Author: Anton Antich, a serial tech entrepreneur and investor, known as ex-SVP in Veam Software, where he helped to build up business from $20M in sales in 2010 to over $1 billion USD in 2018, which lead to its acquisition for $5B in 2020. Currently Anton is board member at InnMind and COO at Intento.

I have invested and worked closely with over 20 startups over the last 5 years or so. Creating, maintaining, and developing a good financial model for the company is inevitably challenging for all founders. You need to define your business model, make sure your parameter assumptions are sane, track costs carefully for your employees and other expenses, and then constantly update it based on your real performance.

There are several challenges to this process. But before we invite you to subscribe to our newsletter and get weekly insights on startup development and growth in your mailbox!

First, you need to build a good model concept. The most common approach among inexperienced founders is to simply "invent" some customer growth expectations, extrapolate some vague ideas about CAC (customer acquisition costs) into the future, come up with what seems a reasonable LTV (lifetime customer value), multiply resulting customer numbers, and draw nice charts based on them.

Unfortunately, such a simplistic approach never really works.

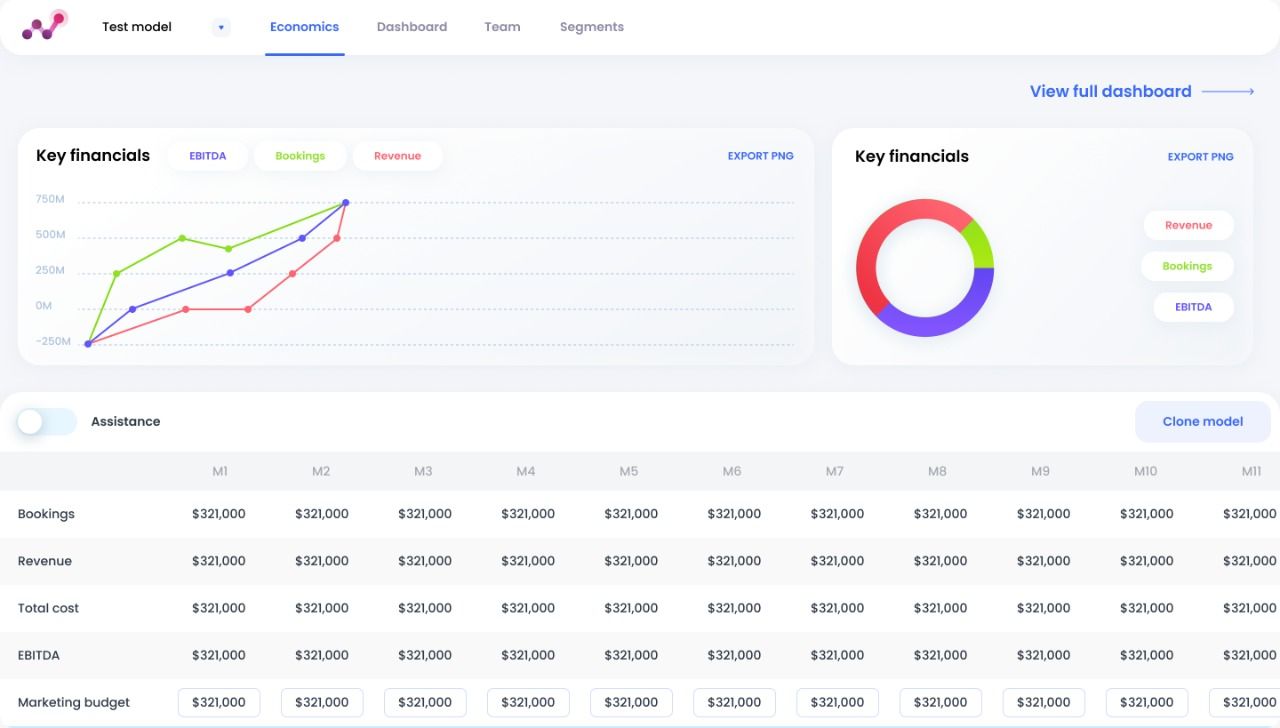

To build a good model, you need to get granular and detailed, and this process cannot be done without planning your GTM (Go-To-Market) strategy first. Start with defining clear (the more narrow - the better the forecasting ability) customer segments:

- Who are your potential customers?

- Where would you get them?

- How much they'd be willing to pay for your product?

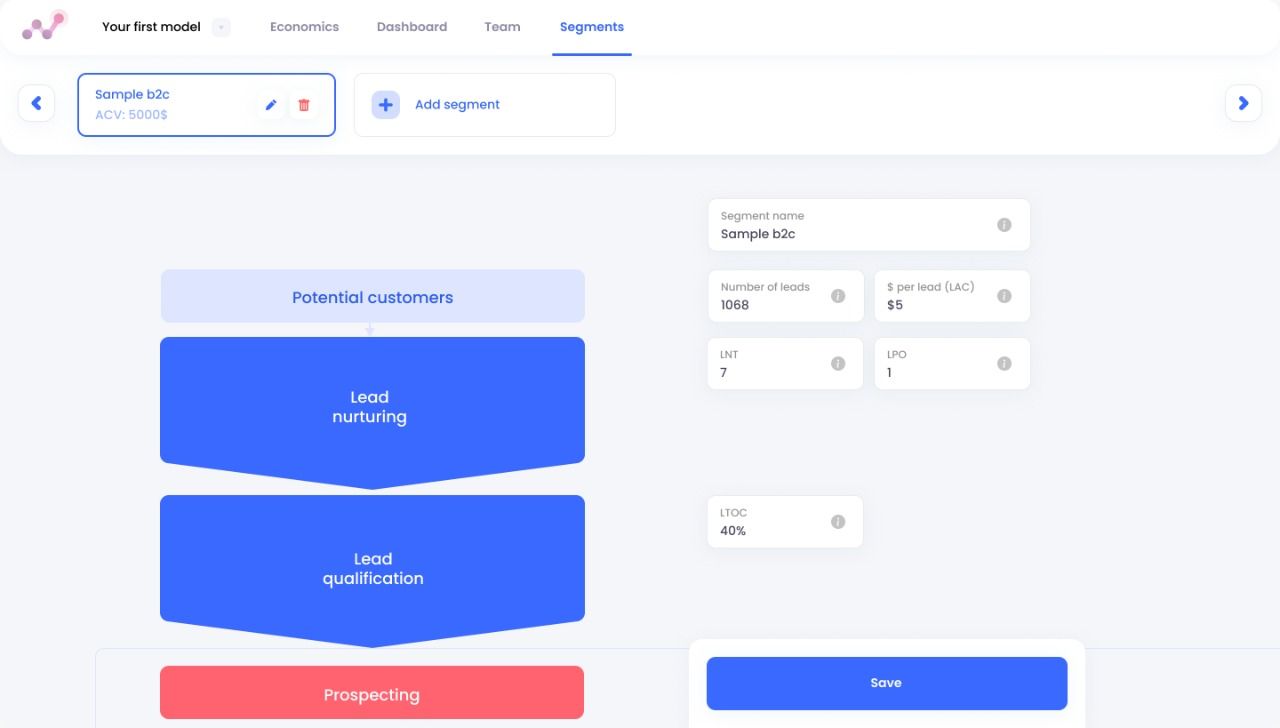

Then, you need to accurately map all funnel parameters - and it gets quite tricky in the b2b space since you need to look at the whole lead generation -> lead nurturing -> sales funnel -> expansion and customer success process and define conversions, times, and other parameters at each step. Doing this at the first pass without prior experience is very tricky.

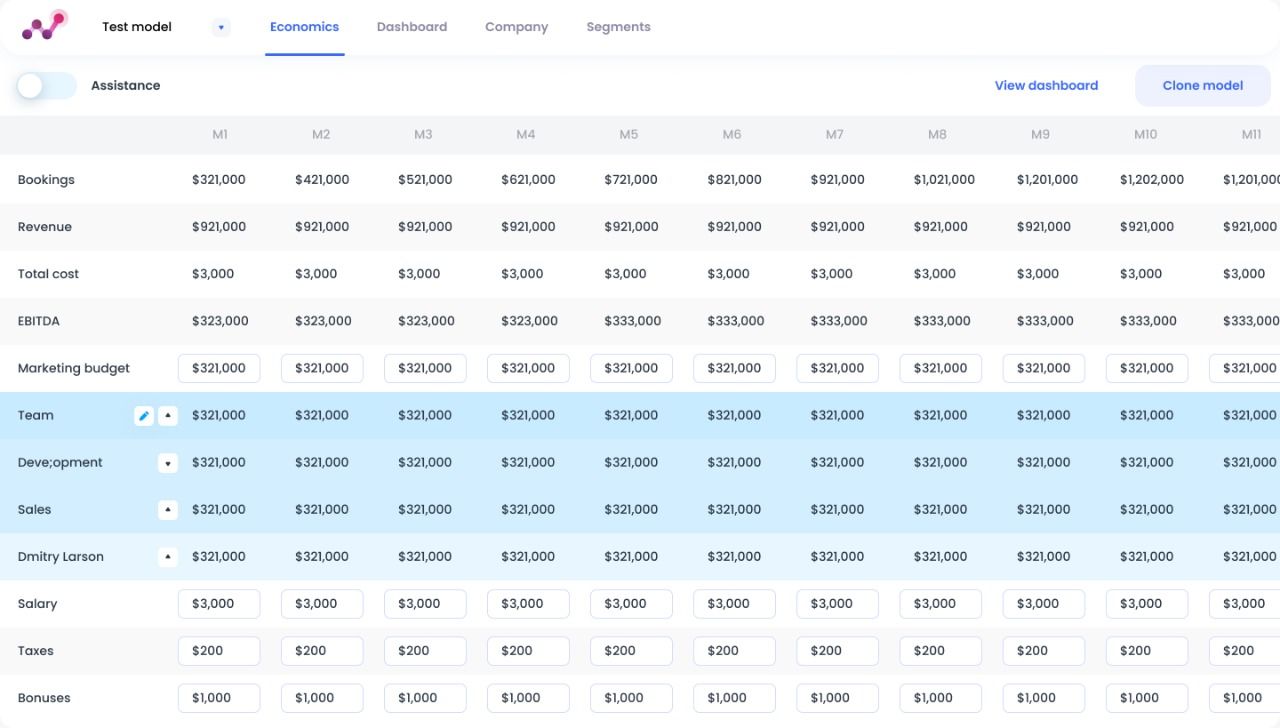

Second, even if you manage to define a reasonably realistic model with sanity-checked assumptions based on the industry data, you need to implement it.

Usually, it is done in Excel or Google Spreadsheets - universal, but for anything more complex than simple multiplications and additions, the formulae you'll need to use get very cumbersome to define while maintaining becomes nothing short of a nightmare. And in case we'd want to improve our model and add more realism by using Monte-Carlo simulations of lead generations, conversions, and sales performance - it is simply impossible to do in the spreadsheet.

Third, having done the previous two steps, you will need to constantly revise your model parameters based on the real-world data. Monitor your sales for 3 months, calculate adjusted conversion rates, CAC, LTV, etc., re-enter into the model, redefine customer segments, recalculate. Again, tedious and boring work, which still needs to be done.

Wouldn't it be great if there were resources that taught how to do financial modelling of the startups more efficiently? Wouldn't it be even greater if it was accompanied by an easy to use tool to implement the actual models?

That's what we thought, too, and created Beamtee - Business Model Tool for Startups! Sign up here to become one of the first users of Beamtee for your startup!

Watch the webinar "From $0 to $100 million in sales: Revenue generation process for global scaling", where I told about the journey of scaling a startup company from 0 to 100M dollars in sales based on the Veeam Software success story and tens of startups experience.

You might also like the following posts: