Web3 Compliance 2025: Smart Legal Moves for Founders & Investors (+ Country Breakdown)

The article offers a candid, founder-to-founder perspective on the evolving regulatory landscape, highlighting real-world examples and practical strategies for staying compliant without breaking the bank.

Let's face it—navigating the legal landscape in Web3 can feel like trying to solve a Rubik's Cube blindfolded. Regulations are evolving lightning fast: what's acceptable today might be considered a violation tomorrow. While the crypto legal landscape is tightening, Web3 Compliance 2025 is top-of-mind for every crypto founder trying to fundraise or scale globally.

The cost of legal advice? Astronomical! Meanwhile, the fear of unknowingly stepping into regulatory quicksand is real.

On top of that, if you're talking to institutional investors in 2025, expect a sharp focus on legal hygiene—compliance is no longer optional if you're raising serious capital. Public trust is thin after a wave of high-profile scams and exploits, which means transparency and governance are now core features, not extras. And because most Web3 startups serve users across borders, you're not just dealing with one set of rules—you're juggling a whole patchwork of them.

But here's the thing: compliance doesn't have to be a black hole for your resources. You can build a legally sound foundation without draining your runway with the right approach and understanding.

Let’s start with the last changes in the regulatory environment in crypto. This guide gives you founder-friendly clarity on major 2025 crypto compliance updates and how to navigate token classification, MiCA rules, and regulatory risks.

🔒 Key Legal Pillars of Web3 Compliance in 2025 (Token Laws, KYC, GDPR & Audits)

🇺🇸 United States: SEC Clarity & Institutional Turnaround

Under the current administration, the U.S. has taken steps to provide clearer guidelines for digital assets. The introduction of the Digital Asset Market Structure Bill aims to delineate which digital assets fall under securities laws, offering startups a more defined path forward:

- Strategic Bitcoin Reserve: A federal reserve of over $17B in BTC was established, signalling institutional support for digital assets.

- Regulatory Clarity: The SEC and CFTC have issued new guidelines to help classify digital assets, and enforcement actions have decreased significantly.

- Startup Influx: Companies like Deribit, OKX, and Nexo are opening offices in the U.S. again, and investor confidence is rising.

- State-Level Innovation: Wyoming leads with DAO LLC laws and its Stable Token Act, providing a sandbox-like environment for experimentation and growth.

Despite this, of course positive moment for web3 companies and the USA influence in this area, there are real-world examples of both sides:

- MoonPay's Strategic Move: MoonPay established its U.S. headquarters in New York City, signalling confidence in the evolving regulatory environment and highlighting the importance of aligning operations with local laws.

- KuCoin's Legal Challenges: KuCoin faced significant legal issues in the U.S., resulting in substantial fines and operational restrictions. This underscores the importance of proactive compliance and understanding jurisdictional requirements.

🇪🇺 MiCA Regulation in Full Effect Across the EU

The EU's Markets in Crypto-Assets Regulation (MiCA) is now fully applicable, providing a harmonised regulatory framework across member states. This means clearer rules for token issuers and service providers, but also stricter compliance requirements.

Tackle the intricacies of the Markets in Crypto-Assets (MiCA) regulation with this professionally crafted White Paper Template, created by Janina Pietrowska, Partner at ZÜGERLAW in Zurich, Rapperswil & Liechtenstein.

United Kingdom: Striving for Balance

The UK is working on enhancing its cryptoasset regulations to bolster investor confidence and protect consumers. While the FCA is seeking industry feedback, startups should prepare for more robust oversight soon.

Switzerland: Steady, Clear, and Institutional-Ready

Switzerland remains a top-tier crypto jurisdiction with no capital gains tax for private investors and robust regulatory clarity. In 2025, the country is preparing for the OECD’s Crypto-Asset Reporting Framework (CARF), further solidifying its global compliance leadership. The Swiss stock exchange (SIX) is launching a crypto trading platform, and even a referendum is in motion to get Bitcoin onto the national balance sheet. If you’re aiming for long-term, compliant growth, Switzerland is still as crypto-friendly as it gets.

Portugal: From Haven to Harmonised

Once the darling of crypto expats, Portugal now taxes short-term crypto gains at 28%, though long-term holdings (1+ year) remain exempt. It fully adopted the EU’s MiCA regulation by late 2024, bringing structure but also more bureaucracy. Licensing as a Crypto-Asset Service Provider (CASP) is doable but slow. Still a solid option—just no longer the “tax-free paradise” it used to be.

United Arab Emirates (Dubai): All-In on Crypto Innovation

Dubai is building its brand as a global Web3 capital. VARA (Virtual Assets Regulatory Authority) runs a clear licensing regime, and there’s no income tax, with a modest 9% corporate tax. In 2025, Tether launched a dirham-backed stablecoin, and a crypto-only skyscraper opened in DMCC. If you’re after speed, support, and spectacle, Dubai delivers.

4 Legal Compliance Essentials for Web3 Startups in 2025

Now that we've mapped the regulatory terrain, let's zoom in on the core areas where every Web3 founder needs to get it right. These are the pillars of a solid compliance strategy, regardless of where you’re based.

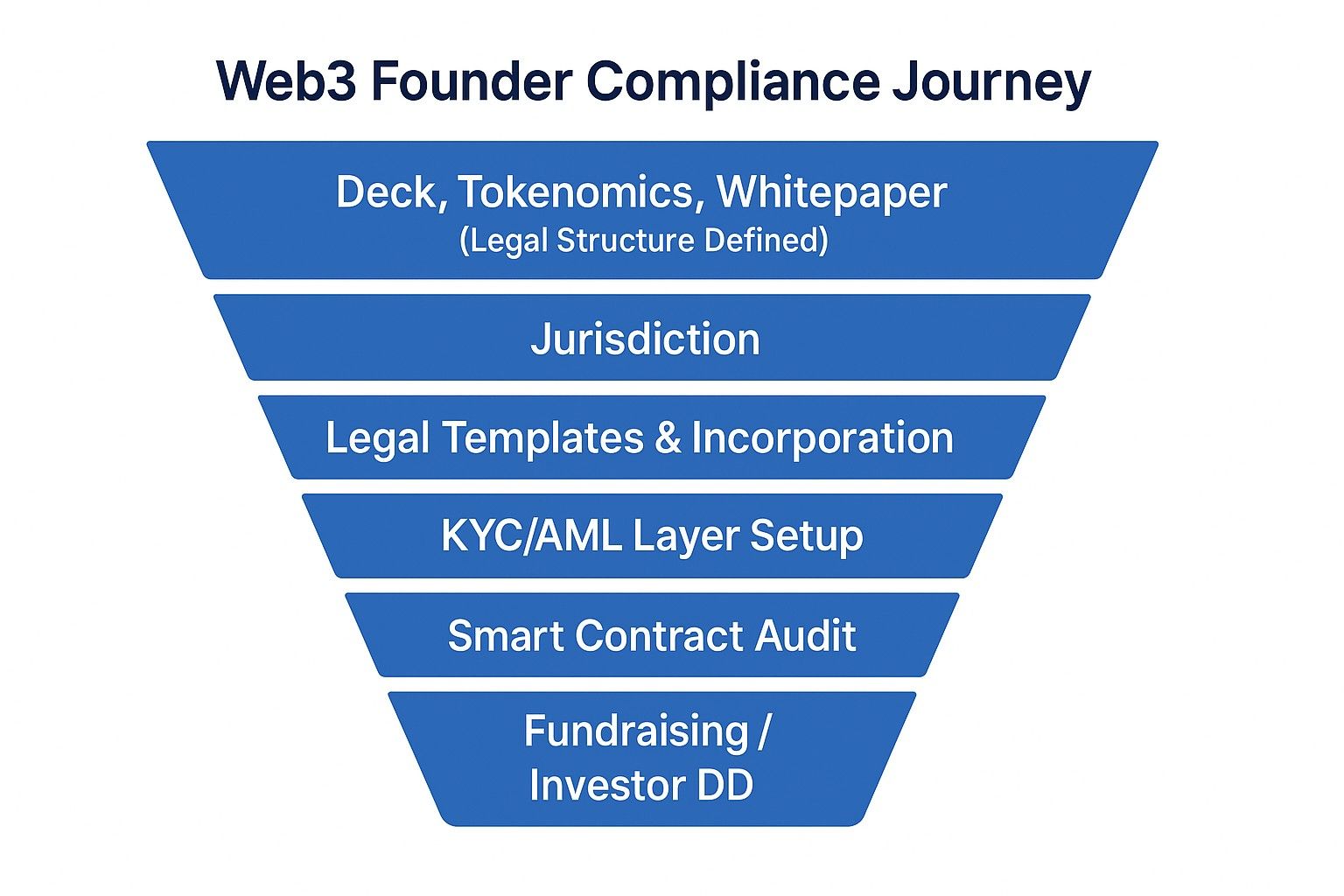

1. Token Classification

Understanding whether a token is classified as a security, utility, or commodity is crucial. Misclassification can lead to regulatory penalties or blocked funding. Staying compliant with token classification rules and understanding crypto securities laws is foundational for any legitimate Web3 play. Startups should consult legal experts to navigate this complex area.

If you're preparing to launch a utility token, this detailed guideline walks you through the legal and compliance steps to do it right. From regulatory essentials to strategic tips, it’s everything Web3 founders need to know before going to market.

>>> Check it out here

2. Anti-Money Laundering (AML) and Know Your Customer (KYC) Protocols

Implementing robust AML and KYC procedures is essential. Regulators worldwide are emphasising the importance of these protocols to prevent illicit activities.

3. Data Privacy and Protection

Compliance with data protection laws, such as the EU's General Data Protection Regulation (GDPR), is mandatory. Startups must ensure user data is handled securely and transparently.

4. Smart Contract Audits

Regular audits of smart contracts can prevent vulnerabilities and demonstrate a commitment to security and compliance. Crypto investors in 2025 increasingly demand visible smart contract audit results as part of their due diligence process (especially for DeFi projects). Audits are not just about safety—they signal serious crypto founder compliance.

Before diving into cost-effective strategies, here's a high-level view of the core compliance steps every Web3 founder should keep in mind:

Startup-Savvy Crypto Compliance: Cost-Effective Strategies

Not every team has deep pockets for ongoing legal support, and that’s okay. The reality is that staying compliant doesn’t always require expensive retainers or in-house counsel. With a few smart strategies and the right tools, you can build defensible operations that meet regulatory expectations and still keep your startup agile and focused on growth.

- Leverage Legal Templates: Utilise open-source legal templates tailored for Web3 startups to save on initial legal costs.

Looking for more hands-on resources to grow and fund your Web3 startup? The InnMind Knowledge Base is packed with practical guides, expert templates, and tools to help founders navigate everything from compliance to fundraising.

>>> Explore it here

2. Engage Specialised Legal Counsel: While generalist lawyers might be more affordable, engaging counsel with specific crypto expertise can prevent costly mistakes down the line.

The InnMind Expert Database offers direct access to vetted legal, technical, and strategic advisors with deep experience in Web3 and crypto. Whether you're navigating compliance, tokenomics, or fundraising, these experts can support your startup's next steps.

3. Implement Compliance Tools: Adopt compliance software solutions that automate KYC/AML processes, reducing manual workload and ensuring adherence to regulations.

4. Stay Informed: Regularly monitor regulatory developments in your operating jurisdictions to adapt swiftly to changes.

If you’re planning to raise capital or expand into new markets, aligning your operations with these evolving regulatory frameworks for Web3 can be your strong competitive edge.

Compliance as a Strategic Edge for Web3 Founders

Compliance isn't just a legal necessity—it's a trust signal to users, investors, and partners. By proactively addressing regulatory requirements, you position your startup as a credible and reliable player in the Web3 space. Remember, in the rapidly evolving world of crypto, staying ahead of compliance curves isn't just smart—it's essential.

Read also:

The Web3 Founder’s Survival Kit: 10 Must-Read Guides to Build and Scale Your Startup