5 Game-Changing DeFi & Web3 FinTech Startups to Watch in 2025

While crypto capital fell 40% in Q3'25, these 5 DeFi startups are thriving. Explore early-stage projects in PayFi, RWAs, trading, banking, and reputation.

Fintech and digital assets have converged into a single market where payment innovation, RWA tokenisation, and DeFi protocols reinforce each other. While global fintech investment held steady at ~$11B in Q3'25 (CB Insights), crypto capital fell 40% quarter-over-quarter (Architect Partners), signalling a flight to quality and institutional-grade infrastructure.

Against this backdrop, we've selected five DeFi infrastructure projects from the InnMind ecosystem that are building real utility and demonstrating early traction.

Here's your dossier on each project.

ChiCha Technology: Stablecoin Wallet for the AI & Human Economy

Startup Profile | Website | X

What they do:

ChiCha bridges everyday payments and crypto rewards through an AI-powered stablecoin wallet. Users spend USDT like cash and earn ChiPoints, redeemable for $CHI tokens, NFTs, and Genie AI modules that optimise yields, track whale movements, and improve spending habits. The platform processes $5M+ in monthly transaction volume across 200,000+ wallets and 1,300+ merchants.

Why it matters:

ChiCha solves crypto's real-world utility problem by combining compliant crypto payment solutions with on-chain loyalty programs. Through a strategic minority stake in PayLoro (a BSP-licensed EMI/OPS), ChiCha connects stablecoin rewards to regulated fiat settlement, delivering the crypto experience consumers want without regulatory friction. The tokenomics include a sustainable 10% revenue buyback-and-burn mechanism, with a multi-launchpad TGE led by AlphaMind scheduled for Q4 2025.

Key traction: 2,000+ UCard activations, partnerships with AlphaMind, Kommunitas, BSCS, Galxe, and Zealy for distribution.

DexPilot: The all-in-one DeFi trading terminal

Startup Profile | Website | X

A unified DeFi trading stack where AI models compete, traders execute with precision, and earnings can be spent in the real world. DexPilot combines an AI trading sandbox, a next-generation terminal, and crypto cards into a single product experience.

What they do:

- AI Trading Sandbox: Neural networks run live strategies with real capital and real data. Models compete on performance, users can back the winners, mirror decisions, and track every move on-chain. Think “financial esports” for AIs, with transparent leaderboards and verifiable results.

- Next-Generation Terminal: One interface that aggregates liquidity across major DEXs and CEXs. Traders get advanced execution, smart routing, real-time order flow, PnL from AI models, analytics, and goal tracking. Social leaderboards highlight top human and AI performers.

- Crypto Cards and Everyday Finance: With Apple Pay–ready crypto cards, users can spend trading profits, staking yields, or AI rewards instantly. A slice of transaction fees cycles back to community pools to fund buybacks, rewards, and ecosystem growth.

- Unified Ecosystem: Not just a terminal, not only an AI lab, and more than payments. DexPilot turns trading into a social, data-driven game where you can watch AIs compete, allocate to them, or jump into the arena yourself.

Why it matters:

DeFi is fast and fragmented. DexPilot provides traders with an edge by combining discovery, execution, and post-trade utility in one platform. On-chain transparency makes AI performance auditable, which helps democratise quant strategies beyond closed funds. Real-world spending closes the loop, so gains are immediately useful rather than stuck on an exchange. For builders and communities, the fee flywheel and public leaderboards create incentives that reward skill and participation, not just hype.

Real Finance: Institutional-grade RWA Layer-1

Startup Profile | Website | X

What they do:

Real Finance is an EVM-compatible Layer-1 (built on Cosmos Tendermint), purpose-built for tokenising, scoring, insuring, and trading tokenised real-world assets (RWAs). The network brings tokenisers, risk assessors, and insurers into consensus as “business validators,” embedding real-world logic and accountability on-chain.

Why it matters:

Real tackles TradFi pain points - opaque risk, high ops costs, centralisation - by baking risk scores and compliance metadata into tokens and aligning participants via dual validators and a no-inflation Disaster Recovery Fund. With $500M+ in RWAs onboarding and relationships spanning Wiener Privatbank, Experian, and Barents Re, it’s a serious bridge from TradFi to DeFi credit pools and securitised RWA markets.

Fasqon: Crypto-Friendly Banking for Europe's Digital Workforce

Startup Profile | Website | X

What they do:

Fasqon blends traditional banking with crypto-native infrastructure for freelancers, founders, and cross-border operators. Think full digital bank plus crypto wallet, personal IBAN-linked crypto cards, euro↔crypto interoperability, a passive rewards engine, and compliance together with an EU banking partner (VASP licensed).

Why it matters:

Legacy banks frequently freeze accounts over crypto activity and create friction for cross-border operations. While neobanks like Revolut offer limited crypto features, they often restrict regular crypto withdrawals. Fasqon provides a genuine alternative: a dual fiat + crypto stack serving both B2C users and B2B clients, with revenue from transactions, FX, subscriptions, and token utility.

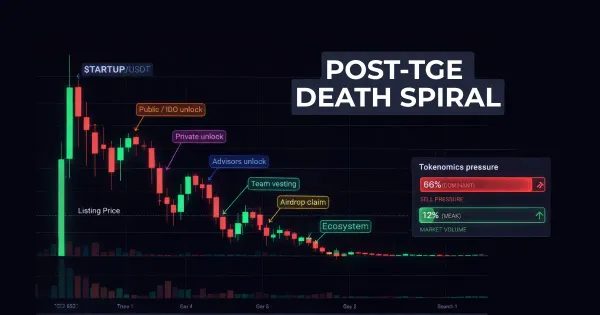

Special spotlight: On-chain reputation as a new DeFi primitive

Unlike the other projects in this list, the next startup isn't about payments, trading, or banking - it's about the trust layer. On-chain reputation and on-chain credit scoring address a long-standing DeFi pain: distinguishing real users from bots/sybil accounts, assessing risk, and improving capital efficiency.

A reputation layer can be used by lending protocols (dynamic LTV, limits, and rates based on user reputation), launchpads (anti-farm whitelists), DEXes and aggregators (order prioritisation and anti-bot filters), and other DeFi apps. It’s the missing building block for better UX and risk-managed on-chain finance.

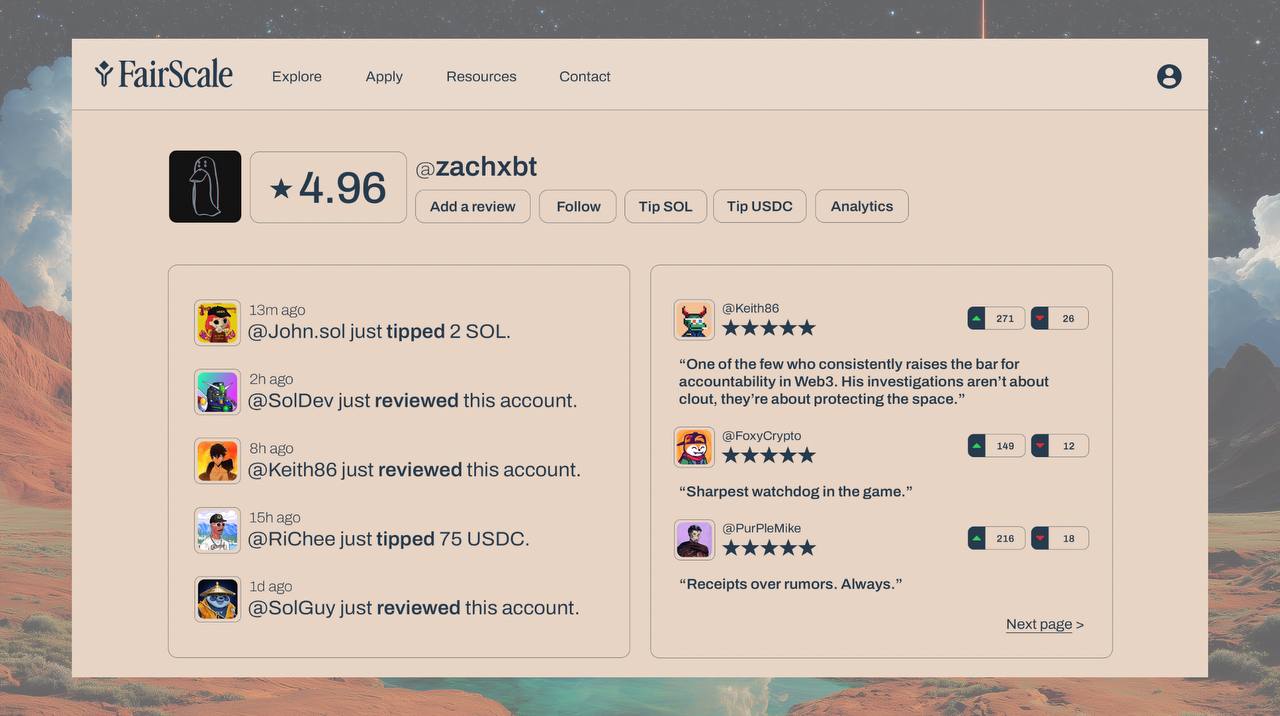

FairScale: On-chain reputation protocol

Startup Profile | LinkTree | X

What they do:

FairScale turns wallets, users, and projects into reputation-bearing identities via the FairScore, a dynamic on-chain 0 to 5-star index. It combines transaction behaviour, community reviews, and social signals, while preserving user privacy. Any app can integrate FairScores through FairScale's SDKs and APIs. Starting with Solana, it plans to expand multichain in 2026.

Why it matters:

Trust is the missing primitive in Web3. FairScale’s portable, verifiable scores unlock smarter whitelists, lending terms, DEX prioritisation, prediction markets, and more. The result? Better risk profiles, stronger sybil resistance, and higher conversions without sacrificing privacy.

Frequently Asked Questions

What is PayFi?

PayFi refers to payment-focused blockchain applications that combine stablecoin infrastructure with real-world merchant acceptance and loyalty programs. Unlike traditional payment processors, PayFi solutions leverage blockchain rails for instant settlement, lower fees, and programmable rewards.

Why are RWAs important for DeFi?

Real-world assets (RWAs) bring trillions in traditional finance value onto blockchain rails, enabling institutional participation and better capital efficiency. By tokenizing assets like real estate, bonds, or commodities, RWAs bridge the gap between traditional finance and decentralized protocols.

How does on-chain reputation work?

On-chain reputation systems analyze wallet behavior, transaction history, and community signals to create verifiable trust scores. These scores help DeFi protocols reduce risk, prevent Sybil attacks, and improve user experience without compromising privacy—similar to how credit scores work in traditional finance.

What makes these startups different from established crypto projects?

These early-stage projects focus on solving real-world pain points - compliant payments, institutional-grade infrastructure, and user experience - rather than purely speculative use cases. They combine proven business models with blockchain innovation.

How can I invest in or partner with these startups?

Visit their profiles on InnMind (linked throughout the article) to connect with founders, view detailed metrics, and explore investment opportunities. InnMind's platform facilitates direct introductions between vetted startups and accredited investors.

The Bottom Line

These five early-stage web3 startups represent the infrastructure layer powering DeFi's next evolution: AI-enhanced payments, institutional-grade RWA protocols, compliant crypto banking, and portable reputation systems. In a market that's rewarding quality over quantity, they've demonstrated real traction and utility.

Want to discover tomorrow's category leaders before they hit your radar? Join InnMind's community of 60,000+ founders and investors to explore curated Web3 fintech investment opportunities, discover Web3 and AI projects, connect with ecosystem builders, and stay ahead of market trends.

Other interesting reads: