more details and tell your story. Again: be laconic and focus on presenting the business opportunity instead, and leave the story about your mission for the next, deeper talks.

4. Focus more on product and features description

How does your product differ from competitors? Why will customers love it more? It’s all about product features. You should not hesitate focusing on this aspect, and describing slide-by-slide all the features that you have (or plan to develop) during the next x years.

WRONG!

Product is important, but it is not the features that will make it a great startup. It’s all about product market fit, execution, and traction. That is why in the pitch deck it is more important to demonstrate what you know about your business and how you plan to make it successful than to describe the set of features you plan to develop.

5. Fake it until you make it!

This is another well-known expression and advice that many great entrepreneurs repeated publicly. Why not use it for your good in the pitch deck? For example, in the slide about traction. Imagine numbers, that investors would love to see, and then just put them on the paper. There is always a chance that they will not request to proof it.

WRONG!

It can be a fatal mistake that will not only put you on the “rejected list”, but most probably will ruin your reputation in the sector. When you talk with business partners (and the potential investor can become one of them), trust is everything. If you ruin it, declaring false numbers and fake traction, no one will ever want to make business with you.

Remember: you should never mislead or misinform your partners, investors and stakeholders!

6. Numbers are for nerds

There are other documents for numbers: financial model, business model, business plan, revenue, etc. There is no need to put your numbers in the investment pitch deck. Moreover, to get access to your numbers investors need to sign an NDA or give a preliminary commitment to invest. Avoid putting numbers in the deck not to dilute investors’ attention to the idea, storytelling and big picture.

WRONG!

Traction is an important part of the pitch deck, and the financials have to be in there. If you're a pre-revenue startup, reflect your summary of estimated/forecasted figures in the pitch from your business plan. If you're already generating sales, show your revenue and growth numbers.

And this is not considered confidential information, you will look “paranoid” if you ask for an NDA to share this basic data, which is essential for investors to assess your startup’s potential.

7. Pitch deck design: 90% design, 10% content

"Design is intelligence made visible", - that is why you should demonstrate your intelligence and serious approach through visualising the most impressive design of your startup pitch deck. Make it something that investors will remember. Play with colors, fonts and pictures in every slide, remove the frames and show your limitless creative spirit.

WRONG!

Like in a case of an employee with many diplomas: it doesn’t prove that he is smart or talented, it only proves that he is capable of studying a lot and getting many diplomas. Same with your design of the startup pitch deck: it will only show investors that you can spend time or money on fancy design, which is not something VCs are looking for.

A simple, but clear startup pitch deck with relevant information will look way more convincing for venture capital investors than slides with expensive designs, but lacking data.

For proof, check any pitch deck example here from companies that raised millions of dollars in venture capital funding. Will you find a super fancy slide or over-designed deck there?

8. Keep your contact info away from the slides

Your contact details are confidential. Anyway, if you send the pitch deck by email, investors will know how to contact you. In other cases, interested investors can spend a few minutes to find you on LinkedIn or other social media. Presentation is not the place to share contact information.

WRONG!

This is a very typical mistake so many founders are doing that we’re getting tired of repeating it! Put your contacts in the startup pitch deck: either on the first title slide, or on the last one.

A good practice is to have at least your Name, Title and E-mail (and your telegram ID for crypto startups) in your pitch deck, so that investors can easily find your contact details and the name of the startup founder without wasting extra time for internet surfing.

It is in your interests to shorten the distance between you and investors, agree? So be sure you don’t complicate it!

…

If you follow these quoted pieces of bad advice, you can be sure that you’ll screw your fundraising and make the worst impression you can. Otherwise, you can register on InnMind and download the pitch deck template that goes against these pieces of advice and puts the golden standards for a perfect pitch deck.

Another good read for you about startup pitch and pitch deck examples: