3 reasons for Bitcoin’s recovery in 2023

"BTC price = $69,420".

Nope. That’s not a joke.

That was the price of Bitcoin on November 8, 2021. The highest price of cryptocurrency ever.

Six months ago, Bitcoin was 60% off its all-time high.

This was right after – FTX collapsed, and billions of dollars in crypto went down with it. Back then every VC I know had an SBF poster in their bedroom 🤣

Now, the Bitcoin price is above $30,000 for the first time since June 2022, which is 46% off its all-time high.

By the way, every week we curate a special web3 digest packed with useful tools, market insights, and exclusive opportunities tailored for web3 founders and investors. Take a moment to subscribe to our weekly web3 digest.

But what has changed from then to now that Bitcoin is suddenly recovering?

And what does this mean for the rest of 2023?

Bitcoin, not crypto

Here, we gotta differentiate between Bitcoin and the rest of the crypto market.

By the rest of the crypto market, I mean:

- Ethereum

- Alternative L1s

- Non-fungible tokens

- DeFi protocol tokens

- Ethereum-based L2s

- Other web3 investments

These investments are no doubt carried by Bitcoin, just like Harry Maguire carries Manchester United (all the way down) 🥲.

But now, the narrative is clearly stronger for Bitcoin than for any other crypto-based investment.

Why?

3 reasons.

- Macro push

- Self-custody

- Inflation worries

Let's dive deeper into each of them:

1️⃣ How macro-based environment affects Bitcoin

The current macro environment is…not good9.

Just ask Balaji Srinivasan, the guy who bet that Bitcoin will hit $1 million in June 2023.

Now, while his bet might be waaay up there. The thought process is not very far off though.

And it starts with the 💣 macro-economic environment in the United States.

Last month, the US central bank – the Federal Reserve – raised rates by 0.25%. This is most likely the last time they’ll raise rates for a long long time.

The reason?

Because a 💩-ton of US banks are holding onto US treasury bonds which are about as valuable as LUNA right now. 🤣

These banks bought US bonds because between 2021-2022, the FED kept raising rates → US bond rates kept going 🚀 → US banks kept buying them because they were hella safe

🤷♂️

Now, they’re as valuable as Eden Hazard has been for Real Madrid. 😭

When [not if] the FED lowers rates [again] → Liquidity in the market will increase → US bond yields will fall → Other alternative assets will look 👌

Other alternative assets like Bitcoin, technology stocks, etc.

2️⃣ The market need for self custody

Since the turn of the year, US regulators have gone after these companies:

(see if you can spot a theme)

- Paxos

- Gemini

- Kraken

- Binance

- Coinbase

Notice how regulators were absolutely chill about FTX and FTX US until after it turned out to be a complete flaming ball of 💩*.*

From claiming ☝️ they’re offering unregistered security trading to allowing US citizens ways to launder their money, the SEC’s allegations are wild af.

But the effect it’s having is good and bad for the SEC.

👍 GOOD – people are losing trust in crypto exchanges.

👎 BAD – people are trusting decentralized currencies more.

Yup, people are now moving to self-custody cryptocurrencies like Bitcoin.

This, again, was one of the tenants of Balaji’s bets.

He very clearly said, ‘Get your Bitcoin off exchanges.’

And sensing this massive move to self-custody, Ledger, a cold-wallet manufacturer, just raised $108 million at a $1.4 billion valuation in March 2023.

3️⃣ Inflation on the UP

When interest rates go down, what happens?

For starters, this happens:

And then inflation goes up and up and up.

Once again, we’ve seen this in 2022.

Between March to August 2022, the cost of essentials (like energy and food) was 8-9% higher than a year ago.

The reason was simple. It wasn’t the Russia-Ukraine war. It wasn’t Luna’s meltdown. It was because the FED printed a TON of money, gave cheap loans to people, and literally airdropped money to US citizens in the past 2 years.

All of this made hard currencies, like Bitcoin, stronger.

It’s no surprise then, from a macro perspective that Bitcoin was down only when the FED raised rates last year. 🫢

Now, if the FED goes back to this, it’ll be like deja vu for Bitcoin.

Or maybe the deja vu has already started. 😲

What do you think?

Let us know if these 3 factors (or others) will influence Bitcoin’s price in 2023? And in what direction? 👀

Q1 had web3 investors going 🤑

In Q1 2023, web3 investors got back their mojo.

And we know first hand. 🤙

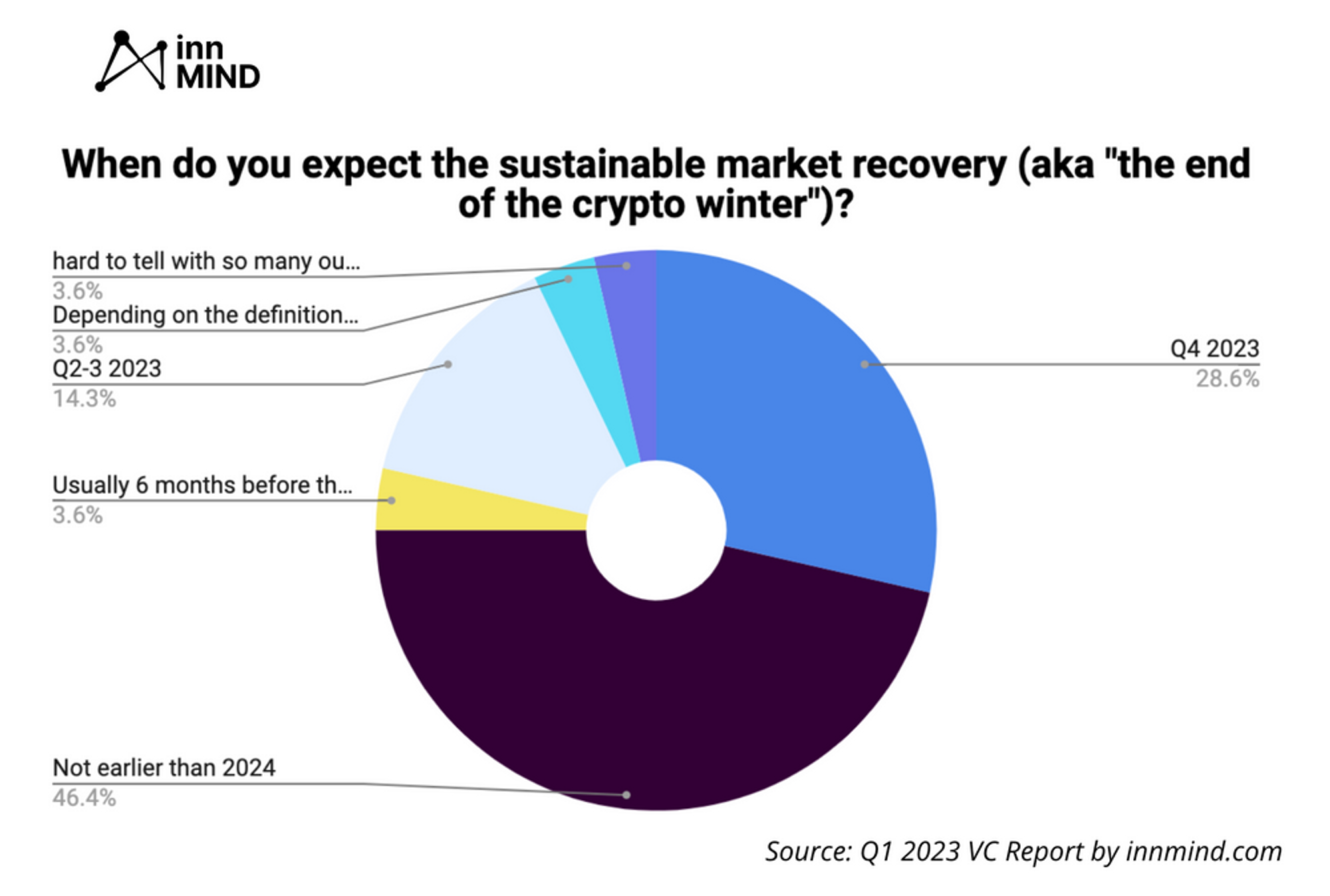

We, at InnMind, conducted a survey of close to 150 crypto VCs from – Europe, Asia, the Middle East, and the US to find out what’s hot and what’s not.

Here are the details:

- Hottest sectors – Web3 Infrastructure and DeFi

- Trending chains – Ethereum, Polygon, and Polkadot

- Reason to invest – Team, tokenomics, and valuation

Despite the positive price action, from an investing lens, most VCs think the market is still fairly meh in 2023. Only in 2024, do they expect the bull market to make a comeback and VC investments to get back to 2021 levels.

You can read the full report 👉 here.

Read more: