Why 80% of Tokens Crash After CEX Listings (And How the Other 20% Survive)

Why 80% of tokens crash post-CEX listing. Real exchange costs, refundable deposit scams, API blackouts, and when to walk away.

What CJ's leak revealed: 8% token allocations, $2.5M deposits that never return, API blackouts during launch, and the path forward for founders.

🔄 Updated October 31, 2025: This article has been enriched with additional founder insights shared within hours of publication. Multiple experienced founders reached out to provide firsthand experiences with CEX listing practices, which we've incorporated throughout.

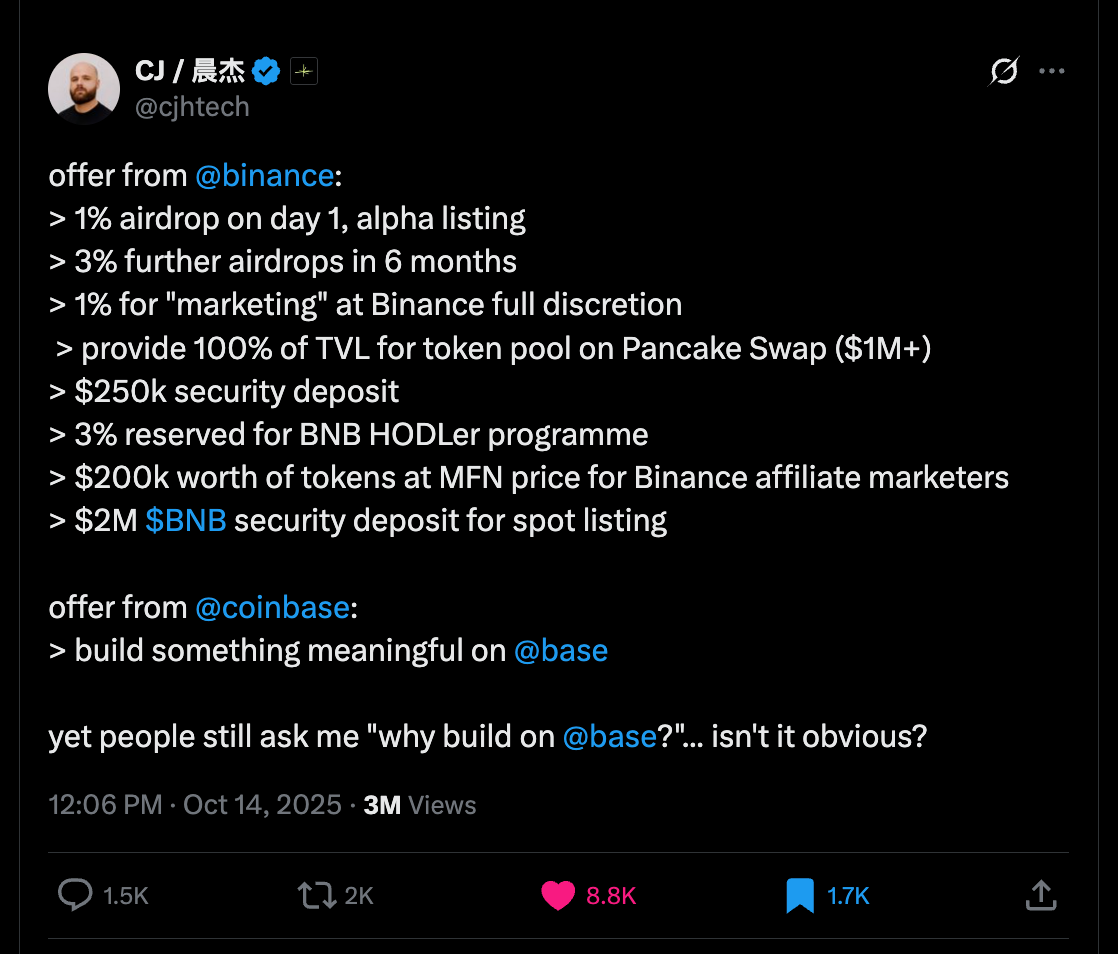

On October 14, 2025, Limitless Labs CEO CJ Hetherington did something unprecedented: he publicly leaked Binance's listing terms. The tweet went nuclear. Within hours, the crypto community was divided between those calling it "brave transparency" and those screaming "NDA violation."

But beneath the drama lies a story every web3 founder needs to understand, because it might explain why your token dumped 70-90% post-listing, or why so many of those "prestigious exchange listings" never translated into actual projects success.

Let's break down what really happened, what Binance and CZ said in response, and most importantly - what this means for your project. If you've ever considered listing your token, this blog post will become your handbook.

The Binance Listing Leak That Shook Crypto

CJ Hetherington's tweet was refreshingly specific.

He publicly shared what he claimed were screenshots of Binance's "alpha listing" terms, detailing:

Token Allocations:

- 1% of total supply for day-one airdrop

- 3% additional airdrops over 6 months

- 1% for "marketing" (at Binance's full discretion)

- 3% reserved for BNB HODLer program

Cash Requirements:

- $250,000 security deposit

- $2M+ in BNB as collateral for spot listing

- $200,000 worth of tokens at MFN price for Binance affiliate marketers

- 100% of TVL (~$1M) for token pool on PancakeSwap

The total ask: ~8% of token supply + $2.5M+ in deposits.

For context, Limitless Labs is the decentralized prediction markets platform. It just secured a $10 million seed round from notable investors, led by 1confirmation and followed by Collider Ventures, DCG, Node Capital, Arrington Capital, Flyer One Ventures, as well as Coinbase Ventures and Base Ecosystem Fund alongside with others.

That said, Binance's terms weren't impossible for them, but they were steep enough to make CJ question the value proposition.

His comparison was damning: Coinbase's offer? Simply 'build something meaningful on Base.'

No percentages. No deposits. No negotiations. Just build.

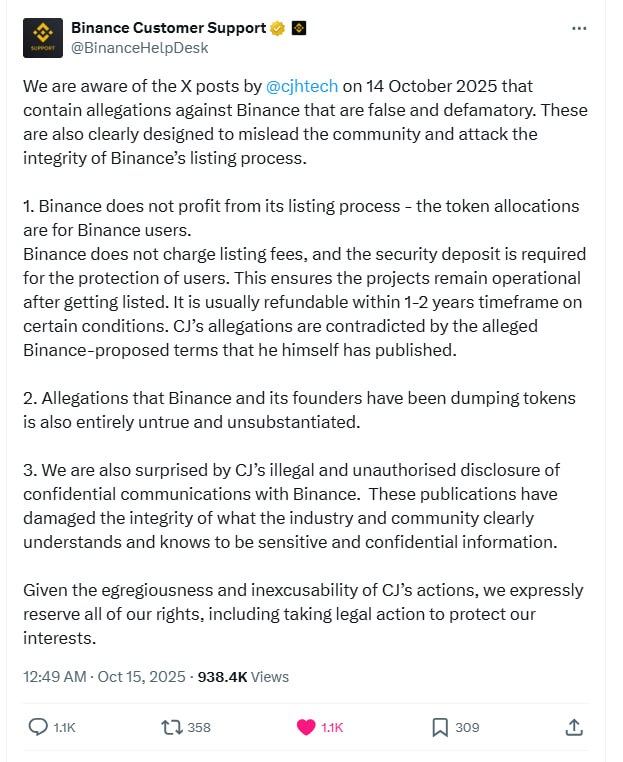

Binance's Response: Denial, Deletion, and Defence

Binance's initial response came fast and fierce. The exchange called the allegations "false and defamatory" and threatened legal action. Their position:

- "Binance does not profit from the listing process": Token allocations go to users, not the exchange

- Deposits are refundable within 1-2 years under certain conditions

- Security deposits protect users by ensuring project commitment

- CJ violated confidentiality and "undermined the integrity" of industry practices

The twist: Within hours, Binance deleted their aggressive response, later apologizing it was "excessive."

![Screenshot showing Binance deleting response]

The semantic game was on. Binance maintained they don't charge "listing fees" - technically true, if you ignore that founders still must give 8% of supply plus millions in deposits to get listed.

Binance's Response: Denial, Deletion, and Defence

Binance's initial response came fast and fierce. The exchange's help desk called the allegations "false and defamatory" and threatened legal action for what they termed "illegal and unauthorized disclosure of confidential communications." See the screenshot below since the original was deleted shortly after.

Their position was:

- "Binance does not profit from the listing process" - Token allocations go to users, not the exchange

- Deposits are refundable - Typically within 1-2 years under certain conditions

- Security deposits protect users - They ensure projects stay committed post-listing

- CJ violated confidentiality - His disclosure "undermined the integrity" of industry practices

The twist: Within hours, Binance deleted their aggressive response, later apologizing it was "excessive."

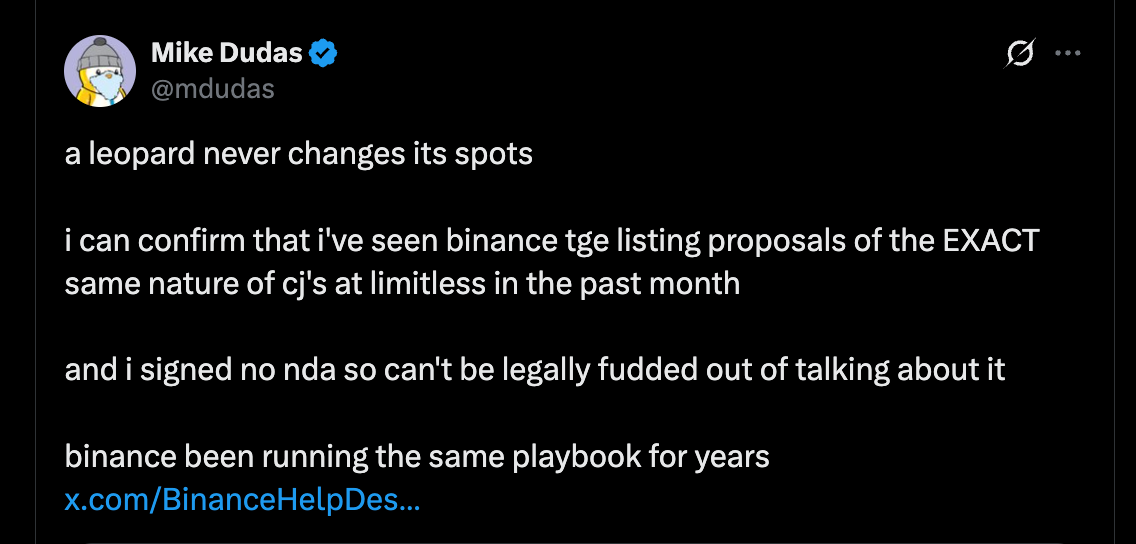

The Smoking Gun: Mike Dudas Confirms the Pattern

If this were just one disgruntled founder's story, it might be dismissed. But it's not. Mike Dudas, founder of 6th Man Ventures, jumped in:

"I can confirm that I've seen Binance TGE listing proposals of the EXACT same nature as CJ's at Limitless in the past month. I signed no NDA so can't be legally fudded out of talking about it. Binance has been running the same playbook for years."

This wasn't isolated. Dudas claimed some proposals approached 10% of token supply. Other founders began sharing similar experiences anonymously, afraid of legal repercussions or blacklisting.

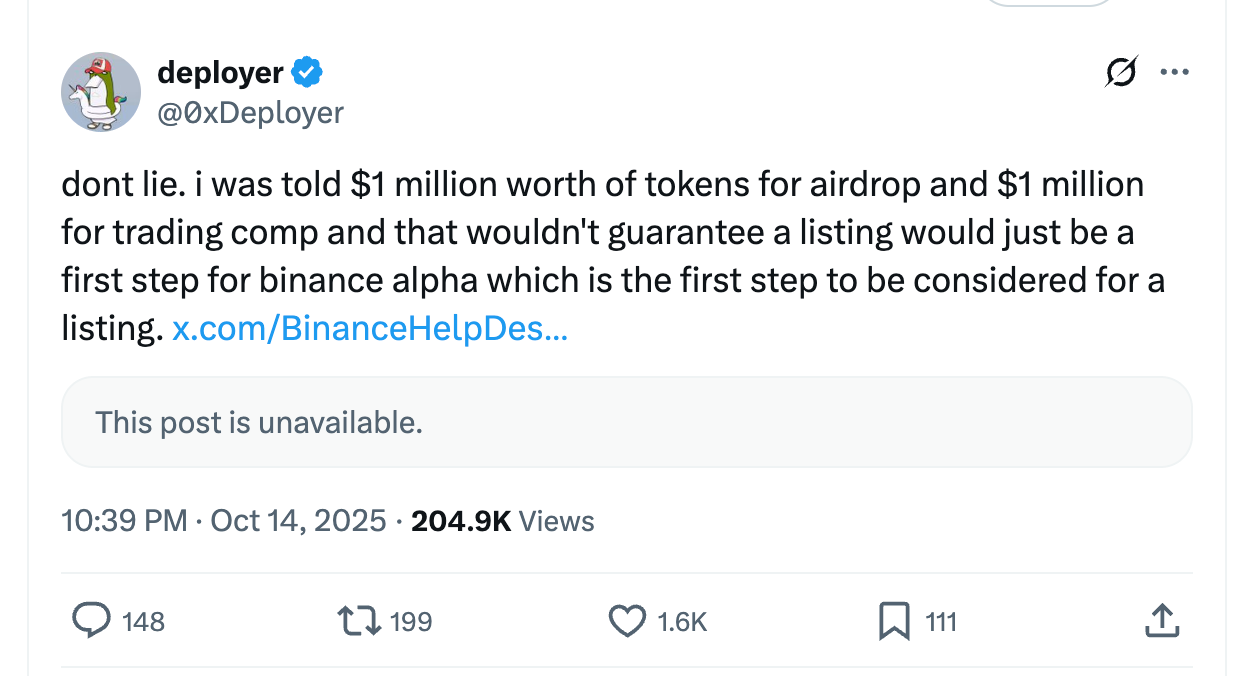

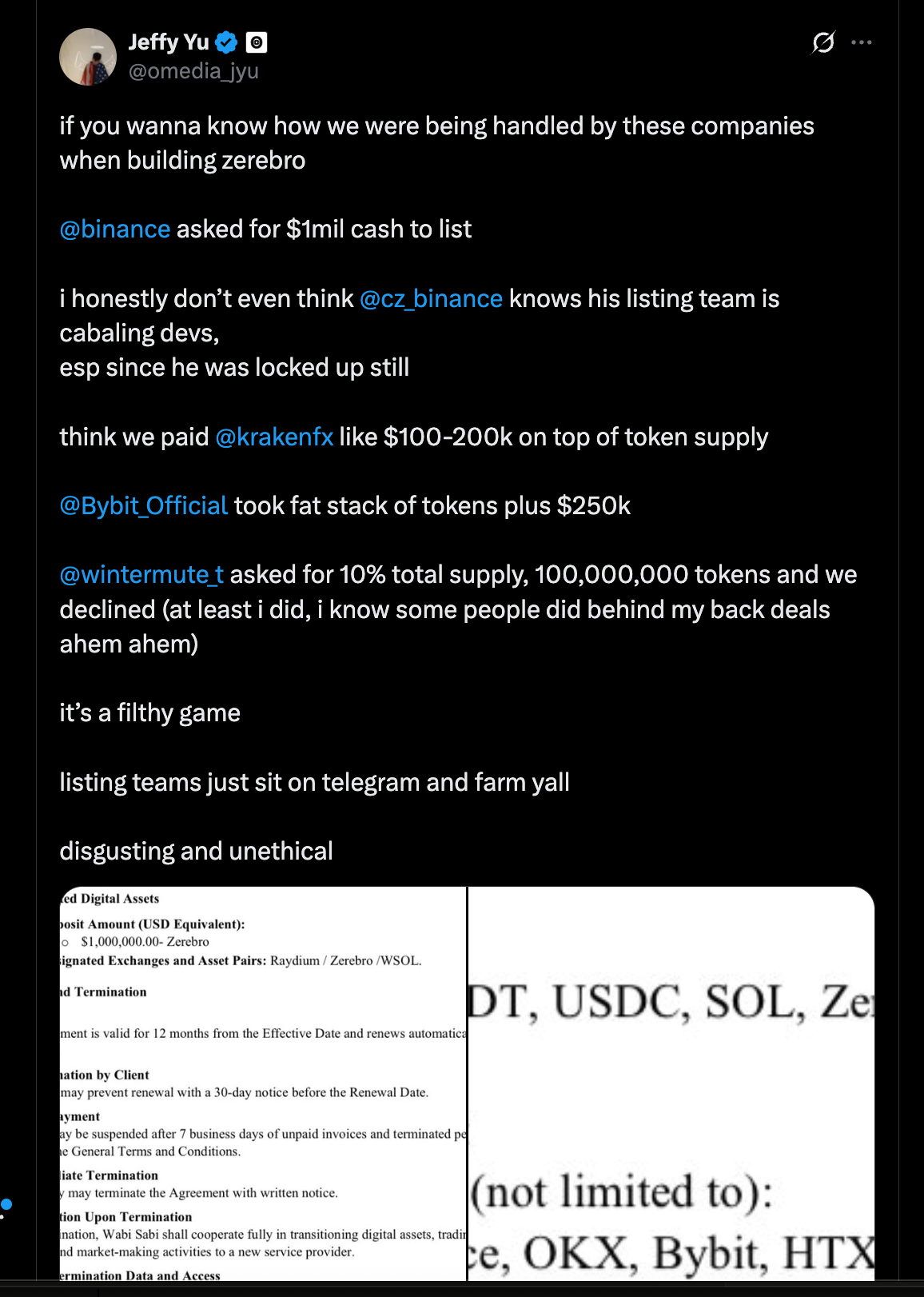

Even O Media CEO Jeffy Yu claimed Binance asked for $1M to list his token. He also stated that Kraken quoted "$100-200k plus token supply" while ByBit requested "tokens plus $250k."

Binance disputed Yu's specific claims, suggesting he likely spoke to a scammer rather than official exchange staff.

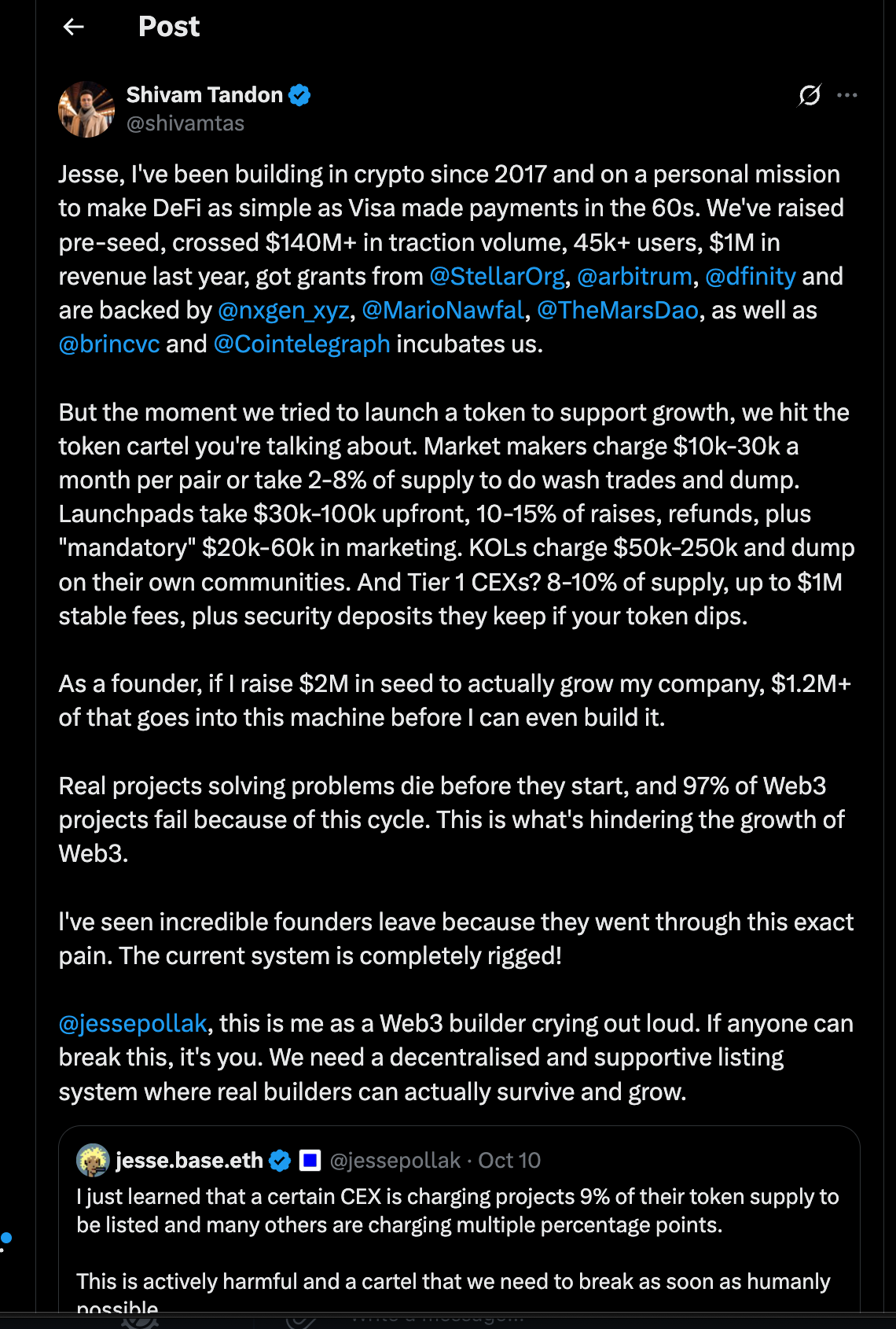

Another founder, Shivam Tandon from zkCross, shared his experience of being quoted substantial listing fees by multiple exchanges:

The consistency of these reports - from CJ, Mike Dudas, Jeffy Yu, Shivam, and dozens of anonymous founders - suggests a systemic pattern rather than isolated incidents.

The pattern extends beyond just Binance. In his recent talk on Bankless podcast (at the moment of writing this post still available on YouTube, but "unlisted", accessible only via direct link), CJ emphasized: "It's not only centralized exchanges that are at fault here... this is kind of a well-kept secret in a way: this is how these things work and operate and play out."

The issue isn't one exchange's bad behavior; it's systemic across the CEX industry. Multiple founders have privately shared similar experiences with other major exchanges, though most remain silent due to NDAs or fear of being blacklisted from future listings. The fact that these practices are widespread doesn't make them acceptable, it makes reform even more urgent.

CZ Breaks His Silence: "Just Build Better Projects"

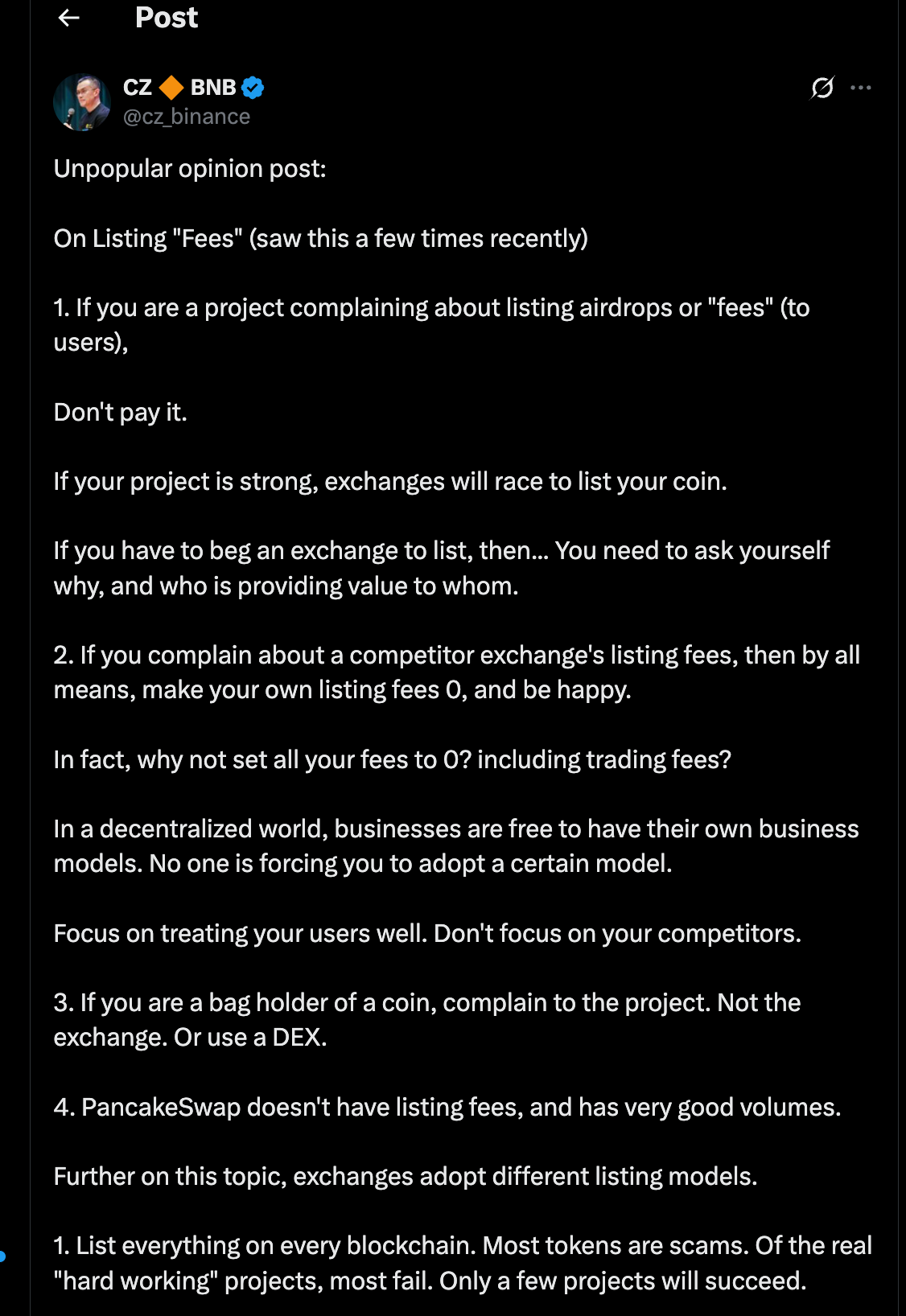

Former Binance CEO Changpeng Zhao (CZ), who was released from US prison in September 2024 after serving four months for enabling money laundering, initially stayed quiet. Then he dropped his infamous tweet:

"Unpopular opinion: If you are a project complaining about listing airdrops or 'fees' (to users), Don't pay it. If your project is strong, exchanges will race to list your coin. If you have to beg an exchange to list, then... You need to ask yourself why, and who is providing value to whom."

Translation: If you're good enough, listing should be free. If you're paying, you're not good enough.

CZ went further, calling Hetherington a "loser" with "clout chasing" behavior, claiming he had a "loser mentality." He later mocked CJ for implying he had blocked him on Twitter, saying: "I didn't even know who he was until he posted this fake image... I could make it real. But I will choose Mute instead. Ignore is the best rejection."

Meanwhile, Coinbase's Jesse Pollak threw gasoline on the fire: "Token listings should cost 0%."

The battle lines were drawn.

The Semantic Game: Why Exchanges Say "We Don't Charge Listing Fees"

Here's an important distinction that every founder needs to understand:

When exchanges say "we don't charge listing fees," they're technically telling the truth, but only in the most literal, legalistic sense.

They don't call it a "listing fee." They call it:

- "Marketing support"

- "Community rewards"

- "User airdrop allocation"

- "Liquidity provision requirements"

- "Security deposits"

- "Platform growth initiatives"

In conversations with various exchanges about listing terms for various startups in InnMind network, we've seen this pattern repeatedly: the exchange carefully avoids the phrase "listing fee" in contracts and proposals. Instead, they structure requirements as separate line items for different purposes.

But in reality: If you must give an exchange $1M (or whatever amount) in tokens or stablecoins to get listed, and they won't list you without it - call it whatever you want, call it "romantic tango"- it's a listing fee.

And when the exchange spends your $1M in tokens on "community marketing"? That marketing drives users to their platform. They're spending your money to acquire customers for themselves. It's functionally identical to taking a listing fee and using it for their own marketing, except this structure gives them plausible deniability. Same logic applied to "refundable deposits" that exchange promises to send back to you IF they will see a certain amount of new traders (users), registered there after your listing, making first deposit and first trade on your token pair.

The legal loophole: By avoiding the term "listing fee," exchanges may technically comply with regulations or public statements claiming "zero listing fees." The law and logic are two different things. The facts speak for themselves.

When Binance's official statements say "Binance does not charge listing fees" while simultaneously requesting 8% of token supply plus millions in deposits, they're playing a semantic game. The tokens and capital still flow from founder to exchange as a prerequisite for listing.

For founders: Don't let terminology confuse you. If it walks like a listing fee, talks like a listing fee, and extracts value like a listing fee - it's a listing fee, regardless of what it's called in the contract.

Trust, but verify your tokenomics

🧮 That 40% community allocation CJ exposed? It was actually 32%.

Before you sign anything with an exchange (or investors, or advisors), model the real numbers yourself.

Try Tokenomics Calculator

→ Full token distribution modeling

→ Captable, vesting schedules & unlocks

→ Node profitability calculator

→ See your REAL allocation percentages

...and more useful stuff inside

The "Refundable Deposit" Myth: What Founders Actually Experience

One of the most misleading aspects of CEX listing terms is the concept of "refundable security deposits." On paper, these deposits sound reasonable—temporary collateral that you'll get back once certain conditions are met.

But here's what founders are actually experiencing.

UPD: The Reality Behind "Refundable" Deposits

After this article was first time published, multiple founders reached out within first hours to share their experiences. One experienced founder, who has listed projects on several major exchanges, told us bluntly:

"I've been told multiple times by listing managers: 'Don't worry about your security deposit, we'll return it.' But here's the reality: I don't know a single case where they actually returned it. The conditions for getting these deposits back are nearly impossible to meet: projects almost never get them back. So I always treat these 'security deposits' as listing fees, which is what they effectively are."

This isn't an isolated case. The pattern is consistent:

The Exchange's Promise:

- "Refundable within 1-2 years"

- "Once certain trading volume targets are met"

- "After successful completion of marketing campaigns"

- "Subject to continued project commitment"

The Reality:

- Volume targets are set impossibly high (often requiring sustained daily volumes that only 5% of listed tokens achieve)

- "Marketing campaign completion" criteria are vague and controlled entirely by the exchange

- Projects are required to hit these targets while the exchange may be simultaneously dumping collected tokens

- Even projects that meet targets report difficulty getting deposits back, with new conditions appearing

Why They Call It a 'Deposit' Instead of a 'Fee'

This is another layer of linguistic maneuvering. By calling it a "refundable deposit" rather than a "fee," exchanges achieve several things:

- Legal cover: They can technically claim "we don't charge listing fees"

- Founder psychology: "Deposit" sounds temporary and recoverable

- Accounting flexibility: It doesn't appear as revenue immediately

- Exit strategy: When founders eventually abandon trying to get it back, it becomes pure profit

What This Means for Your Treasury

That $250,000 "security deposit"? Budget it as a sunk cost, not a temporary hold on your treasury. If you're fortunate enough to get it back, consider it a bonus, but don't count on it when making financial projections.

One founder's advice: "Model your financials as if that money is gone forever. If it comes back in 18 months, great. But if you're depending on getting it back to stay solvent, you've already made a fatal mistake."

The question isn't whether deposits are "technically refundable." The question is: what percentage of projects actually get them back? And from what we're hearing from founders - that number is close to zero.

The Math That Nobody Wants to Talk About

But why the whole listing fee drama evolved? Let's break down what these terms actually mean for a project's tokenomics, and for retail investors who studied those tokenomics before investing.

Your published tokenomics (what investors see):

- Team: 15%

- Community: 40%

- Investors: 25%

- Treasury: 20%

Your actual tokenomics after CEX listing (what really happened):

- Team: 15%

- Community: 32% ⚠️

- Investors: 25%

- Treasury: 20%

- Exchange: 8% 👻 (The ghost allocation)

That "community allocation" you were proud of? It's actually 20% smaller than advertised. But investors will never know, because these 8% don't appear in your whitepaper. They're locked in an NDA.

What This Means in Practice:

- Invisible dilution: Your early supporters bought based on false tokenomics

- Unknown selling pressure: 8% can hit the market at any time, controlled by the exchange

- Marketing discretion: That 1% for "marketing at full discretion" means exactly what you think it means

- Capital drain: $2.5M+ in deposits/collateral drains your treasury before you've even launched

- Lost control: You no longer fully control your token's market dynamics

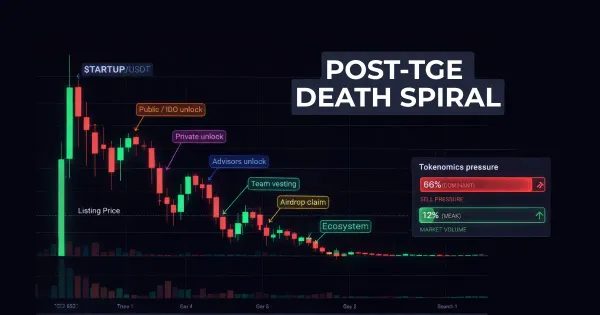

The Post-Listing Token Dump Mystery: Solved?

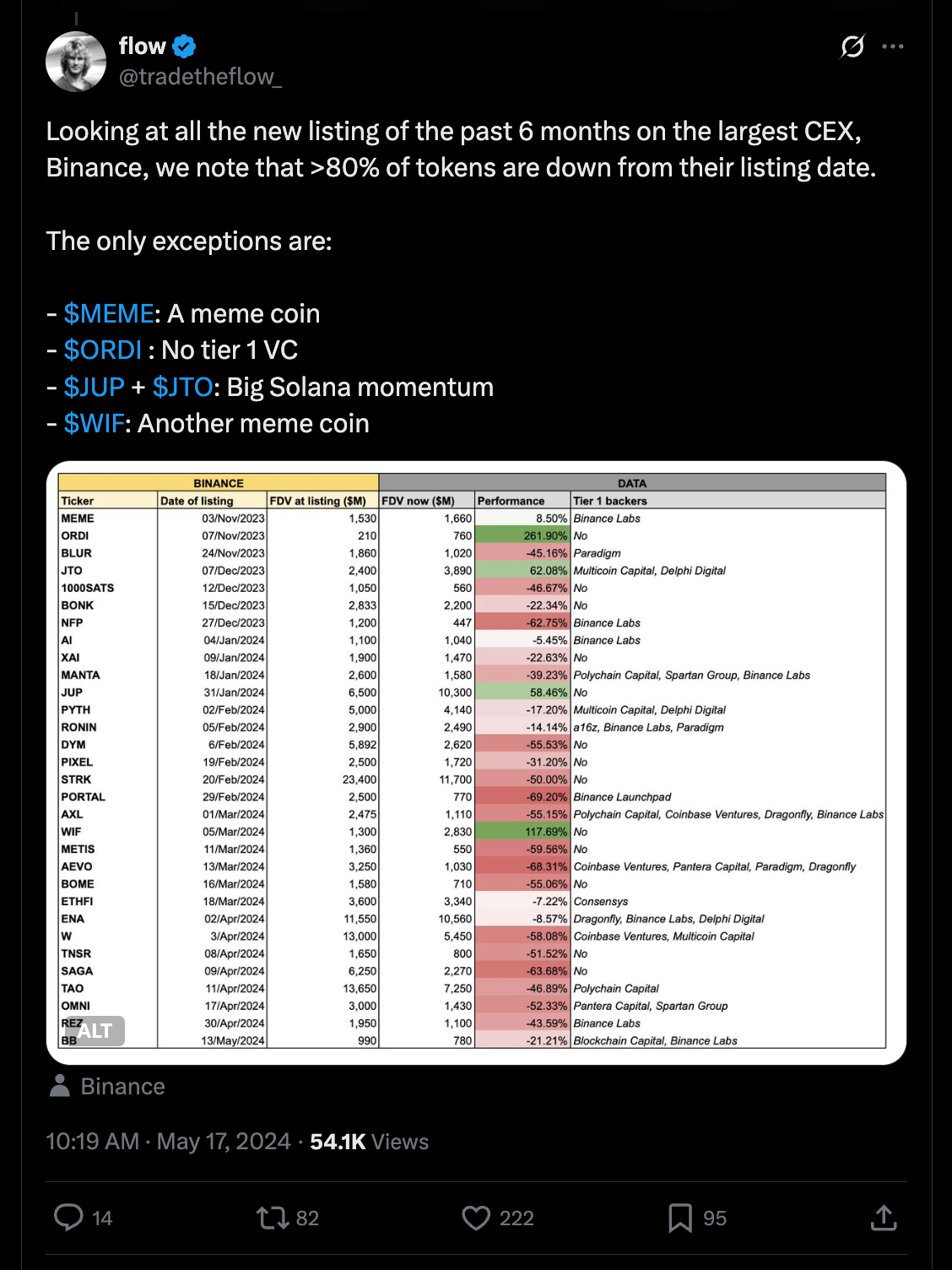

Here's a stat that should terrify every founder: according to reports, more than 80% of tokens listed on Binance lost value within six months of their debut.

Eighty percent, guys.

Even CZ himself criticized Binance's listing process, suggesting centralized exchanges should list "almost everything automatically" like DEXs do, rather than the current selective model.

Now we understand why so many tokens dump post-listing. It's not just "sell the news." It's potentially:

- 8% of supply in exchange hands with undefined vesting

- Market makers with their own incentive structures

- "Marketing" token allocations hitting the market

- Founders who overpaid for the listing now desperate to recoup costs

The invisible 8% explains a lot of "unexplained" price action.

Think about it: If 8% of supply is in exchange hands with no defined vesting, and they can dump whenever they want, that's not 'market forces.' That's systematic sell pressure you never saw coming.

Btw, I also raised this topic some time ago in a LinkedIn post.

⚠️ Remember:

Exchange listings are just one piece of the puzzle. Most Web3 startups fail because founders don't have access to the right tools, advisors, and funding sources early enough.

→ 1000+ crypto VCs & Angels (real users, not crawled profiles)

→ Startup Deals: from AWS and AI credits to nodes running software and marketing automation tools

→ Founder community on Telegram

The resources we wish existed when we started.

What Founders Actually Experience: The Real Cost of "CEX Prestige"

The 8% and $2.5M are just the entry fee. Three founder stories reveal what actually happens after you sign.

Case 1: The Strategic Play That Worked

A DeFi founder listed on Binance Alpha three months ago. Total cost (tokens, deposits, additional marketing, PR, market makers) exceeded their entire raise revenue from the listing.

"We knew going in," they told us. "With our deep VC backing we could easily absorb it. The goal wasn't to raise money or generate returns. It was visibility & credibility."

Result: Within three weeks, four exchanges they'd been targeting reached out with offers. The Binance stamp opened doors that cold outreach never could.

The calculus works if:

- You're well-capitalized (can absorb 6-figure losses)

- You're reputation-building for specific next moves

- Your investors understand it's a marketing expense, not revenue play

Most founders don't have this luxury. For bootstrapped or modestly-funded projects, the math is devastating.

Case 2: The "Perfect" Tokenomics That Failed

RWA protocol. Textbook tokenomics: all investors locked with cliffs, minimal TGE unlock. No one positioned to dump. They were confident.

Listed on four exchanges simultaneously, Bybit and a few major Tier-2. Cost: hundreds of thousands in stablecoins plus massive token allocation.

What happened:

- Token crashed after listing, despite locked supply

- Geographic restrictions on Bybit: only ~8 countries could trade

- VCs, angels, retail—nobody could exit cleanly

- Exchange had destroyed the price before anyone else could move

The founder (requesting anonymity): "Perfect tokenomics meant nothing. The exchange had the ammunition to crash us, and they did."

Case 3: Beyond Listing Fees:The Hidden Exchange Misbehaviors

While we've focused heavily on the 8% token allocation and listing fees, that may have been our mistake. After publication, multiple founders reached out to redirect our attention to what they consider far more serious issues: exchange misbehaviors that would be illegal in regulated markets.

The problems founders are actually losing sleep over:

- API blackouts during launch. Market makers mysteriously lose access during critical first candles

- Pre-launch trading. Some wallets appear to trade before official listing time

- Marketing token misuse. Tokens designated for "user rewards" end up in exchange-controlled wallets

These aren't just fees or business terms. If proven, these would constitute potential market manipulation.

What Founders Report: The API Blackout Pattern

Multiple market makers and founders have reported this sequence to InnMind (most requesting anonymity):

The pattern:

- Exchange collects tokens + stablecoins as "fees" and "marketing"

- Listing goes live

- Project's market maker reports sudden API access "technical issues"

- Extreme volatility occurs with unclear token sources

- Access restored after critical price discovery period

- Token price already significantly impacted

Note: These are founder reports based on their experiences. Exchanges have not confirmed these practices. Technical issues can legitimately occur during high-traffic events. However, the pattern's consistency across multiple exchanges and projects raises questions.

One experienced market maker who works with dozens of projects told us:

"We know which exchanges are more likely to have 'issues.' Good market makers warn their clients: if you list there, we can't guarantee we'll be able to protect your token during launch. Some founders listen. Most don't, because they want that exchange's name on their website."

Why This Matters More Than Fees

As one founder put it after reading our article: "The problem isn't the fee amount. The problem is transparency." Every project receives different conditions and pricing. Listing managers often mislead founders about actual conditions and consequences. But perhaps more importantly—no amount of perfect tokenomics or locked supply protects you if the exchange itself has the ability and incentive to manipulate your listing.

The 8% fee is negotiable if you have leverage. Potential market manipulation during your most critical 60 minutes? That's not something you can negotiate away.

This is why the whisper network exists. This is why good market makers turn down certain exchanges. This is why some experienced founders now refuse listings entirely, choosing to build on DEX-only strategies despite the smaller immediate audience.

After this article's publication, several founders confirmed experiencing similar patterns, not just with Tier-2 exchanges, but with major platforms. The difference? Those with resources and sophisticated market makers knew to avoid certain exchanges. Those without access to this insider knowledge learned the hard way.

The Information Asymmetry Problem in Crypto

Why don't more founders speak up?

NDAs. The moment you sign listing terms, you're legally bound to silence. Projects that get destroyed can't warn others. Exchanges continue the same practices with the next batch of founders who don't know better.

The pattern is systemic, not specific to one exchange. In his Bankless interview, CJ emphasized: "It's not only centralized exchanges that are at fault... this is how these things work and operate and play out."

Multiple founders confirmed similar experiences with Kraken, ByBit, Gate.io, MEXC, and others—though most won't go on record.

💬 FOUNDER REALITY CHECK

"After awhile in crypto, you start realizing that everyone is basically lying to you all the time, so my position is 'take responsibility by DYOR and don't complain.'"

— Experienced founder who's navigated multiple CEX listings (incl. Tier-1)

This isn't cynicism. It's a survival strategy in an industry where information asymmetry is weaponized against founders.

What Professional Market Makers Know

They see the patterns constantly:

- Which exchanges block API access

- Which exchanges dump collected tokens during first candles

- Which listings are set up to fail

- Which terms mean your token is dead on arrival

The difference between good and bad market makers: Good ones warn you. Bad ones take your fee and watch it happen.

Looking for market makers who actually protect your interests? Our Web3 Experts database includes vetted market makers with proven track records, verified by actual founder feedback—not scraped data from the internet.

The Hidden Costs Nobody Warns You About

Beyond the 8% and millions in deposits:

- Additional marketing spend to promote the listing (often equals or exceeds listing fee)

- PR and community management during launch

- Market maker fees and ongoing costs

- Opportunity cost of founder time (months of negotiations)

- Emotional toll of watching your tokenomics destroyed

- Community trust permanently damaged

- "Refundable" deposits that almost never return (budget them as sunk costs from day one: founders report near-zero actual return rate)

The DeFi founder's summary:

"We spent more getting listed than we made from it. It only made sense because we were playing a different game: reputation over revenue. I think the problem is that most founders that do CEX listing have different objectives and can't afford that game."

💡Looking for reputable market makers who operate transparently? Check out InnMind's Web3 Experts database where we've vetted market makers, exchanges, and other web3 service providers based on reputation and founder feedback.

The Questions Every Founder Must Ask BEFORE Signing in with CEX

These questions sound simple. But watch how exchanges dodge them—that dodge tells you everything. Before negotiating with any exchange, ask:

- What's the TOTAL token allocation? (Not "fees" - total supply going to exchange)

- Who controls the "marketing" tokens? (If they say "at our discretion" - RUN)

- What are refund conditions, specifically? ("Refundable within 1-2 years" means never)

- Can you show me 3 recent projects with similar terms? (If they dodge - red flag)

- What happens if our token is geographically restricted? (This destroys liquidity)

- Will our market maker have guaranteed API access? (If they laugh - walk away)

- What's your actual deposit return rate? Ask for 3 recent projects (with names and dates) that got their full deposits back on schedule. If they can't provide specifics, that's your answer.

- What specific metrics trigger deposit return? If they say "sustained trading volume" instead of "$X daily volume for Y consecutive days," the conditions are designed to be impossible to meet.

If they dodge ANY of these, you have your answer.

Two Paths in Token Listing Strategy

❌ Path to Failure:

Raise money → chase Binance → accept any terms for "exposure" → drain treasury → launch with hidden dilution → token dumps 70% → community revolts → shut down in 12 months.

✅ Path to Success:

Build real product → grow organic community → launch on DEX → let volume speak → field offers from strength → negotiate or walk → maintain control.

The difference isn't strategy. It's self-belief.

Do you believe in your project enough to say no?

When to Walk Away from CEX listing

- If listing requires >5% of supply without user benefit → Walk.

- If "marketing" gives exchange full discretion → Walk.

- If you can't publicly discuss terms → Walk.

- If timeline pressure suggests they need you more → Walk.

Walking away isn't failure. It's the most founder-like thing you can do.

Remember: Declining Binance (or other big CEX) today doesn't mean never listing. It means listing later on better terms.

Better you delay 6 months than destroy your token permanently.

Better alternatives when you say no:

- Local market exchanges with transparent terms (for example, Korean exchanges recently demonstrate great volumes on sane conditions)

- DEX-only launch with proper liquidity management

- Wait 6-12 months until your traction makes exchanges compete for you

- Hybrid approach: DEX first, CEX when terms improve

- Focus on product: Building real utility beats listing every time

Remember: Declining CEX today doesn't mean never getting listed. It means getting listed later on better terms.

What This Means for You

The system is broken. You can't fix it. But you can protect yourself:

Document everything - Even with NDAs, keep internal records for your board

Talk to other founders - The whisper network exists for a reason

Demand transparency - If they hide terms, they'll hide worse later

Build leverage first - List from strength, not desperation

The more founders who walk away from bad deals, the faster terms improve for everyone.

Four Things to Remember

- Traction > Listing - 100K engaged users on DEX beats 10M volume on CEX with bleeding price

- 8% is not standard - It's negotiable if you have leverage. Build leverage first.

- NDAs protect them, not you - Document everything for your board, even what you can't share publicly

- Your "no" today is better terms tomorrow - Every founder who walks away makes the next founder's deal better

Everything else is tactics. These are principles.

Final Thoughts: You're Building a Company, Not an Exit for Exchanges

CJ Hetherington risked hard consequences to give founders information exchanges wanted hidden.

Whether that was worth it depends on what happens next. If founders keep accepting these terms, nothing changes. If enough founders walk away, terms improve for everyone.

The real power shift happens when founders realize: you're building a company, not preparing an exit for an exchange.

Listings are tools, not goals. They should serve your project, not define it.

If you're a web3 founder currently negotiating with exchanges, remember:

- Your product matters more than your listing

- Your community matters more than your exchange

- Your long-term vision matters more than short-term exposure

- Your control matters more than "prestige"

And when your community starts spamming "wen Binance?" in the Discord, maybe send them this article. Let them understand what they're actually asking for.

Because the real question isn't "wen Binance?"

The real question is: "Are we good enough that Binance will eventually beg to list us?"

If the answer is yes, you don't need to pay 8% of your supply for the privilege.

Join the Conversation

What's your experience with exchange listing terms? We've created a safe space for founders to share insights (anonymously if preferred).

👉 Join InnMind's Telegram community for web3 founders: t.me/innmind - Share your listing stories, ask questions, and connect with 30,000+ founders who've been through this.

Need help navigating exchange relationships? At InnMind, we've worked with 30,000+ web3 founders over 7+ years. We've seen hundreds of exchange deals—the good, the bad, and the predatory.

- Get connected: Explore vetted market makers and exchange partners in our Web3 Experts database

- Get funded: Access our network of 1,000+ Crypto VCs who understand tokenomics. Important: This isn't a scraped database. These are real investors who registered on our platform, filled out profiles, and actively review startups. Investors with a green "verified" badge have been personally verified by our team through direct calls. This is rare in the web3 space—most "investor databases" are just scraped data from the internet.

- Get guidance: Book a strategy session with our team who can review your terms confidentially

Remember: You're not alone in navigating this. The more founders share their experiences, the better terms the entire industry will get.

About the Author: This article was researched and written by the InnMind team, drawing on our 7+ years of experience supporting web3 founders through funding, launches, and growth. We've built the network of 1,000+ verified crypto VCs, facilitated warm intros and seed round closures for hundreds of web3 startups, and seen the full spectrum of exchange relationships.

Sources: This article incorporates insights from CJ Hetherington's interview on Bankless (October 2025), public Twitter/X statements, and multiple news outlets covering the controversy. Some founder accounts have been anonymized at their request.

Legal Disclaimer: This article is for informational and educational purposes only and does not constitute legal, financial, or investment advice. All claims about specific exchange listing terms are based on public statements by CJ Hetherington of Limitless Labs, which Binance has denied and called "false and defamatory." Reports about Tier-2 exchange practices come from anonymized founder accounts shared with InnMind and have not been independently verified or confirmed by the exchanges mentioned. Technical issues during token listings can occur for various legitimate operational reasons. The patterns described may represent individual experiences rather than systematic practices. Readers are strongly advised to conduct their own due diligence, verify all information independently, and consult with legal and financial professionals before entering any exchange listing agreements or making investment decisions. Past performance and individual experiences are not indicative of future results. The experiences shared by anonymized founders represent their perspectives and interpretations of events. Different parties may have different views of the same events.

Related Reading: