The BITCOIN bet that could end the world

$1 million...

That’s how much one Bitcoin will be worth in 90 days.

Wait, before you accuse us of price predictions. That’s not us talking.

It’s a guy who:

- was the CTO of Coinbase

- almost led the FDA under Donald Trump

- predicted that the coronavirus would be a pandemic 2 months before the world went into lockdown

Yeah, this dude:

... Balaji Srinivasan

Now, he’s betting that Bitcoin will reach $1 million per coin in under 90 days.

That’s by 🗓️ June 15, 2023. 🗓️

Alright team, mark your calendar because one way or another someone gonna become a millionaire thanks to Bitcoin. 🤣

But who’s he betting against?

Some dude named – James Medlock – a self-described “Social democrat in the streets, market socialist in the sheets.”

Freaky 👌

So, it’s Balaji vs James – in the battle for $1 million or 1 BTC.

What are they betting on exactly?

Simple 👇

Balaji expects the US to enter → “hyperinflation” in the next 90 days.

James does not expect the US to enter → “hyperinflation” in the next 90 days.

Wait, but why does Balaji think the US is on course to enter hyperinflation? What exactly is hyperinflation? Why are people making million-dollar bets on the bird app?

Soo many questions 😰

Wait, idk what hyperinflation means, so I googled it:

Hyperinflation is a term to describe rapid, excessive, and out-of-control general price increases in an economy. While inflation measures the pace of rising prices for goods and services, hyperinflation is rapidly rising inflation, typically measuring more than 50% per month.

Oh shit.

Why is this gonna happen? This long-ass tweet from Balaji details it.

But of course, you’re not gonna read that. So here’s the breakdown in 3 points:

1️⃣ Enter Covid-19

The US Federal Reserve [aka the FED] began printing tons of money. They didn’t literally go around with a printer going “BRRRRR.”

Wait, no. ✋

Instead they:

- decreased interest rates

- loaned money to commercial banks

- literally gave out stimulus cheques to citizens

This carried on in 2021 as well lol 🤣

This was when stocks + crypto went up like crazy 🚀

2️⃣ The aftereffect of this was – massive inflation.

I mean, things that were worth less than $2, suddenly rose to $4. No wonder Chelsea spent $600 million in one season on new signings with new owners. 😲

So, the FED decided to raise rates.

But they didn’t take their time with this. 👎

They raised it so quickly that banks just couldn’t keep up.

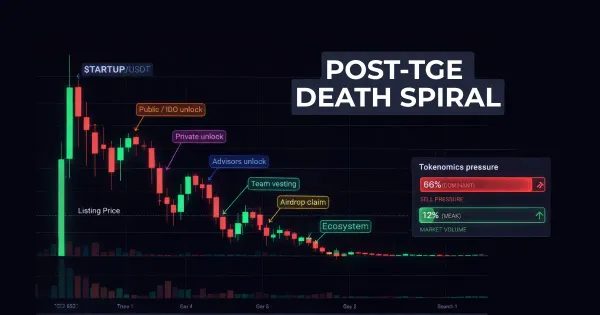

And as rates rose – yields on US bonds went up and up and up.

Look at that 👇 BABY goooo 🚀

When this happened, there were 2 reactions:

- Banks → Banks began to stock up on US bonds to keep paying interest on customer deposits.

- Depositors → Depositors (companies and individuals) began to pull money out because of rising inflation to pay for more expensive stuff.

Plus, a buncha companies (in the crypto and tech industries) laid off their staff which caused even more need for cash.

3️⃣ SVB + Signature collapse

When the FED began to raise rates + depositors decided to withdraw their money – banks were left holding the bag. 💰

And the bag was filled with – “the ultimate shitcoin: long-dated US Treasuries” – according to Balaji Srinivasan.

Well, his initials might be BS, but he sure doesn’t take any 🤣

SVB was the first highly leveraged bank that couldn’t survive. Then it was Signature Bank. Now, there are rumors that over 150 banks are in this position and will collapse.

If this ☝️ happens – the government will respond with the only financial + economic + military tool they know → lowering interest rates yet again.

But this won’t be a gradual decline. 👎

They will drop rates faster than I drop my dating standards after a few drinks 🤣

Live scenes of the Fed dropping rates

And when rates go down [again] Bitcoin goes up [again] at least according to Balaji.

This is not that far-fetched tbh. It’s quite logical. 👌

But what is really 🤪 LOCO 🤪 is the rate at which Balaji thinks the US will drop rates + print money + save US and foreign banks.

He thinks this will cause = Hyperinflation.

Which will further cause = Hyperbitcoinization.

Tf is hyperbitcoinization?!?

“The moment that the world redenominates on Bitcoin as digital gold, returning to a model much like before the 20th century. What's going to happen is that individuals, then firms, then large funds will buy Bitcoin.”

I’ve just got 2 words for this – OH 💩.

What do you think?

Will the US Federal Reserve trigger hyperinflation? Will Bitcoin reach $1 million? Will Ronaldo ever come back to United? Will Balaji be right again?!?

Let us know by tagging @innmindcom in Twitter

Don't miss: Web3 Startup Pitch Deck Template

A new useful document on InnMind knowledge base: the ultimate Web3 Startup Pitch Deck Structure template is designed to save you time and effort while ensuring that your pitch deck covers all the key areas that matter to investors.

Use it to craft a compelling narrative in a well-structured and easy-to-digest document that resonates with investors and gives them a complete overview of your project scope🚀

🔗 Download the PPTX template for free here

Don't miss other web3 read: