What Type of Fundraising Works Best for Startups

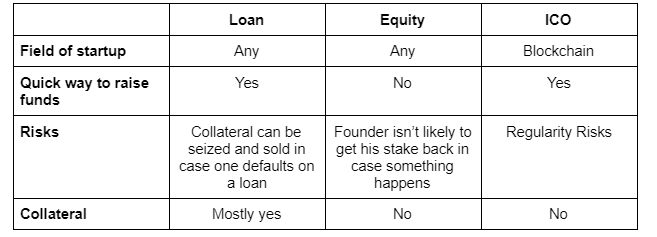

Comparison of classic types of fundraising with new types of fundraising.

When it comes to fundraising, you need to keep in mind that you have a lot of options. You’ve probably heard about equities, loans, convertible debts, but do you know the exact differences? Apart from these classic types of fundraising, new options keep appearing - such as private token sale also known as ICO. Let’s dig a bit deeper and find out which type of fundraising fits you.

Classic types of fundraising

- Loan

- Loan is certainly the simplest way to raise funds. You just ask for money and then pay it back with interest.

- Loan is the best way to get money when you need a small amount of cash (usually not more than 100.000 $).

- Loan is usually secured - you have to put up a collateral for a loan for investors to be safe in case you won’t be able to repay the sum.

- Loan is also the option when you need money quickly or you are reluctant to offer somebody a stake in your company.

Example: you need $ 800.000 to hire more people and enter new markets. You take a 3-year-loan, APR (annual percentage rate) is 10%. You’ll have to pay back $ 800.000 + $80.000 * 3 (yrs) = $1.040.000.

2. Equity

Equity is a form of fundraising that is specifically attractive for founders that have great plans and a clear vision of their company development but - unfortunately - lack any collateral. In exchange for money put into, investors receive a stake in your company. If you resort to equity fundraising, you are to value your company in a proper way - investors will get a stake on the basis of your valuation. You can use our valuation calculator not to get in trouble.

Example: you’ve calculated that your company is now worth $ 1.500.000. An investor that’s ready to give you $ 600.000 will receive 40% equity. As soon as your company sells or goes public the investor gets proportional (in our case 40%) compensation.

Equity is your option when

- Your business is very promising, but it needs time to develop. Equity investors are ready to wait if they see prospects.

- You don’t have anything to secure a loan.

- You can’t bootstrap - you need an impressive amount of money from the outset.

- You do have a great plan and believe in yourself - investors won’t risk if you’re not self-confident

The advantage of equity - it has nothing to do with repayments-at-the-exact-time. However, remember about the points below:

- It takes time to find an equity investor. There are a lot of entrepreneurs eager to raise funds - and there are much fewer investors. Be ready that your business will be examined from every angle. (check our due-diligence checklist)

- There is almost no way back - once an investor got a share of your company, he or she’s likely not to give it back. Find an investor that you’ll be able to work with in a comfortable way.

New type of fundraising - Initial Coin Offering (ICO)

Initial Coin Offering can also be considered as quite an easy form of fundraising. Initial Coin Offerings (ICOs) consist of the creation of digital tokens by small companies to investors, in exchange for fiat currency (euros, dollars) or other dominant crypto currency. ICOs are enabled using Distributed Ledger Technologies (DLTs), such as the Blockchain, which facilitate the exchange of value without the need for a trusted central authority or intermediary, allowing for important efficiency gains driven by such disintermediation.

ICOs enable value creation through the potential development of network effects and efficiency gains driven using the blockchain. It is favourable among start-ups because they do not have to give up any equity and any retail investor can participate in the fundraising which makes it a much easier form of fundraising.

There are different types of ICO’s like IDO or IEO

- Initial Dex Offering or IDO is when a project launches a token through a decentralized liquidity exchange.

- Initial Exchange Offering or IEO is when crypto projects launch their token and raise funds via a centralized exchange.

There are some pros and cons in both types of fundraising, and it's upon start-ups which one is preferable to them.

Example: One of the first and successful ICOs is Ethereum, a smart contracts platform which has a crypto token named Ether. In 2014, the Ethereum project was announced and its ICO raised $18 million in Bitcoins or $0.40 per Ether. The project went live in 2015. About 30% of the total supply of tokens was given away for ICO. Today, Value of one Ethereum Token is around $2,400.

It might seem that ICO is a way to go, but it is crucial to note that there are many factors why you should not go with ICO: It's important to see whether your product needs a crypto token or not, if not, it's better to avoid ICO. Many projects, just for the sake of fundraising, introduce a crypto token which is unnecessary. It not only takes down the credibility of a start-up but it also creates a mismatch among the project and investors which is not efficient for a startup long term.

Whereas, Raising money via equity from traditional investors gives you a strong trust score because of their long due diligence process, which helps in PR and further expansion. Also, traditional equity investors bring a lot of experience and network with them, that helps in business guidelines and building valuable connections.

So, to sum up:

What would you prefer - a classic type of fundraising or ICO? Would you like to learn more about convertible debts? Or are differences between IDO and IEO your sweet spot? Anyway, let us know!

Read popular posts in our blog: